A Business Owner’s Guide to Invoice Factoring

Content

Invoice factoring is a mainstream business financing option. It is designed to accelerate cash flow by delivering payments to businesses within hours of issuing invoice receivables to their customers. Qualification is quick and easy. New accounts can be approved, set up, and begin first funding in a few days. Although this fast, flexible financing option is growing in popularity, many often misunderstand invoice factoring. This guide takes business owners through a comprehensive overview of this alternative financing option.

Learn what invoice factoring is, how it works, and how to qualify for this type of financing. Keep reading to understand the different types of factoring arrangements and how costs are determined. Next, we’ll look at the benefits and drawbacks of invoice factoring to help you to determine if this is the right financing structure for your business. This guide explains the ins and outs of invoice factoring and how to choose the right factoring company for your business.

What is invoice factoring?

This century’s old financing practice has been revived and modernized to meet the capital needs of today’s business owners. Invoice factoring provides fast, flexible business financing. It is a growing trend used by businesses needing immediate financial relief, established companies needing to fill funding gaps, and businesses in growth mode. It is not a loan. It is the selling of invoice receivables at a discount in exchange for immediate cash. This liquidity helps to stabilize business operations and provides the financial means to support long-term goals without debt.

In simple terms, invoice factoring is a financial transaction that turns account receivable invoices into immediate cash. Converting receivable assets into accessible working capital is a tremendous boost to company finances as business customers increasingly delay payments to benefit their cash flow situation. Invoice factoring unlocks the money your business has already earned so you can access working capital within hours of issuing an invoice to a creditworthy customer.

Invoice factoring has been used to finance commerce for thousands of years. Although it has evolved, it has kept its original intent – to convert the value of goods and services to immediate cash before a customer pays the invoice. Modern alternative lenders have refined this ancient cash flow strategy by using technological advancements to create a much-needed, simple-to-manage financing arrangement for small and mid-sized businesses.

Invoice factoring is easy to qualify for, simple to manage, and highly flexible. Credit limits can expand to keep funding aligned with new business opportunities as a company grows.

How does invoice factoring work?

A company delivers products or services, invoices the customer, and gets paid in hours – it’s that simple! To better understand how invoice factoring works, let’s take a closer look under the hood.

The transaction involves the following three parties:

- Client business: The seller of invoices

- Debtors: The business’s customers

- Factoring company: The lender who buys invoices and advances cash

The funding cycle involves three financial transactions:

- The advance: The amount transferred to the client’s business account within hours of the factoring company receiving and verifying the invoice.

- The reserve: The amount held back by the invoice factoring company until they receive full payment for the invoice total.

- The factoring fee: The factoring company charges a factoring fee for its services. The fee is deducted from either the advance or the reserve amount.

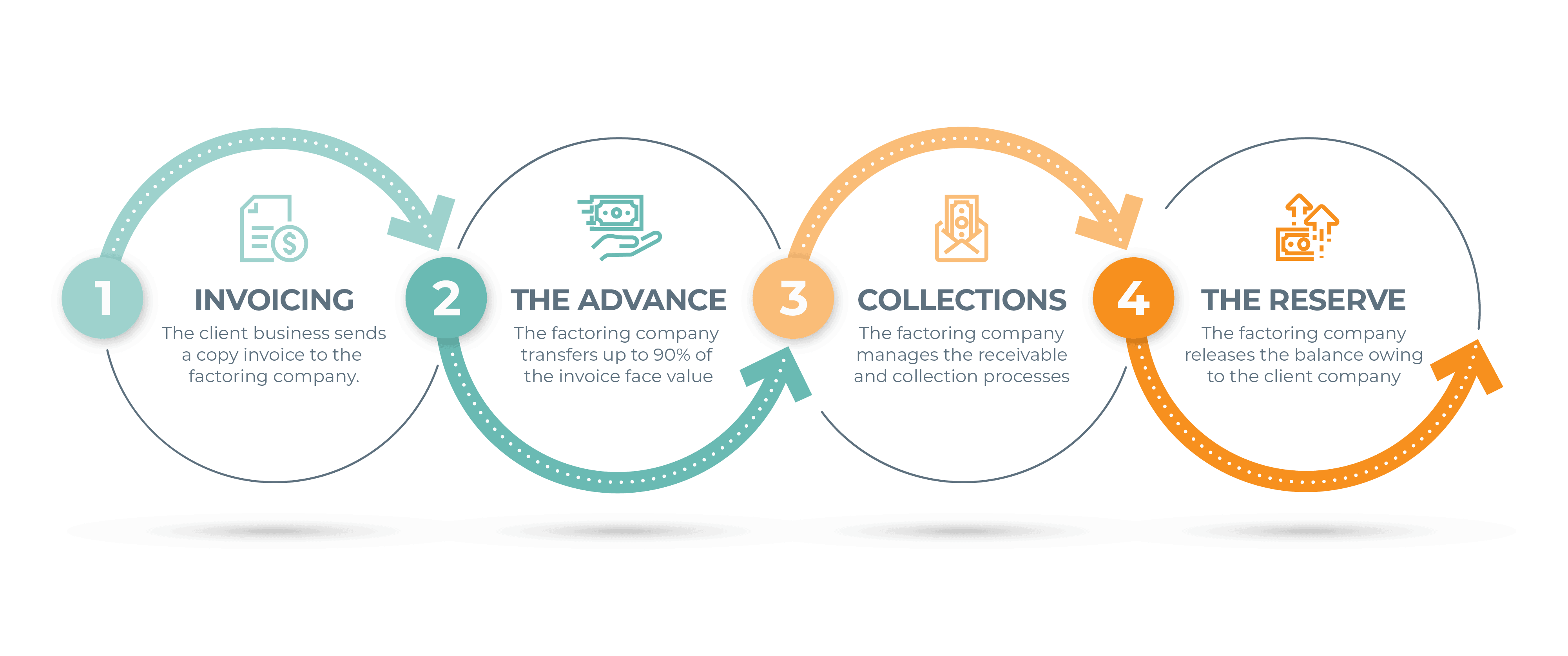

The four steps to immediate funding are:

- Invoicing: The client business delivers products or services, invoices the customer, and sends a copy invoice to the factoring company.

- The advance: The factoring company verifies the invoice and immediately transfers cash equaling up to 90% of the invoice face value to the client business’s cash account. The remaining invoice balance is held as a reserve until the factoring company receives full payment from the debtor. Depending on their industry, some businesses can receive higher advance rates.

- Collections: The factoring company manages the receivable and collection processes.

- The reserve: When the debtor pays the invoice in full to the factoring company, the factor releases the reserve amount and pays the balance owing to the client business. The factoring transaction is complete.

Note: The factoring company will buy an invoice for a defined time (usually 60, or 90 days) called the “recourse period.” The transaction is completed if the debtor pays the full invoice within the recourse period. If the factoring company can’t collect full payment within the recourse period, the client business must buy back the invoice and return the amount advanced plus an additional fee.[/vc_column_text]

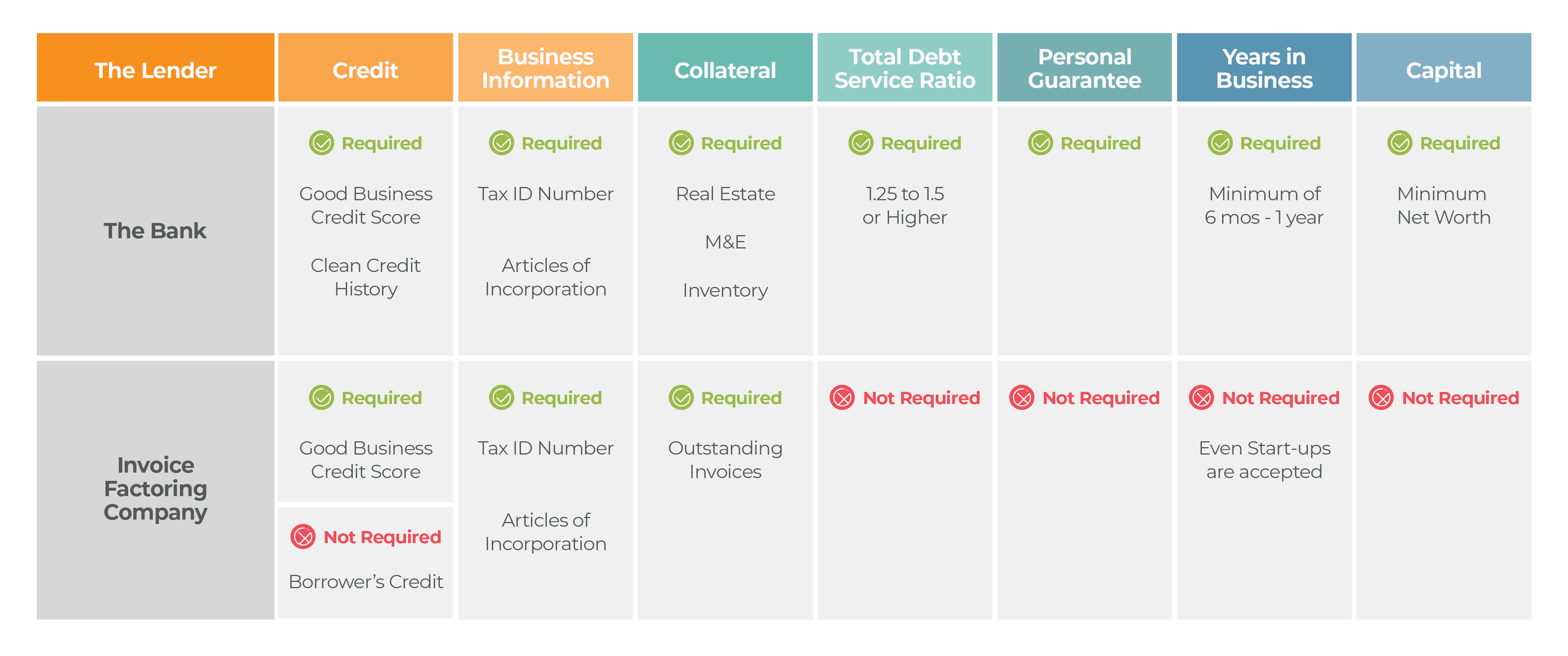

Qualifying for invoice factoring is easy

Since qualification for invoice factoring is mainly based on the creditworthiness of the client’s customers, not on the client’s own personal or company worth, it is far easier and quicker to attain than bank financing.

If your business regularly invoices creditworthy customers, qualifying for invoice factoring is easy! A good factoring company will have a simple online form to get started and be able to process an application and approve funding in just a few days.

Types of invoice factoring

Invoice factoring is a general category that classifies various types of accounts receivable financing under one umbrella. These distinct types have been developed and tailored to serve the needs of specific purposes or industries. Although each type of invoice factoring serves the same purpose, to advance fast cash on outstanding invoices, they offer different features, terms, and conditions tailored to the business needs for which they are intended.

The following list identifies commonly used types of invoice factoring:

General account receivable factoring is the most all-purpose form of invoice factoring. It is most often employed by manufacturing and import/export companies. Usually, advances are 75% to 90% of the face value of the invoice.

Freight factoring is a distinct type of invoice factoring designed specifically for transportation companies. Freight factoring typically delivers the fastest speed of funding, easy document submission, and ease of use to busy truck company owners. Factoring fees range depending on the factoring company but typically are much more competitive than general accounts receivable factoring fees. Advance rates can be as high as 100%.

Payroll funding can refer to other funding solutions, such as ABL financing, but usually refers to a specific invoice factoring solution tailored to the staffing industry. Its purpose is to ensure staffing companies have dependable cash flow to support the regular burden of meeting payroll. Advance rates are typically between 80% to 95%.

Spot factoring is the selling of a single invoice to a factoring company. It is intended for companies that issue high-value invoices in small volumes. Spot factoring is best used by construction companies, or other businesses that receive large contract orders or that choose to fund only their largest receivables when cash flow is required. It is a pay-as-you-go facility that only carries a cost when money is advanced. Spot factoring rates are generally high compared to other types of invoice factoring. Advance rates are typically between 70% to 85%.

Understanding the various classifications and types of invoice factoring will better prepare you for choosing the best factoring solution to service the needs of your business. However, there is more to consider. Invoice factoring is also categorized by two other characteristics – “recourse” or “non-recourse” factoring, and “notification” or “non-notification” factoring.

Recourse vs non-recourse factoring

Whether the factoring arrangement is recourse or non-recourse refers to the client company’s responsibility should their debtor fails to pay the invoice within the recourse period (usually 90 days).

Recourse factoring is the lower cost of financing between these two categories, but it lacks the credit protection offered by its counterpart. If the factoring company can’t collect full payment within the recourse period, the invoice is charged back to the client business who must return the amount advanced plus an additional fee.

Non-recourse factoring is a no-risk option to protect the client business should a customer (the debtor) fail to pay their invoice for reasons of insolvency or bankruptcy. In this circumstance, the client company retains the advanced funds and is free and clear of encumbrances. Meanwhile, the factoring company is responsible for absorbing the loss of the unpaid invoice. For this reason, non-recourse factoring costs more than recourse factoring.

Notification vs Non-Notification Factoring

Whether the factoring arrangement is notification or non-notification refers to the debtors’ knowledge of who they are paying.

Notification is when a factoring company notifies a client’s customers (debtors) that their payments for the services provided by the client should be paid to the factoring company. As invoice factoring has become a mainstream cash flow strategy, debtors’ accounts payable departments are likely dealing with factoring companies all the time. Debtors often favor working with the professionalism of experienced accounts receivable teams and prefer working with factoring companies for this reason.

Non-notification factoring is entirely different in that the debtors are not notified or made aware that the client business is factoring invoices. All paperwork and communication conducted by the factor with the client’s customers are made as if they were coming from the client business. This practice is less common than decades ago, as invoice factoring is now a well-recognized and accepted form of business financing.

How much does invoice factoring cost?

While the client business receives immediate payment for an invoice, the factoring company is responsible for managing invoice payment processing and collection. In exchange for fast payment and being relieved of collection responsibilities, the client business gives up a small percentage of the invoice amount as the factoring fee.

Factoring rates are typically 2% – 5% of the amount invoiced. Most competitive rates land on the bottom end of this scale.

Each factoring company has its unique formula for determining a client business’s factoring fee, but all factoring companies use similar essential criteria to calculate the rate.

Following is a list of the standard criteria all factoring companies consider when determining a factoring fee for each business they serve:

- The creditworthiness of the customer base

- Total dollar volume to be factored monthly

- Average invoice amount

- Collection period

- Diversity of the business’s customer base (referred to as “concentrations”)

- Type of industry served

Typically, factoring companies specializing in specific industries provide the best and most cost-effective factoring options. For instance, a factoring company specializing in transportation may offer freight factoring with features designed to benefit truck company owners. A factoring company may also provide specialized factoring solutions for staffing companies and offer payroll funding with service features to ensure payroll is never missed.

For a deeper dive into what determines your factoring rate, visit our blog on Understanding Rates, Fees, and the Total Cost of a Factoring Agreement.

Benefits and drawbacks of invoice factoring

Invoice factoring provides fast access to working capital. A quick qualification process leads to fast underwriting, accounts setup, and client onboarding. The first funding can take place in a few short days. This speed of funding provides immediate financial relief to businesses in financial distress, increased cash flow for businesses in growth mode, and flexibility to support a transition or expansion. But the overall advantages of factoring invoices are far greater than the speed of funding.

Benefits

Following are some of the significant business benefits of utilizing invoice factoring:

Immediate access to working capital: Advanced funds are transferred within hours of the client submitting an invoice.

No impact on your credit score: Invoice factoring is not a loan it is the selling of an asset. There is no debt incurred, and therefore, there is no impact on your credit score.

Funding keeps pace with business growth: The more invoices your business generates to creditworthy customers, the more funds become available.

Full transparency and accountability: Tech-enabled invoice factoring companies provide a robust online account management portal to allow client businesses 24/7 access to real-time data. Monitor account balances, track transactions, and view credit limits to help keep a watchful eye on your business’s financial health.

Streamlined efficiencies: Dedicated account managers help onboard new clients, streamline services, and clear the tracks of any issues that may impact regular funding.

Credit protection: Invoice factoring companies have experienced credit teams and managers to help manage enhanced risk management practices. Their expertise and access to expansive databases provide the resources to assist in identifying potential risks associated with new business customers and help to avoid bad debt.

Operational agility: As the economy heads deeper into uncharted territory, consumer spending, workforce trends, and costing conditions change. Businesses with easy access to working capital have more financial flexibility to adapt. Further, when new business opportunities develop, invoice factoring’s flexibility allows credit limits to increase as the client business’s size or volume of invoices grow.

Drawbacks

Following are some of the drawbacks associated with invoice factoring:

Customer reliability: Businesses wanting invoice factoring largely depend on their customers’ creditworthiness. If some of these customers have a long record of late or delinquent payments, any invoices issued to them may be denied financing.

Chargebacks: Recourse factoring is the standard invoice factoring arrangement. Under this financing structure, any invoices financed but not paid by the debtor within the recourse period (typically 90 days) will be charged back to the client business. However, strong credit protection measures and experienced collection teams are at work to minimize the occurrence of chargebacks.

Common misconceptions about invoice factoring

Because invoice factoring has been around longer than the ancient Greeks, it carries some myths and misconceptions.

Despite its rising popularity as a business financing strategy, this fast and flexible funding solution is misunderstood by some and clouded in myth for others. Misconceptions are quickly changing as today’s business owners are becoming more aware of this powerful financial strategy’s advanced features and benefits.

Following is a list of the most misunderstood myths that still confuse some people who remain unaware of the true nature of invoice factoring:

Only start-ups and struggling companies benefit from freight factoring – False!

According to research, the main reason for business failures is a lack of adequate funding. No matter what stage of development they are in, the ability to effectively manage regular and adequate cash flow substantially impacts the success or failure of most businesses.

- Start-ups need capital to carry the business until revenue streams are established to carry the load.

- Growing companies need growth capital to fuel expansion – you’re either growing or dying!

- Mature companies need dependable access to capital to support large overheads and infrastructures.

- Companies pursuing M&A strategies benefit from the financial stability regular cash flow provides during transitions.

Invoice factoring companies are all the same – False!

Each factoring company has a unique blend of products, services, and expertise. Their company culture will reflect their industry knowledge, commitment to customer satisfaction, integrity, and ability to support your business when times get tough. Ensure the factoring company you choose is the right fit for your business needs.

Invoice factoring is complicated – False!

Only those who have not experienced the convenience of contemporary invoice factoring may falsely state that factoring is complicated. It is a simple process backed by dedicated customer service and online management systems to enhance convenience and ease of use.

Invoice factoring is expensive – False!

When comparing the total cost of financing with traditional bank financing – banks may win on price, but factoring companies win on value. Invoice factoring provides additional service benefits traditional lenders can’t match:

- Credit protection resources at your fingertips.

- Access to industry expertise and dedicated customer service to help guide you through financial challenges.

- Growing credit limits without the need to restructure financing.

- Funding agreements tailored to meet your company’s needs and ability to pay.

Value-added services provide greater business resilience and flexibility to navigate challenging economic conditions. That’s real value in today’s economy!

How to choose the right invoice factoring company

Choose a reputable invoice factoring company experienced in your industry – they understand how your business works. A factoring company that genuinely understands your business can provide cost-saving and value-added services to increase operational efficiency and improve your bottom line.

Select several leading invoice factoring companies to reach out to. Interview them and ask questions to assess their products, service capabilities, and fit. Will they work well with your organization? Do they display the qualities of a trusted financial partner?

When interviewing a lender, look for:

– Straightforward answers to your questions.

– Any hidden fees that are not advertised.

– A commitment to dedicated customer service.

– Evidence of expertise in the industry your business serves.

– Are they solution focused when faced with challenges?

– Do they have deep pockets – enough to support your business trajectory as new business opportunities begin to open up?

Check the factoring company’s online reviews and case studies to determine their brand value as experienced by other businesses like yours.

Conclusion

There is a reason invoice factoring has survived as a reliable business financing option for centuries – it works! And it works well no matter what stage of development your business is in (start-up, growing, mature). Whatever state your business finances are in, invoice factoring provides easy-to-manage, flexible financing that supports your business through most funding challenges. Products, services, and work practices are designed to make the lives of business owners easier with cash flow solutions you can count on.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.