Warning Signs and Strategies to Avoid Insolvency

Content

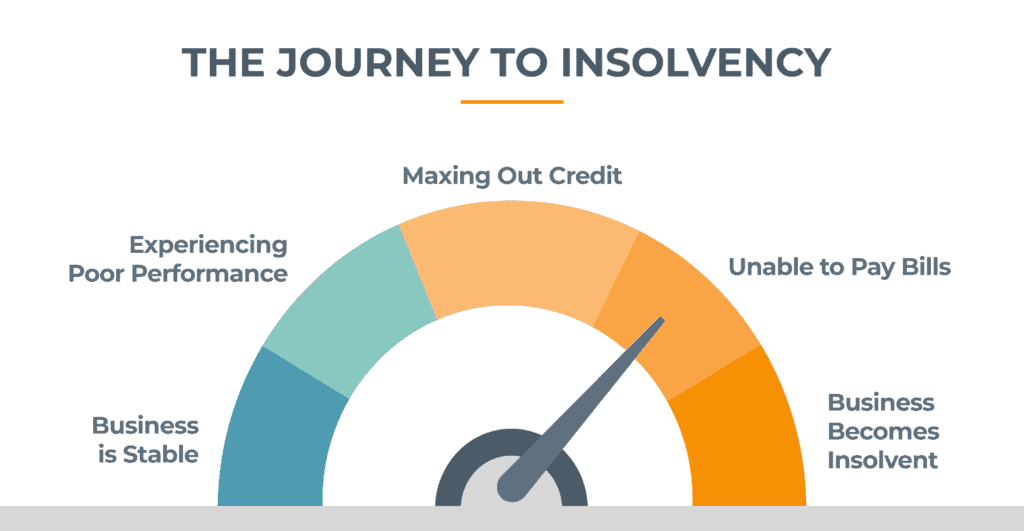

Supply chain slowdowns, inflation, labor shortages, and a host of other adverse conditions are challenging thousands of company operations in 2023. As performance levels decline, finances become stretched. Short-term financial challenges can evolve into significant problems, threatening your company’s ability to meet payments when they become due. If this situation is left unresolved, it may lead your business down the road to insolvency.

Business owners must know how to spot warning signs before disaster strikes to avoid this financial crisis. Learn to avoid a financial crisis and keep your business in good standing by understanding insolvency, spotting early warning signs, and knowing effective strategies to rectify the situation.

What is business insolvency?

Before diving into the warning signs and strategies to rectify insolvency, it’s essential to first fully understand insolvency.

There are two forms of insolvency:

- Cash flow insolvency is when a company has enough assets to pay what is owed but does not have access to available capital to pay debts when they become due. For example, a business may have thousands of dollars in accounts receivable and inventory on its balance sheet but not enough liquid assets to pay debt when it becomes due.

Cash flow insolvency can be rectified by applying strategies that accelerate cash flow and release capital that may be buried in your current assets. More details on this topic will be discussed further in this article.

- Balance sheet insolvency is when a company’s liabilities exceed its assets. Sometimes referred to as “technical insolvency” it means the company does not have enough assets to cover all its debts.

This condition is more complex than cash flow insolvency. Companies in this situation are best advised to contact a reputable insolvency professional to help navigate the resulting financial distress.

Insolvency is often mistakenly confused with the term bankruptcy. Insolvency is a state of financial distress. Bankruptcy is the legal process an insolvent debtor must follow to surrender assets in exchange for relief from debts. A company can be insolvent but not bankrupt, whereas a bankrupt company must, by law, be insolvent.

What causes business insolvency?

Insolvency is typically a result of unresolved operational challenges or poor sales. These situations occur most frequently in weak market conditions. Many companies facing diminishing performance levels focus on operational challenges and sales initiatives but fail to track their overall financial progress properly. Instead, they may convert any available funds from struggling cash flow into operating capital to keep the business moving forward. Only the most pressing financial obligations are paid to keep the wolves at bay. This isn’t a strategy: it’s a tactic – and a bad one! Unless the company suddenly reverses trends and becomes more profitable, this path often leads to insolvency.

A more effective strategy involves a balanced approach – working to resolve issues while closely monitoring the company’s financial health. A company’s financial standing will soon eclipse operational challenges if an insolvency crisis occurs.

What are the warning signs of insolvency for businesses?

To manage the balance between operational challenges and sales initiatives while monitoring financial health, businesses need to watch closely for warning signs of financial distress. Warning signs are easy to monitor if you know what to look for.

The following is a list of signs that warn of approaching insolvency. The list is separated into early warning signs and signs of immediate danger.

Early Warning Signs of Insolvency: If left unchecked, business conditions could prompt a slide toward insolvency.

- Declining or negative cash flow

- Declining sources of working capital

- Negatively trending financial ratios

- High rate of aging accounts payable or receivable

- Regularly accessing overdrafts

- Breaking debt covenants

- Declining industry conditions

- Unsold or obsolete inventory

- Extended cash conversion cycles

- Increases in employee turnover

- Declining product or service quality issues

Signs of immediate danger: Business conditions that signal a high likelihood of insolvency.

- A sustained decline in revenue

- Declining EBITDA margins

- Lenders restricting credit

- Late payments to creditors

- Taxes not being paid

- Loss of key customers

- Increasingly large liabilities

- Missed or delayed shipments

- Vendors cutting off credit

- Increased regulatory inquiries

- High management turnover

- Payroll in danger of being missed

- Employee benefits have not been paid

Testing for business insolvency

Watching for warning signs of insolvency is only the first level of defense. Testing for insolvency takes your scrutiny to a higher level. Calculating financial ratios and analyzing results is a more advanced method of gauging your company’s financial health and determining whether you are at a heightened risk of insolvency.

The following four ratios are most often used to measure insolvency:

interest coverage ratio

debt-to-assets ratio

shareholder equity ratio

debt-to-equity

It’s important to note that evaluating financial ratio results requires a certain amount of experience, as interpretation is necessary to develop an accurate assessment. For instance, a company with surging accounts payable but low debt may appear in good standing if only insolvency ratios that include debt are measured.

Businesses should always consult with trusted professionals knowledgeable with the use of financial ratios to help determine the true financial health of their business.

Your company is at risk of insolvency: what’s next?

If your company is sliding towards insolvency, don’t hesitate: take action to avoid the impending crisis! Avoiding insolvency is preferred, but recovery and turnaround are viable if managed well. That’s why it’s always best to seek professional help to secure a lifeline as soon as your business begins to tread water.

Cash flow insolvency is the easier of the two forms of insolvency to rectify. If you are facing cash flow insolvency, contact a reputable alternative lender experienced in your industry. Their options of flexible business financing solutions are designed to release funds from untapped sources of equity and improve cash flow. Transitioning to a flexible financing structure can provide immediate relief by providing quick access to capital. Asset-based lending and invoice factoring are two powerful financial tools that leverage collateral strength, helping deliver the capital businesses need when needed.

Balance sheet insolvency is the more complex form of insolvency to deal with but can be rectified without significant disruption if managed efficiently. In this case, consult with an insolvency lawyer or turnaround consultant to fully understand your business’s options and chart a path to recovery.

Conclusion

Always be on the lookout for early warning signs of insolvency. With market conditions continuing to challenge businesses nationwide, keeping a vigilant eye on your company’s financial health while managing operational challenges is critical. If you suspect a severe cash flow crunch is on the horizon, reach out to an alternative financing specialist to help avoid a crisis, or if insolvency appears inevitable, engage an insolvency lawyer or consultant to facilitate a turnaround strategy and plan your recovery.

Monitoring for insolvency and acting quickly at the first sign of distress will help to mitigate disruption and accelerate your return to profitability.

How eCapital helps businesses avoid insolvency

eCapital has provided flexible alternative financing solutions to SMBs in over 81 industries since 2006. Our team of industry experts works to thoroughly understand your business model before recommending tailored business financing solutions to meet your capital requirements. Whether it’s a rapidly deployed invoice factoring facility, a flexible asset-based loan, or a mix of financing solutions to meet your needs, our skilled, dedicated, and friendly team structures specialized alternative funding as unique and distinct as your business.

For more information about how our experienced team supports businesses’ capital requirements through all economic conditions, visit eCapital.com

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.