Cash Flow Insolvency vs Accounting Insolvency: 3 Steps to Correct the Situation

Content

If your company finds itself with excessive debt and missing loan or bill payments, or if your liabilities outweigh its assets, your business may be insolvent or approaching insolvency. In today’s uncertain economy, missing just one or two payments can cause red flags to go up, signaling to lenders, investors, and suppliers that your company may be encountering financial distress. There is no time to lose if your business is insolvent or approaching insolvency.

Insolvency is a financial state of distress and the precondition to bankruptcy, a legal declaration and process. According to the New York Times, the first four months of 2023 have seen the highest level of American companies filing for bankruptcy since 2010. It’s a troubling sign for distressed companies that may face an uphill battle managing their debt as refinancing becomes tougher.

So, how can you help your company from being included in this year’s bankruptcy statistics?

Learn the three steps to correcting insolvency. The first step is to recognize the signs and assess the situation. Next, identify what type of insolvency your business is facing. Finally, determine how to manage your way out of insolvency and back to financial stability.

Step 1: Recognize the signs and assess the situation

Being declared insolvent is a serious matter – you must act on it as soon as you see warning signs or the repercussions could be fatal for the business. Problems ordering stock due to overdue debts, refusal of new credit, creditors harassing you daily, and refusal by creditors to extend payment terms are all signs of potential insolvency.

If your business is in debt and you believe it may be insolvent or approaching insolvency, there is no time to lose. Start by confirming your financial position. Calculate financial ratios and analyze results. A business is insolvent when it has a negative debt service coverage ratio and no liquidity. Perhaps your business is not yet insolvent, but every indication is that it soon could be – in either case it is essential to take immediate action. If insolvency is left unresolved, it could be fatal for your company.

Step 2: What type of insolvency is your business facing?

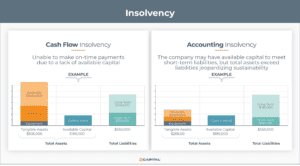

The next step is determining what type of insolvency your business faces. There are two types – cash flow and accounting insolvency. Both can be equally devastating, but knowing which type your business faces will determine the best approach to resolve the situation.

Cash flow insolvency defined

If you can’t make on-time debt payments because you don’t have available capital, you may be cash flow insolvent. Companies in this situation have enough assets to cover their debt payments but need to turn these assets into cash to meet financial obligations.

The troubling news is that needing to liquidate additional assets to meet immediate financial obligations is a short-term remedy only, not a long-term solution to cash flow shortfalls.

Accounting insolvency defined

You are considered accounting insolvent if your company’s liabilities are larger than your assets. Accounting insolvency is also referred to as balance sheet or technical insolvency.

An interesting characteristic of accounting insolvency is that your business may still have enough cash to continue operating and meet current debt obligations, at least in the short term. However, suppose you can’t reverse course to reduce your total liabilities within a short amount of time. In that case, your lenders may force you into action by calling a loan or forcing you to sell collateral to satisfy the loan.

Step 3: Manage your way out of insolvency

Several strategies and tactics can be employed to overcome insolvency. Your actions to correct course will be determined mainly by the type of insolvency your company faces.

Cash flow insolvency solutions

Several ways to resolve a company’s cash flow insolvency include generating more revenue, reducing debt, increasing efficiencies, or borrowing more money. Of these strategies, the quickest way to solve cash flow insolvency is to find immediate cash sources that don’t require you to sell an existing asset on your balance sheet. Alternative lenders are well suited with multiple cash flow solutions to provide fast financial relief to businesses in this form of financial distress.

Alternative lenders can process applications, approve credit, and start first funding in a matter of days, whereas banks typically take several weeks to several months to process loan applications. What’s more paralyzing is that bank loan approvals are becoming more challenging to acquire. The larger banks approved just 13.3% of applications in July 2023, and the small banks approved 18.9%. Meanwhile, alternative lenders’ approval rate reached 29.3% during the same month and continues to increase each month as bank financing becomes more elusive.

Here are four commonly used cash flow insolvency solutions alternative lenders provide:

Asset-based lending (ABL) allows a business to secure a loan based on the value of that business’s assets. The borrowing is usually managed as a revolving line of credit with credit limits equaling up to 75% of the value of the business’s inventory, machinery, or equipment. Higher advance rates are provided when the company’s accounts receivable is used as collateral.

ABL provides a significant source of capital that can be used without lender oversight in whatever manner best suits the business. For companies facing insolvency, this funding option can balance the books and provide additional working capital to support restructuring and turnaround strategies.

Alternative lenders have streamlined this popular funding option to quicken the qualification process and deliver a covenant-light lending arrangement. Since your business’s physical assets are used for collateral, even companies with less-than-perfect credit scores can easily qualify.

Invoice factoring is a type of invoice financing that allows you to continuously release cash quickly from your sales ledger to improve your cash flow. It is the process of selling your company’s unpaid invoices to a third party at a discount in exchange for immediate payment.

It is a simple transaction. When products or services are delivered, invoice the customer and submit a copy invoice to the factoring company. Invoices are immediately verified, and advanced funds, up to 90% of the invoice value minus a small fee, are transferred to the business’s cash account within 24 hours or sooner. The remaining balance due is held as a reserve by the factoring company until they receive full invoice payment from the business’s customer. When the invoice is paid, the factor releases the reserve amount and transfers the funds to the business to complete the transaction.

Invoice factoring is simple to manage, accelerates cash flow, and does not incur debt. It is one of the most effective ways for businesses to improve cash flow and sustain financial health in today’s uncertain climate.

Line of credit (LOC) is a credit facility that provides immediate access to a predetermined amount of money. The borrower can typically draw down on the account at any time up to a maximum limit that cannot be exceeded. With this funding option, you only pay interest on the money you spend.

LOCs are typically used to help smooth out cash flow fluctuations, such as when you need cash to make on-time loan and debt payments.

Visa commercial cards provide the purchasing power of a credit card to support your business’s daily purchases and operations. Cards can be distributed to as many employees as needed to pay bills and settle outstanding debt payments. Businesses can create an effective companywide expense management system by customizing spending limits and categories for where each card can be used and by tracking each transaction.

The flexible financing options and dedicated service offered by alternative lenders provide the fast financial support businesses in financial distress need to overcome cash flow insolvency and fund turnaround strategies.

Accounting insolvency solutions

A business usually becomes accounting insolvent either because the value of its assets significantly declines or the amount of debt substantially increases. To solve the problem of accounting insolvency, the business will need to do the opposite – either significantly increase the value of its assets or substantially decrease its amount of debt.

While these approaches seem straightforward, the solution to resolving accounting insolvency is usually more complicated. There’s a reason the business became accounting insolvent in the first place. And unfortunately, the underlying issue, for example, the loss of significant customers or a piece of equipment suddenly becoming obsolete, likely still exists.

As a result, the most effective action to resolve accounting insolvency is to schedule a consultation with a reputable insolvency professional to help identify the best course of action for your company.

Key Takeaways

- Insolvency is a financial state of distress and the precondition to bankruptcy.

- Being declared insolvent is a serious matter – act quickly!

- There are two types of insolvency – cash flow and accounting insolvency.

- Actions to correct course is determined mainly by the type of insolvency.

Conclusion

Insolvency doesn’t have to mean the end of your business. But you need to act quickly to correct course as soon as possible.

To help get your company back on solid financial footing, first determine if your company is insolvent or heading that way. Next, identify the type of insolvency you’re facing. Then, contact financial specialists experienced in recovery strategies for businesses in financial distress. For businesses facing cash flow insolvency, look for industry-leading alternative lenders with a proven track record for successfully managing turnaround situations. For those facing accounting insolvency, look for a professional insolvency trustee or lawyer to help navigate the path back to financial stability.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.