BUILD YOUR BUSINESS WITH US

Working capital solutions that are good for you – and your clients.

Working capital solutions that are good for you – and your clients.

Business is built on strong partnerships and we never forget it. Commercial finance brokers count on us to provide the right funding solution for their clients. Our range of flexible, personalized financial products combined with nearly 20 years of experience and an industry-leading commission structure lead to winning scenarios.

We’re here to help you get businesses the funding they need to achieve their goals.

Make the MOST MONEY with unlimited income from multiple products.

Get FAST MONEY as deals close in as little as 48 hours.

Earn EASY MONEY selling cash flow solutions that clients want.

Get SMART MONEY with cost-effective financing and long-term benefits.

Take advantage of MORE MONEY with industry-leading advance rates.

Have FLEXIBLE MONEY with terms designed to meet unique needs.

In today’s ever-evolving business environment, unique challenges demand innovative and customized financial strategies. Our expertise in collaboration brings diverse perspectives and expertise to the table, fostering a richer understanding of the situation and facilitating the design of more effective and tailored solutions.

Advance rates on collateral:

Facilities up to $50 million. Flexible and covenant light.

Advance rates on the value of accounts receivable:

Notified or confidential.

Recourse, Non-Recourse and Off-Balance Sheet structures.

90 days outstanding, up to 120 days in some cases.

Visa Commercial Cards, InstaPay and self-directed funding.

Credit amounts based on collateral values. Seamless integration and online account management.

eCapital is an award-winning, industry-leader in the commercial funding space. Here are a few reasons why businesses choose eCapital as their finance partner:

Get paid for every deal we fund, with no limit on what you can earn.

Can we do the deal? We’ll let you know as soon as the same day.

All we need from you is an introduction to your client – we’ll take care of the rest!

Rely on our dedicated teams for in-depth industry knowledge.

View status reports for every referral submission and track deal progress.

We help you build your business with educational opportunities and marketing support.

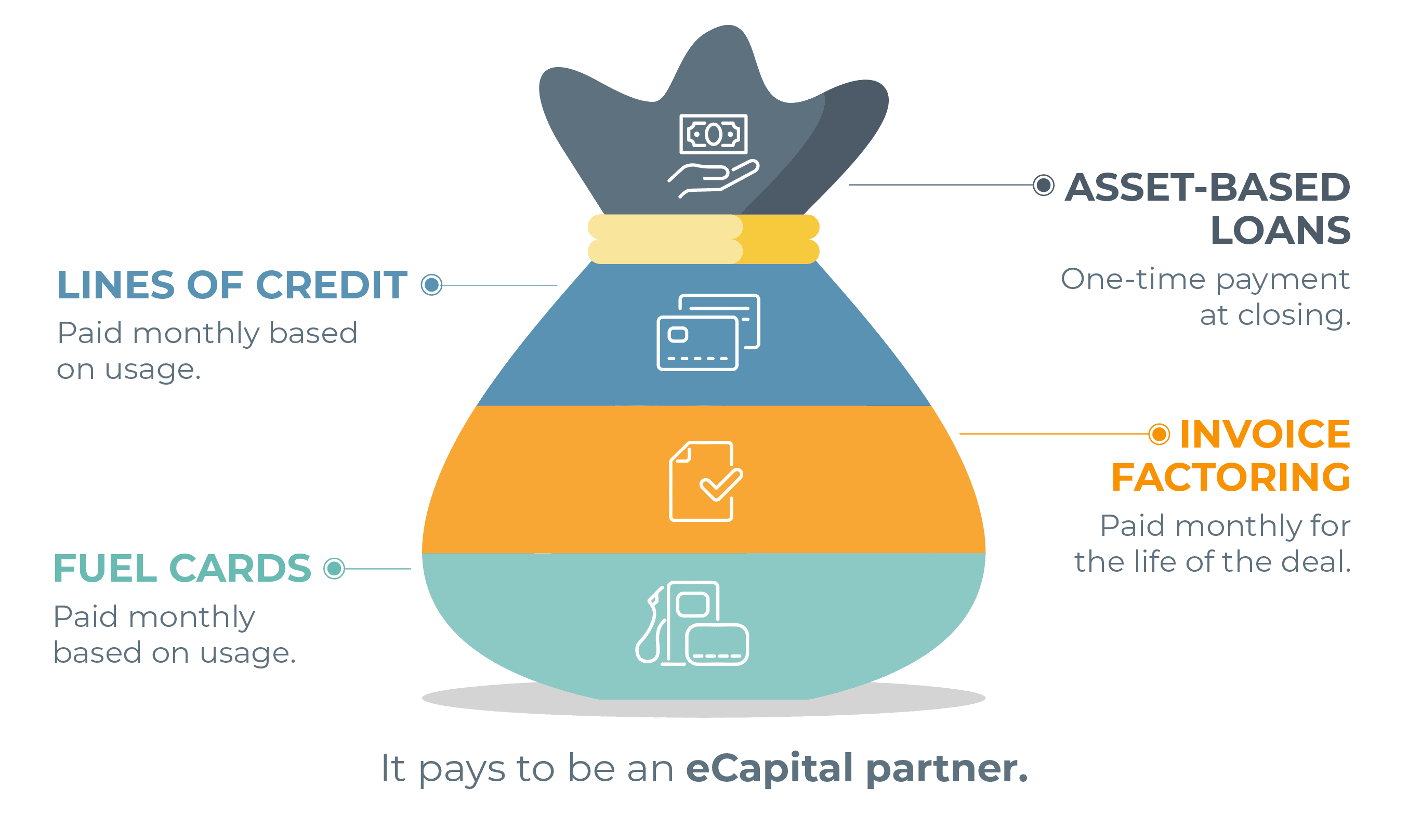

Earn big with every referral. Our generous commission structure allows you to maximize your earnings across our range of products. Send your clients our way and get paid for every funded deal.

Once you have a solid understanding of our offerings, reach out to us expressing your interest in becoming a broker partner by filling out the form above or giving us a call. You’ll be connected with our Partners team and begin the setup process for our broker program.

No, at eCapital, we specialize in providing financing solutions for a wide range of businesses, but this does not include those that operate in the consumer sector (B2C).

At eCapital, we have a diverse range of preferred asset classes for asset-based loans. We understand that businesses have unique financing needs, and our asset-based lending solutions are designed to provide flexible and tailored options based on the specific assets you have available. Some of our preferred asset classes for asset-based loans include:

Our approach is flexible and customizable, ensuring that we work closely with you to understand your business’s unique asset structure and financing requirements. If you’re interested in exploring asset-based loan options tailored to your specific asset classes, please contact us. Our team is ready to guide you through the process and find the best financing solution for your needs.

At eCapital, we strive to make the financing process as efficient and streamlined as possible. To review a deal and provide you with the best possible financing solution, we typically require certain documentation that helps us understand your business, its financial health, and the collateral being offered. While specific documentation needs may vary based on the nature of the deal and the type of financing you’re seeking, here’s a general list of documents that we often request:

Please note that the documentation required may vary based on factors such as the type of financing, the collateral being offered, and the specific nature of your business. Our goal is to work closely with you to ensure a smooth and efficient application process. Once you express interest in financing, our team will guide you through the specific documentation requirements relevant to your deal.

In most cases, your commission will be paid upon the successful closure of the financing deal. This means that once the client’s application is approved, the financing is finalized, and all necessary paperwork and documentation are completed, your commission will be processed.

The strictness of eCapital’s approval process can vary based on factors such as the type of financing, the applicant’s financial situation, the collateral being offered, and the lender’s risk assessment policies. Here are some general points to consider:

It’s important to note that each financing application is unique, and the approval process can vary accordingly.