Choosing Between a Pledged Asset Line and Asset-based Lending For Your Business Financing

Content

Due to the liquidity of security, using assets as collateral in business financing offers lenders reduced risk. In return, lenders are able to offer easy credit qualification, and favorable terms for companies with weak credit histories, struggling in distress, stretching for growth, investing in efficiencies, or funding acquisitions.

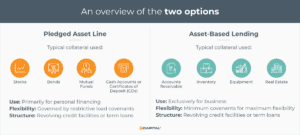

A pledged asset line and asset-based lending are both financing methods that involve the use of assets to secure a loan. However, they differ significantly in their purpose, structure, and the types of assets used as collateral.

Understanding the differences between these two forms of lending is crucial for making an informed assessment and choosing the best option to meet your company’s business goals.

An overview of the choices

The choice between using these two financing options depends on the specific needs and circumstances of the business. A brief overview of each option’s purpose, structure and type of assets used will help determine which is best suited for your business needs.

Pledged asset line

The purpose of a pledged asset line is primarily for personal financing. The use of funds is often governed by debt covenants that may designate the funds for a specific purpose only. A pledged asset line is typically used for purchasing additional securities, funding personal projects, or covering personal expenses. A pledged asset line is suitable for significant short-term financing such as to bridge finance a new home purchase before selling an existing property.

While its use may be less frequent in commercial financing, certain businesses facing sudden liquidity needs might opt for a pledged asset line to address urgent financial obligations. An unexpected tax bill is enough to trigger a sudden need for short-term financing. Marketable securities, stocks, bonds, and other liquid investments are generally more straightforward to value and convert, lowering risk for lenders and therefore streamlining the qualification process for fast funding.

Whether used for personal or commercial purposes, a pledged asset line provides fast funding to meet short-term financial obligations.

The structure of pledged asset lines may be more focused on the value of the specific assets being pledged rather than the overall financial health of the business. This makes them more accessible to businesses with strong assets but weaker credit profiles. These assets are typically held by the lender as security until the loan is repaid.

Pledged asset lines typically offer revolving credit facilities or term loans with fixed or variable interest rates. The terms and structure of these loans may vary depending on the lender and the specific assets being pledged as collateral.

Types of collateral assets used are typically cashable assets, such as marketable securities, stocks, bonds, or other liquid investments.

Asset-based lending

The purpose of asset-based lending is for business use only. With minimal loan covenants it provides working capital for any business requirements, from supporting operations to funding growth initiatives, or any other use that benefits the borrowing company.

For businesses in growth mode or facing financial challenges, asset-based lending from leading non-bank lenders provides lines up to $50M.

The structure of asset-based funding is typically based on a broader range of assets than a pledged asset line, providing more collateral strength for companies with a mix of tangible assets. Assets are used to secure a revolving line of credit or term loan based on a percentage of the value of eligible collateral. These lines of credit allow borrowers to draw funds as needed and repay them as their cash flow allows, providing flexibility for managing working capital needs.

Types of collateral assets used are typically tangible with locked in value that can be converted to cash through various processes. Securities based on inventory, equipment and machinery, or real estate are subject to regular audits to calculate current borrowing base. Accounts receivable is an easy to manage and valuable asset category many B2B business use to securitize credit facilities.

Which option is best suited for your business needs?

Both pledged asset lines and asset-based lending offer advantages for supporting business financial needs, but the optimal choice depends on specific circumstances and preferences.

Pledged asset lines are most beneficial for businesses requiring rapid access to funds. By leveraging liquid investments as collateral, this option features quick financing approvals to facilitate fast access to working capital.

Examples of urgent business financial obligations requiring the benefits of a pledged asset line’s fast access to capital include the following:

- payroll

- vendor payments

- emergency repair

- tax payments

- legal expenses

- expansion opportunities

- debt repayment

- insurance premiums

- marketing campaigns

- dealing with disruptive events

- recovering from natural disasters

Asset-based lending allows businesses to leverage a broader range of assets, providing more flexibility than a pledged asset line in accessing capital. This option can be advantageous for businesses with a diverse mix of assets seeking larger financing amounts. Asset-based lending facilities typically require more extensive documentation and due diligence, including detailed analysis of accounts receivable, inventory, and other assets. This process can be more complex and time-consuming than valuing and pledging marketable securities. However, as a result of closely monitoring asset value, businesses gain maximum access to credit with terms tailored to meet the business’ requirements.

Ultimately, the best option depends on factors such as the nature of the business, its assets, and financing needs. Consulting with financial advisors or lenders can help determine whether a pledged asset line or asset-based lending is the most suitable financing option.

Leading non-bank lenders, experienced in various financing strategies to support business needs across numerous industries are well suited to advise and provide the best funding option to support your company’s capital requirements.

The best lender to support your business

Selecting the best lender to support your business involves careful consideration of several factors:

Reputation and Reliability: Look for lenders with a history of consistently meeting clients’ financial needs. Check reviews, testimonials, and ratings from other businesses.

Transparency: Choose a lender that is transparent and straightforward about their terms, fees, and conditions.

Flexibility: Seek lenders that offer tailored financing options including flexibility in loan amounts, repayment terms, and collateral requirements.

Speed of Approval and Funding: Prioritize lenders that can process loan applications quickly and provide funds in a timely manner.

Interest Rates and Fees: Compare interest rates, fees, and other charges from different lenders to ensure you’re getting the most competitive terms possible.

Customer Service: Assess the lender’s industry knowledge and responsiveness to ensure streamlined service through growth, financial distress, or transition.

Industry Experience: Consider lenders that have experience working with businesses in your industry. They may better understand your unique needs and challenges.

Look for a lender with a fair and thorough risk assessment process to provide favorable terms tailored to your business’s financial situation. Seek recommendations from other business owners or industry peers who have worked with pledged asset line and asset-based lenders. Their insights and experiences can help guide your decision. By carefully evaluating these factors and conducting thorough research, SMBs can select the best lender to support their short-term financial needs and long-term stability.

Conclusion

Overall, while both pledged asset lines and asset-based lending involve using assets as collateral for financing, they differ in the types of assets used, the flexibility of funds, and the associated risks and interest rates. The choice between the two depends on the specific needs and circumstances of the borrower.

Key Takeaways

- Using assets as collateral in business financing offers lenders reduced risk and typically provides more favorable terms to undercapitalized businesses.

- A pledged asset line and asset-based lending are both financing methods that involve the use of assets to secure a loan.

- They differ in the types of assets used, the flexibility of funds, and the associated risks and interest rates.

- Leading non-bank lenders are well suited to advise and provide the best funding option to support your company’s capital requirements.

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.