Equipment Financing: Powering Business Growth with Tailored Solutions

Content

For many businesses, having access to the right equipment is essential to operations, productivity, and growth. Whether you’re a construction company needing heavy equipment, a manufacturer upgrading machinery, or a tech firm investing in the latest tools, equipment financing can provide the capital to acquire these assets without straining your cash flow.

Equipment financing can be a loan or lease used to obtain tangible assets having significant value and are necessary for day-to-day operations or business growth. Basically, it can be used to finance any tangible asset other than real estate.

This blog delves into equipment financing, how it works, its benefits, and why it’s a smart choice for businesses looking to invest in their future.

What Is Equipment Financing?

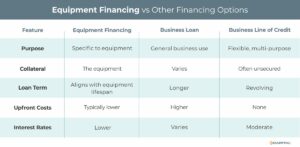

For this blog article, equipment financing refers to a loan, although it can also include leasing options. This financing arrangement is designed to help businesses purchase or upgrade the equipment they need to operate and grow. The equipment serves as collateral for the loan, which often results in faster approval and favorable terms compared to unsecured loans.

Key Features of Equipment Financing:

- Purpose-Specific: Funds are used solely to purchase equipment.

- Collateralized: The equipment being financed acts as collateral.

- Flexible Options: Leading specialty lenders can align terms and repayment schedules to align with the borrowing company’s needs and cash flow cycles.

How Does Equipment Financing Work?

- Application: Businesses apply for equipment financing, providing details about the equipment, business financials, and credit history.

- Approval: Lenders evaluate the value of the equipment and the business’s debt capacity to determine its ability to repay the loan.

- Loan Disbursement: Once approved, funds are disbursed immediately. The best specialty lenders integrate fintech capabilities to streamline processes and accelerate the speed of funding.

- Repayment: Businesses repay the loan via installments throughout the duration of the agreement, including principal and interest.

Benefits of Equipment Financing

- Preserve Cash Flow

- Avoid large upfront costs and spread the expense over time, allowing businesses to maintain liquidity for other needs.

- Access to Modern Technology

- Stay competitive by upgrading to the latest equipment without significant financial strain.

- Flexible Options

- Choose repayment terms and financing structures that align with your business’s budget and cash flow.

- Collateral Efficiency

- The equipment itself serves as collateral, reducing the need for additional assets.

- Tax Benefits

- In many cases, the interest paid on equipment loans can be tax-deductible. Consult with a tax advisor for specifics.

- Fast Approval

- Since the loan is secured by the equipment, approval processes are often quicker compared to other types of loans.

Challenges of Equipment Financing

- Interest Costs

- Financing adds interest costs over time, making the equipment more expensive than an outright purchase.

- Depreciation

- Equipment loses value over time, which may affect the business’s return on investment.

- Ownership Risks

- The business is responsible for maintenance, repairs, and eventual disposal.

- Qualification Barriers

- Businesses with poor credit may face difficulty securing favorable terms.

Industries That Benefit from Equipment Financing

- Construction

- Heavy machinery, cranes, and trucks are vital for operations and are often financed.

- Manufacturing

- Production lines, robotics, and tools can be costly, making financing essential.

- Healthcare

- Medical practices and hospitals use financing for diagnostic machines, surgical tools, and other high-cost equipment.

- Transportation

- Trucking companies and logistics providers use financing to maintain and expand fleets.

- Restaurants and Hospitality

- From kitchen appliances to point-of-sale systems, financing supports operations in customer-facing industries.

- Technology

- IT firms leverage financing for servers, computers, and specialized software.

How to Choose the Right Equipment Financing Option

- Evaluate Your Needs

- Determine whether ownership or leasing aligns better with your long-term business strategy.

- Research Lenders

- Compare interest rates, repayment terms, and fees from banks, alternative lenders, and equipment vendors.

- Understand Costs

- Consider the total cost of ownership, including interest, maintenance, and depreciation.

- Assess Financial Health

- Ensure your cash flow supports repayment without disrupting other operations.

- Consult Experts

- Work with financial advisors or equipment financing specialists to make informed decisions.

Real-World Example: Equipment Financing in Action

Scenario: A mid-sized manufacturing company needs $250,000 to upgrade its production line to improve efficiency and meet growing demand.

Solution: The company secures an equipment loan with a 5-year term and a fixed interest rate. The equipment serves as collateral, minimizing additional financial requirements.

Outcome: The upgraded production line increases output by 20%, enabling the company to fulfill larger orders and boost profitability. The loan is repaid comfortably through the additional revenue generated.

Partner with a reputable and experienced lender

To choose the best lender for equipment financing, consider factors such as interest rates, loan terms, and repayment flexibility. Evaluate the lender’s reputation and experience in your industry, as well as their approval process and speed. It’s also important to compare fees, down payment requirements, and any additional charges to ensure the financing solution aligns with your business’s financial goals and cash flow needs.

Shortlist your choice of lenders and research more thoroughly. Check their company websites for service capabilities and examine client reviews to assess customer satisfaction. Follow up with interviews to confirm loan agreement details and determine if the lender’s business culture and practices align with your company’s needs.

Conclusion

Equipment financing offers a practical and cost-effective solution for businesses seeking the tools they need to succeed. By spreading out the cost and preserving cash flow, businesses can stay competitive, enhance efficiency, and drive growth without sacrificing financial stability.

Whether operations, upgrading outdated tools, or starting a new venture, equipment financing provides the flexibility and support to meet your goals. Evaluate your needs, compare lenders, and choose a financing option that aligns with your business strategy. Equipment financing can be a stepping stone to long-term success with the right approach,.

Contact us to learn more about our equipment financing options and the selection of flexible funding options available to support your company’s stability and growth.

Key Takeaways

- For many businesses, having access to the right equipment is essential to operations, productivity, and growth.

- Equipment financing is a cost-effective solution to help businesses purchase or upgrade the equipment they need to operate and grow.

- The equipment itself serves as collateral for the loan, which often results in faster approval and favorable terms compared to unsecured loans.

- Whether you’re expanding operations, upgrading outdated tools, or starting a new venture, equipment financing provides the flexibility and support to meet your goals.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.