Important Insights into Reverse Factoring for Business Owners

Content

Reverse factoring, also known as supplier finance, is a powerful, strategic tool for managing cash flow and strengthening supplier relationships. Reverse factoring is a financial subset of supply chain financing. As a finance professional, I’ve seen firsthand how leveraging this financing solution can offer businesses a competitive edge. Here’s a straightforward guide to understanding reverse factoring and how you can incorporate it into your business operations effectively.

Reverse factoring, also known as supplier finance, is a powerful, strategic tool for managing cash flow and strengthening supplier relationships. Reverse factoring is a financial subset of Supply Chain Financing. As a finance professional, I’ve seen firsthand how leveraging this financing solution can offer businesses a competitive edge. Here’s a straightforward guide to understanding reverse factoring and how you can incorporate it into your business operations effectively.

Understanding Reverse Factoring

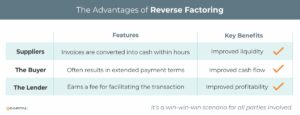

At its core, reverse factoring is a financial arrangement where a business (the buyer) utilizes a financial institution to pay its suppliers early. This setup benefits all parties involved: suppliers get paid faster, which can be crucial for their liquidity; the buyer often enjoys extended payment terms; and the financing institution earns a fee for facilitating the transaction. It’s a win-win-win.

Why Consider Reverse Factoring?

- Improved Cash Flow Management: By extending payment terms through reverse factoring, your business can better manage its working capital and maintain a healthier cash flow.

- Supplier Satisfaction: Paying suppliers early strengthens your relationship with them, ensuring their loyalty and possibly even securing better terms or pricing in the future.

- Financial Flexibility: This arrangement offers an alternative to traditional loans or credit lines, without diluting equity or incurring debt that could impact your balance sheet.

Implementing Reverse Factoring in Your Business

- Evaluate Your Supplier Base: Not all suppliers may need or want early payment. Identify key suppliers for whom early payment would be a significant benefit and start discussions with them.

- Choose the Right Finance Partner: Look for a financial institution or third-party provider that offers reverse factoring services with terms that align with your business needs. Transparency, fees, and ease of integration into your existing systems are crucial factors to consider.

- Understand the Costs: Be clear about the fees involved and how they compare to the cost of other financing options or the benefits of improved supplier relationships and extended payment terms.

- Communicate Clearly with Suppliers: Ensure your suppliers understand how reverse factoring works, its benefits, and any changes to the payment process. Clear communication is key to a successful implementation.

Practical Tips for Business Owners

- Assess Your Needs Regularly: As your business grows, your financing needs and supplier dynamics may change. Regularly assess whether reverse factoring is meeting your objectives.

- Monitor Your Cash Flow: Use reverse factoring as part of a broader strategy for cash flow management. Keep an eye on how it affects your overall financial health.

- Negotiate Terms: Just like any financial service, there’s room to negotiate terms with both your suppliers and the financing institution. Don’t hesitate to seek better terms that favor your business.

Reverse Factoring in Action

A real-world example of reverse factoring (also known as supplier finance) in action involves the global retail giant, Walmart. Recognizing the importance of maintaining a healthy and robust supply chain, Walmart has implemented supplier finance programs to strengthen relationships with its suppliers and ensure the stability of its inventory flow.

How Walmart’s Supplier Finance Program Works:

- The Setup: Walmart establishes agreements with financial institutions to provide financing options to its suppliers. This arrangement is based on Walmart’s strong credit rating, which allows suppliers to access finance at more favorable rates than they might achieve independently.

- Invoice Approval: When a supplier ships goods to Walmart, the invoice is approved for payment by Walmart but with extended payment terms. This means the supplier would typically wait longer to receive payment under the standard terms.

- Financing Option: Instead of waiting for the extended payment term, the supplier can choose to receive payment immediately from the financing institution. The financial institution pays the supplier the invoice amount (minus a small discount for the early payment).

- Repayment: Walmart pays the financial institution the full invoice amount on the original agreed-upon date. This repayment closes the loop, with the financial institution profiting from the discount taken when it paid the supplier early.

The Impact:

For Walmart, this reverse factoring arrangement helps to solidify the supply chain by providing suppliers with immediate access to cash, reducing their financial strain, and ensuring they can maintain or increase production levels without worrying about cash flow gaps. This is particularly beneficial for smaller suppliers who may have limited access to traditional financing options and for whom extended payment terms could pose significant liquidity challenges.

For suppliers, the program offers an opportunity to improve their cash flow without taking on traditional debt. It allows them to capitalize on Walmart’s creditworthiness to secure financing at competitive rates, which can be a lifeline for businesses operating on thin margins.

The Broader Implications:

Walmart’s use of reverse factoring is a prime example of how large retailers can leverage their financial strength to support their supply chain ecosystem. It demonstrates a win-win scenario where the retailer ensures a stable supply of goods, and suppliers gain access to vital working capital, fostering a more resilient and dynamic supply chain network. This approach not only enhances operational efficiencies but also strengthens relationships between retailers and their suppliers, creating a more collaborative and supportive business environment.

Walmart’s supplier finance program underscores the innovative use of financial instruments to address common business challenges, showcasing the potential of reverse factoring to transform supply chain dynamics and financial management practices across industries.

Conclusion

Reverse factoring can be a powerful tool in your financial arsenal, offering a practical solution to improve cash flow, enhance supplier relationships, and maintain operational stability without the burden of traditional debt. By understanding and applying the principles of reverse factoring wisely, you can navigate your business towards sustained growth and success.

Remember, the best financial decisions are informed ones. Consider how reverse factoring fits into your broader financial strategy and whether it aligns with your business goals. With careful planning and strategic implementation, reverse factoring can help pave the way for a financially healthy future for your business.

Key Takeaways

- Reverse factoring is a financial arrangement where a business (the buyer) utilizes a financial institution to pay its suppliers early.

- By extending payment terms through reverse factoring, your business can better manage its working capital and maintain a healthier cash flow.

- Walmart’s use of reverse factoring is a prime example of how large retailers can leverage their financial strength to support their supply chain ecosystem.

- Reverse factoring can be a powerful tool to enhance supplier relationships and maintain operational stability without the burden of traditional debt.

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.