Five Ways to Improve Cash Flow And Manage Financial Challenges With Alternative Financing

Content

No matter the industry, cash flow is critical to operating a successful business in 2023.

As traditional lenders restrict credit, a new rise in commercial bankruptcy rates is highlighting the growing risk businesses now face amid rocky economic conditions. Many small and medium-sized businesses are now considering alternative financing to access faster, more flexible, and tailored funding options to pay suppliers, maintain payroll, manage operating expenses, and cover unexpected bills.

Recent financial technology developments have revolutionized the lending landscape. Alternative finance companies have become preferred partners for many businesses seeking fast funding to fill cash flow gaps, respond to financial distress, and maintain financial stability.

The best alternative finance companies provide a suite of innovative funding options to help companies overcome financial roadblocks and maintain regular cash flow. Here are five ways you can now leverage alternative financing to improve cash flow and manage financial challenges.

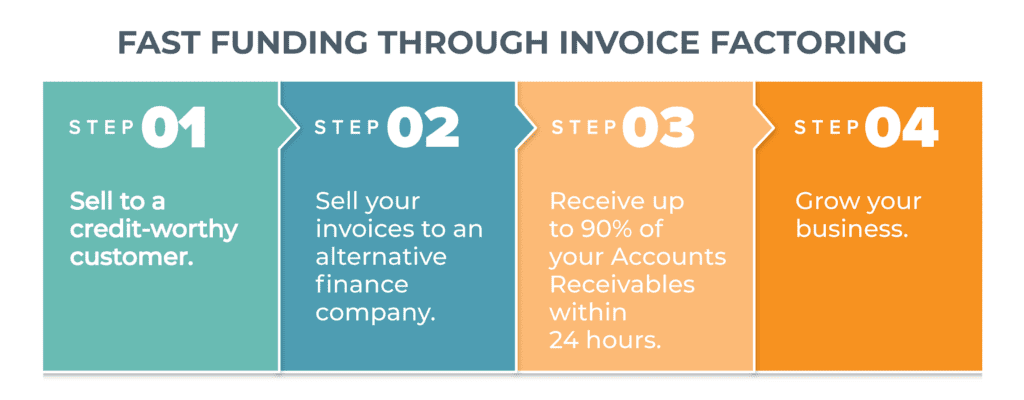

1. Convert your outstanding invoices into immediate cash

The slow collection of accounts receivable payments blocks your company’s access to readily available cash. With business customers taking over 40 days, on average, to pay outstanding invoices, invoice factoring has become a preferred solution to access funds quickly to improve cash flow.

Invoice Factoring is the selling of your unpaid invoices at a discount to an alternative finance company in exchange for immediate payment. Rapidly advancing technology has exponentially accelerated the speed of this funding strategy:

- Advanced algorithms and customized computer programs quickly verify invoices issued to customers against purchase orders and delivery receipts.

- Rapid verification process allows an alternative finance company to expedite approval and transfer funds within hours of receiving a funding request.

- Enhanced speed of funding creates instant positive cash flow and fast access to working capital.

Qualification for invoice factoring is fast and simple. If you have creditworthy customers your business will likely be approved in a few days. Credit limits are based on accounts receivable volume and the creditworthiness of your customers. The more invoices you send to creditworthy customers, the more cash you can receive.

2. Unlock the maximum value of your assets

A business’ assets are often underused resources. With asset-based lending (ABL) a business can unlock value tied up in their assets. With few covenants and limited lender oversight, this flexible lending option allows companies to access the capital they need quickly and efficiently to increase cash flow and grow their business.

ABL allows you to secure a loan based on the value of your business assets, such as inventory, machines and equipment, real estate, and accounts receivables.

Here’s how ABL from alternative finance companies differs from traditional funding options:

- More flexibility: In loan amounts, repayment terms, and collateral requirements. ABL solutions from alternative finance companies have minimal lender oversight and fewer covenants attached than with traditional lending options.

- Faster approval and funding: Traditional lenders can take several months to process a loan. Alternative finance companies have streamlined underwriting processes and fewer regulatory hurdles to navigate.

- Competitive rates: High demand for ABL services means industry-leading alternative lenders will likely offer competitive and transparent rates.

- Less emphasis on credit history: Approvals are based on the value of your company assets rather than your company’s credit history. In contrast, traditional business loans are based predominantly on your company’s credit score and history – both of which can be restrictive to companies that do not have a long or established operating history.

- Industry specialization: Alternative finance companies have extensive expertise and deep industry specialization and provide high evaluations and competitive advance rates on a range of asset types providing your company fast access to more capital.

ABL solutions from alternative finance companies provide greater flexibility, competitive rates, personalized services with industry specialization, and faster access to more funding than traditional lenders can provide. These differentiators give business owners the most money they need to grow and thrive, even in uncertain economic environments.

3. Use more flexible lines of credit

Lines of Credit help manage the short-term cash flow needs of your business. The value of a line of credit is that it allows your business to draw funds as needed, rather than receiving a lump sum upfront. Alternative finance companies are often more willing to provide lines of credit to businesses with less established credit histories or lower credit scores than traditional lenders. Their lines of credit have more flexible underwriting standards and faster funding times too. Alternative lenders also offer higher credit limits and require less collateral than traditional lenders. That makes it easier for businesses to qualify and get the needed cash.

Other key benefits include:

- An alternative finance provider’s line of credit allows you to spend on credit as needed up to a limit, but with minimal lender oversight or reporting. This means the facility is easier to use and less time-consuming to manage.

- The line of credit has minimal covenants, and no restrictions that prevent you from pursuing additional forms of credit. You retain the ability to take on additional business financing if financial challenges or cash flow issues arise.

4. Access additional capital through your equipment

Equipment refinancing is a specialized form of asset-based lending that converts the equity tied up in working equipment into the money you need when you need it. By leveraging the value in long-term assets to provide cash in hand, companies can improve operations, take on new contracts, reduce debt, or fund new strategic initiatives.

Here’s why so many businesses are pursuing equipment refinancing:

- Fast qualification and provision of a term sheet help companies solve urgent financial challenges.

- High appraisal values with up to 75% advance rates on working equipment provide capital resources previously untapped.

- Funds transferred directly to your business account streamlines the funding process.

- Few rules, minimal reporting requirements, and limited loan covenants extend funding flexibility to provide more creative avenues to better manage debt.

5. Use Visa commercial cards to cover expenses

Visa commercial cards provide businesses with a convenient and consistent cash flow to cover day-to-day expenses. Authorized administrators can issue funds and limit expenses, allowing for greater tracking and control over spending. With streamlined purchasing processes and detailed reporting, businesses can reduce costs, increase efficiency, and improve cash flow.

Here’s how a Visa commercial card can help you boost cash flow with easy expense management:

- Issue cards to employees needing to procure goods and services. Initialize all cards for use or activate them individually as required.

- Manage individual or program-wide card control by setting customized spending options with limits by day, purchase type, and amount. Deactivate and freeze cards at the click of a button as needed.

- Account transparency allows for efficient cost control. Enhanced visibility and reporting let you see every expense, payment, and category of each transaction.

With greater visibility and control of expenses, businesses can better manage their cash flow and improve their bottom line.

Conclusion

As access to traditional funding avenues narrows, alternative financing has become a preferred solution for businesses looking to improve cash flow or respond rapidly to financial challenges. Resilient companies are embracing the fast and flexible benefits of alternative funding options to execute effective capital management tactics and overcome financial roadblocks. With fewer restrictions and lender oversight, alternative financing options provide business owners the ability to take control of their cash flow, access more capital than provided by traditional lenders, and monitor all transactions in detail.

Look for a reputable and experienced alternative lender with flexible financing options and the expertise needed to help guide a strategic and tactical approach to improve cash flow and manage financial challenges.

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.