Best Non-Bank Funding Options for Business Financing

Content

While the economy struggles through a downturn, traditional lenders are beginning to restrict credit as government regulators monitor their portfolios for excessive risk and their stakeholders demand profit protection. As a result, it is becoming even more challenging for companies to manage their finances.

From the inability of businesses to satisfy the terms of their bank financing, to their lack of available working capital, to general cash flow constraints, businesses everywhere are experiencing growing financial pressures. With this in mind, more and more businesses are turning to the many advantages of non-bank funding options. The provision of near-immediate relief from the credit restrictions traditional lenders are imposing on their borrowers is a key benefit for many of these companies.

In essence, traditional lenders use conventional credit scoring models to assess risk and the capacity of a business to repay debt. This narrow scope imposes rigid credit requirements that prevent many companies from qualifying or maintaining conventional business financing. Fortunately, alternative lenders are free from regulatory oversight and have more flexible credit requirements to provide easier qualification and faster access to the cash businesses need, when they need it.

Keep reading to learn how leading alternative lenders are accelerating the qualification process and quickly delivering the advantages of the best non-bank funding options for business financing.

Fast and easy qualification

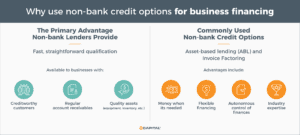

The first roadblock for borrowers is getting approved. By utilizing advanced fintech capabilities, alternative lenders can assess hundreds of credit-related data points to better understand an applicant’s borrowing potential. Leveraging untapped credit strengths and underutilized assets, these tech-enabled lenders can often approve credit and provide flexible non-bank business financing to small, mid-sized, and large businesses in a matter of a few days.

From start-up to maturity, even businesses in growth mode or financial distress can qualify for non-bank business financing options if they have some or all the following:

- Creditworthy customers

- Regular account receivables

- Quality assets (equipment, inventory, etc.)

Armed with advanced technology and the latest risk assessment tools, alternative lenders are rapidly changing the business financing landscape. From easier qualification requirements to incredibly fast speed of funding, these lenders offer many advantages traditional banks can’t match.

Advantages of non-bank financing options

As mentioned, the most significant advantages of non-bank financing options are lower credit requirements and a faster qualification process. Even companies with diminishing profitability can often obtain funding in a matter of days. But the advantages of alternative lending don’t end there! Here are some additional benefits of business financing from leading alternative lenders:

Money when its needed: When businesses require cash, they generally need it now – not months or weeks later, but NOW! From companies facing a bank financing recall to businesses needing daily funding, speed of funding can be critical. Leading alternative lenders typically deliver the money businesses need when they need it! Utilizing fintech advancements, tech-enabled lenders can accelerate the speed of funding from weeks and months to days and hours. As a result, qualification, onboarding, and first funding take place in a few days. Once the lending account is set up, ongoing funding is often measured in hours from the time it is requested.

Flexible financing: Business requirements change regularly, as do the financial resources needed to support growth. As time progresses, the business financing first established with a lender may need to be escalated to sustain new business developments. Leading alternative lenders experienced in the borrower’s industry and invested in technological advancements may offer multiple products and growing credit limits to deliver more money in more ways than traditional lenders.

Autonomous control of finances: If a company does manage to acquire business financing from a bank, it typically comes with severe control measures – multiple restrictive covenants, rigid credit limits, and regular reporting protect the bank’s investment but often stifle the business’s ability to grow. If the regular auditing of the borrowers’ financial performance reveals that the company has breached loan covenants, the bank can even move to recall credit and close the loan. This potentially disastrous event is especially true in today’s economic environment.

In contrast, the best non-bank lending options leave the control of business finances in the borrower’s hands:

- Fewer loan covenants mean more flexibility to maintain credit and grow.

- Expanding credit limits can better align with the company’s growth trajectory.

- Online account management provides greater transparency.

- Unrestricted ability to utilize funds enables borrowers to keep control of their decision making.

Industry expertise: When it comes to making smart borrowing decisions, leading alternative lenders often put industry expertise at your disposal. In many cases, these industry-knowledgeable lenders better understand the unique financial requirements and solutions that apply in given situations. As a result, they can provide much more than access to working capital – they can also offer expertise and industry insights to help maximize the company’s profitability.

Best types of non-bank funding options

Leading alternative lenders typically tailor their business financing solutions, and possibly combine more than one funding option, to help maximize the borrower’s access to working capital. The top two non-bank funding options are:

Asset-based lending (ABL): This financing option is favored by companies needing a large influx of cash to support growth, bridge a financial gap, or face financial challenges. ABL is best used by companies with quality assets such as accounts receivable, inventory, and equipment.

|

Flexible features |

Costing features |

|

Cash advanced on collateral including the following:

|

Costs typically include the following:

|

Invoice factoring: Invoice factoring is ideal for companies that regularly issue invoice receivables to creditworthy customers. This mainstream funding option does not incur debt. It is the selling of invoice receivables at a discount in exchange for immediate cash. By utilizing invoice factoring, businesses accelerate days sales outstanding (DSO) from weeks and months to just a few hours.

|

Flexible features |

Costing features |

|

Multiple pricing structures:

|

Conclusion

When a company requires business financing, it typically needs it as soon as possible and as much as possible. In today’s economic environment, financial pressures often push a company’s capital requirements beyond traditional banks’ ability or willingness to provide. Alternative lenders are servicing the credit gap created by conventional lenders with fintech capabilities to provide business financing faster and with greater flexibility.

Look for the industry leaders in alternative lending. Their experience, resources, and technology advancements provide the best non-bank funding options for business financing.

eCapital is a rapidly growing leader within the alternative lending space and a trusted financial partner to thousands of small and mid-sized businesses since 2006. Our experience and technology advancements have set new industry standards for fast, reliable business financing. Whether a company is managing the financial stress of growth or seeking financial relief from a sudden recall of bank financing, our team has the resources and expertise to transition the organization quickly and seamlessly to reliable cash flow they can count on.

For more information about fast, reliable business financing when its needed, visit eCapital.com

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.