Your Trucking Fleet Received A Forbearance Letter – What Does It Mean And What Should You Do?

Content

All trucking companies need reliable access to working capital to support operations. Many fleets typically utilize bank financing to obtain an operating line of credit at the lowest interest rate they qualify for. But this approach has its risks!

Conventional lenders monitor business performance levels closely, especially during economic downturns. If your lender becomes concerned about your fleet’s financial stability, they may take action to minimize their exposure to the risk of default. Financial institutions often begin this process by sending a forbearance letter.

This communication is often the first indication that your lender is worried about your fleet’s ability to repay a loan or credit line. It’s a severe warning that your trucking company’s financial backing is in danger of being recalled.

Although it is not a reason to panic, correct and immediate action is required. Fleet owners and managers must be well-informed about what a forbearance letter is, what it means for your business, and what steps you should take to avoid a financial crisis.

What’s a forbearance letter?

The word “forbearance” means “to refrain from doing something,” which is precisely what the lender does. A forbearance letter is the lender’s way of saying:

“We will refrain from demanding immediate repayment of the loan or seizing pledged collateral to satisfy the loan if you agree to the following additional terms and conditions.”

Here’s a quick summary of what a forbearance letter means in simple terms:

• The lender is willing NOT to demand immediate repayment of the loan’s outstanding balance or seizing pledged collateral, as long as you agree to additional terms in your lending agreement.

• The letter is part of a forbearance agreement. This agreement will clearly define additional terms and conditions that must be agreed to and complied with by you for the lender to refrain from recalling the loan. While each forbearance agreement is different, several terms and conditions are standard. These include the following:

• Decreased funding. If you have a line of credit, your lender may reduce your available credit limit or freeze future credit increases until the issues raised by the lender are addressed.

• Request for additional information. Your lender may request additional reports and collateral in addition to what is already included in the original loan agreement.

• Additional fees. Your lender may charge you extra fees for spending additional time to monitor your financing performance. Some fees may need to be paid upfront, while others may be paid monthly.

What does this mean to your trucking company?

In short, a forbearance letter provides temporary breathing room to help a freight company get its finances back in order. Meanwhile, the fleet’s financing account will be moved to the lender’s “special loans” division for continued scrutiny until the lender’s concerns are alleviated. If the lender continues to have apprehensions after a reasonable period, they will likely take the next step and deliver a demand notice giving your fleet 10 days to repay the loan in full.

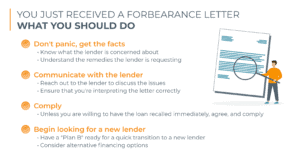

If your fleet receives a forbearance letter, the first action is to grasp exactly what the letter tells you. Start by understanding the problem.

Here are a few common reasons trucking companies receive a forbearance letter:

• Missed payments: The most obvious reason you would receive a forbearance letter is that you’re not making on-time payments, you have deferred, or altered one or more payments.

• Violated covenants: Loan covenants are additional terms and conditions of a loan agreement to define what the borrower must and cannot do. Violating covenants could trigger an immediate issuance of a forbearance letter.

• Failure to report: A lender may require you to submit various reports monthly, quarterly, or annually. Failing to adhere to reporting schedules or providing inadequate reports can also trigger a lender to issue a forbearance agreement.

• Perceived concerns: You don’t need to have missed a payment, violated a covenant, or overlooked a reporting requirement for a lender to send a forbearance letter. All it takes is for the lender to conclude, in their opinion, that your fleet’s financial health is trending downward.

Understanding the problem is crucial. It is recommended to get independent professional advice to ensure you fully comprehend the letter’s intent and how it might impact your fleet financing.

What are the following actions to take?

The key to effectively managing a successful outcome is to keep taking action – don’t become complacent. Instead, follow these next steps:

When the credit market is tight, you should always have a “Plan B” ready in case your current source of financing quickly dries up. This is especially true after receiving a forbearance letter from your lender!

Consider alternative forms of financing

If your existing lender isn’t confident in your trucking company’s financial future, chances are that other conventional lenders will look at your books the same way. When searching for “Plan B” solutions, consider looking at alternative forms of financing so that you have a workable solution in place if your loan is recalled.

Alternative financing options, such as freight factoring and equipment refinancing, are specialized funding solutions for the trucking industry. These options are relatively easy to qualify for, with fast approvals, quick onboarding, and expedited funding speeds. These covenant-light funding options feature flexible terms tailored to meet your fleet’s capital needs and ability to pay. The following are two of the most effective funding solutions for trucking fleets:

• Freight factoring: This funding arrangement delivers immediate cash to the fleet’s cash account once an invoice is submitted and verified for financing. Get up to 100% advance on freight bills within minutes of delivering a load.

• Equipment refinancing is a specialized form of asset-based lending that secures a line of credit based on the equity value of your working equipment. Your fleet can borrow up to 75% of the appraised value of road-worthy trucks and trailers.

The best alternative lenders for your fleet specialize in transportation financing. These lenders provide flexible financing options to improve cash flow and provide greater access to working capital. Selecting alternative lenders experienced in working cooperatively with banks and other conventional creditors paves the way for a seamless transition to a new financing structure if and when needed.

• Asset-based lending (ABL) leverages a combined set of hard assets as collateral to deliver maximum access to working capital. High advance rates on accounts receivable, the appraised value of equipment, plus machinery, real estate and more provides a flexible, covenant light lending arrangement highly suitable for trucking companies in financial distress.

Conclusion

If your fleet receives a forbearance letter, don’t panic; act! A forbearance agreement allows your trucking fleet time to restore financial stability and lender confidence. Understand the cause for concern, work with the lender to resolve issues, and comply with the forbearance letter’s demands. If navigated well, the lender may restore the terms and conditions of the original loan agreement, and funding will continue as normal.

Take immediate action to meet the lender’s revised requirements but plan an alternate financing arrangement better suited to meet your fleet’s capital needs and ability to pay.

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.