FREIGHT FACTORING FOR TRUCKING

CASH FLOW

YOU CAN COUNT ON

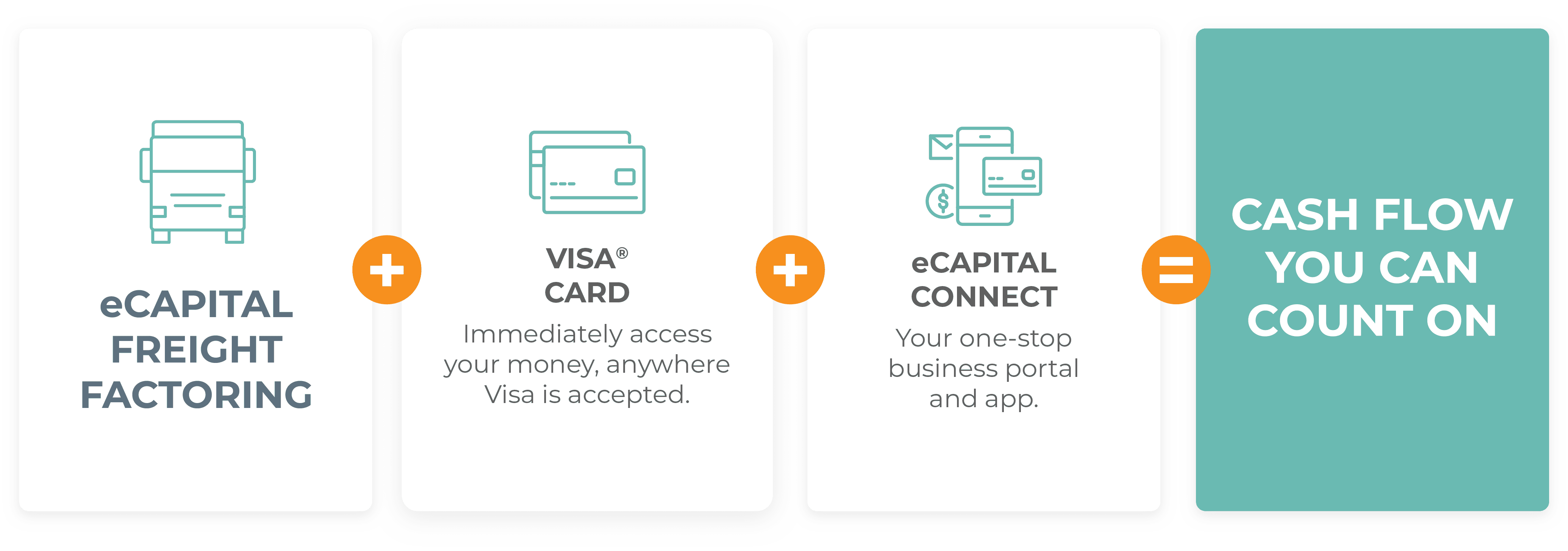

Your business demands a constant source of money. That’s why eCapital provides the best freight factoring in the industry with the most money, in more ways than anyone else. Plus, the lowest factoring rates and best service from experts who understand the needs of transportation companies.

With eCapital InstaPay, after freight factoring your invoices you can make split-second transfers to your bank—even after hours or on holidays and weekends. It’s the easy way to receive money with no waiting or hassles. Plus, you never have to worry about banking hours.

With eCapital Visa® Commercial Cards, you can immediately access your money everywhere Visa is accepted—including ATMs. It works just like a debit card connected to your eCapital freight factoring account. Plus, you can send drivers cash 24/7.

Manage your money your way with eCapital Connect—a revolutionary client portal and one-stop-shop built for businesses like yours. This flexible, secure platform connects you to your funds and more.

Easy-to-Use: Easily access, track, transfer and manage freight factoring funds—all in one place

More Control: Direct how and when funds and credit are accessed, 24/7

Smart Reporting: Make informed decisions from anywhere with visibility into every transaction and real-time reporting

When it comes to all things factoring, we at eCapital are long-time experts in the field as an award-winning factoring company. We offer two great freight factoring packages — recourse and non-recourse factoring — which differ in several ways, including typical fees, qualification requirements and which party is responsible for nonpayment.

BEST FOR FLEETS

With our recourse factoring package, you are ultimately held responsible for unpaid invoices if your customers fail to pay after our maximum attempts to collect via invoice buy-back.

BEST FOR OWNER-OPERATORS

With our non-recourse factoring package, we are responsible for all attempts to collect payment from your customers, and if your customers don’t repay, eCapital accepts the loss.

Are you invoicing more than $1,000,000 per month? Ask about our confidential, non-notification factoring package.

No hassles. Money in your hands in hours, not days.

For over 25 years eCapital a freight factoring company has helped more than 30,000 businesses grow. We want to do the same for you. Take a look at the latest reviews from our customers on TrustPilot!

Freight factoring, truck factoring or logistics factoring is a specialized form of invoice factoring designed for the transportation industry. It is a mainstream financial strategy that involves factoring transportation receivables by the selling of account receivable invoices at a discounted rate in exchange for immediate cash.

Here’s how freight factoring typically works:

Freight factoring provides immediate cash flow to trucking companies, allowing them to cover operational expenses, such as fuel costs, driver wages, equipment maintenance, and other business needs, without having to wait for the clients’ payment. It helps trucking businesses improve their cash flow and maintain smooth operations by converting their unpaid invoices into working capital.

Companies experiencing high growth, financial difficulty or are starting up qualify for freight factoring. Other examples of companies who qualify include:

Freight factoring is different than a commercial line of credit because:

Freight Factoring provides owner operators with trucking startup companies immediate access to capital. With this, you avoid the 30 to 90 day payment period common in the trucking industry. If you do business with creditworthy customers then you qualify for freight factoring.

Getting to know your business is a priority. As a logistics factoring company we want to make sure we offer you the best options possible that match the growing needs of your business. We’ll want to talk to you within 24 hours of you contacting us and we’ll need to see a certain amount of paperwork before we make a decision. If we have the paperwork we need from you, we can make a decision in a couple of days of you getting in touch. That’s why our clients like working with us. We don’t hang around, and you are not required to sign long term contracts.

Costs are dependent on the services you use and the amount of invoices we collect payment for on your behalf. Contact us today for a free, no-obligation quote.

What is recourse factoring?

Recourse factoring is a factoring agreement in which a trucking company sells its invoice receivables to a factoring company with the understanding that if the invoice remains unpaid after the recourse period for any reason (usually 60 to 90 days), the trucking company will be obligated to buy the invoice back.

Recourse factoring is the most popular type of factoring. It is more flexible and costs less than non-recourse factoring.

What is non-recourse factoring?

Non-recourse factoring is a factoring agreement in which a trucking company sells its invoice receivables to a factor with the understanding that if the debtor (your company’s customer) does not pay the invoice by the end of the recourse period, the factoring company may be obligated to absorb the loss. However, in non-recourse factoring, it is important to note that no universal definition specifies the liability’s circumstances. (More on this in the next section).

In effect, non-recourse factoring is like recourse factoring with an added layer of bad debt protection. For this reason, it may be more appealing to trucking companies who deal with higher-risk shippers and shippers who have been known to exceed their agreed-upon payment dates.

A freight factoring company, also known as a trucking factoring company or transportation factoring company, is a specialized financial institution that provides freight factoring services to businesses in the transportation industry, particularly trucking companies and freight carriers. These companies offer a range of financial services tailored to the specific needs of transportation businesses.

Freight bill financing, also known as freight invoice financing or transportation invoice factoring, is a financial service that provides immediate funding to businesses in the transportation industry, specifically freight and trucking companies. It involves the process of converting unpaid freight bills or invoices into immediate working capital.

Looking for more in-depth answers about freight factoring? Read our article All 44 of Your Freight Factoring Questions Answered