In the transportation sector, running a company comes with many challenges but one of the biggest is managing the heart and soul of your business — your cash flow. Restricted cash flow can impact virtually every part of your operation, whether you have a staff of 3 or 300.

Over the past 10 years, the advent of freight factoring has become a made-to-order financial solution to help trucking operators manage their cash flow in real-time. However, while the basic premise behind freight factoring is quite simple, there’s more to know that can help you make the best possible decisions in choosing the factoring approach that will work best for you.

The two most basic forms of factoring agreements are recourse and non-recourse. These distinct forms of factoring focus on the assignment of liability for unpaid invoices. Each of these factoring types has unique strengths and weaknesses depending on your needs. In this blog, we investigate these two particular types of factoring to explain their differences and see where each can provide the most significant benefits.

Need a basic refresher on what factoring is and how it works? Click Here

What is recourse factoring?

Recourse factoring is a factoring agreement in which a trucking company sells its invoice receivables to a factoring company with the understanding that if the invoice remains unpaid after the recourse period for any reason (usually 60 to 90 days), the trucking company will be obligated to buy the invoice back.

Recourse factoring is the most popular type of factoring. It is more flexible and costs less than non-recourse factoring.

What is non-recourse factoring?

Non-recourse factoring is a factoring agreement in which a trucking company sells its invoice receivables to a factor with the understanding that if the debtor (your company’s customer) does not pay the invoice by the end of the recourse period, the factoring company may be obligated to absorb the loss. However, in non-recourse factoring, it is important to note that no universal definition specifies the liability’s circumstances. (More on this in the next section).

In effect, non-recourse factoring is like recourse factoring with an added layer of bad debt protection. For this reason, it may be more appealing to trucking companies who deal with higher-risk shippers and shippers who have been known to exceed their agreed-upon payment dates.

Critical differences between recourse vs. non-recourse factoring

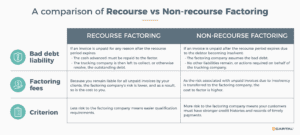

There are three distinct differences between recourse and non-recourse factoring.

- Bad Debt Liability

If an invoice remains unpaid after the recourse period expires with recourse factoring, the bad debt invoice is returned to the trucking company. Any cash advanced on the invoice must be repaid to the factor. The trucking company is then left to collect, or otherwise resolve, the outstanding debt. In non-recourse factoring contracts, the bad debt liability remains with the factor if the invoice goes unpaid. However, the specific triggers for bad debt liability in non-recourse factoring depend on the terms of the agreement you’ve signed. In some cases, factors may only agree to accept the bad debt liability if the debtor becomes insolvent. With other, more reputable factoring companies, the factor may bear responsibility for unpaid invoices as long as you have done your part and got the shipment where it is needed to be. - Factoring Cost

Recourse factoring is the lower-cost option because you remain liable for all unpaid invoices by your clients. If your clients fail to pay their invoices, your company would be obligated to pay back the advanced payment you received from the factoring company. Because the factor is not assuming that responsibility their non-payment risk is lower, and as a result, so is the cost to you. On the contrary, non-recourse factoring is more expensive than recourse factoring since some of the risk associated with unpaid invoices may be transferred to the factoring company. And they will need to be compensated for accepting this risk. However, depending on the nature of your customer mix, this additional expense could be worth it to ensure that your business’s cash flow is shielded from damage in the event of customers’ defaults. - Requirements

Recourse factoring has less stringent requirements for accepting invoices to be factored compared to non-recourse factoring. This is because with recourse factoring, the factor always gets paid: either by your debtor, or by you (if the invoice is returned). Understandably, with non-recourse factoring, the factor may have additional approval requirements to be met before accepting invoices. These requirements may slow down the funding process and impact the overall volume of invoices that you can successfully factor.

Recourse vs. non-recourse factoring: Which is best suited for your organization?

So far, you’ve learned about what recourse vs. non-recourse factoring entails and the key differences between the two. The question now is, how do you choose between recourse and non-recourse factoring?

First, it’s essential to consider your clients before signing any factoring service. Conducting a credit check is the most efficient way to learn about their credit histories. Once you’ve completed your credit checks, place your clients into four categories: excellent, good, fair, and bad credit.

It may be more cost-effective to use a recourse factoring service if you have more clients with excellent or good credit scores and clean payment histories, as they are more likely to pay. However, if you have more clients with fair or bad credit scores and poor payment histories, it’s wise to use non-recourse factoring since you have added protection against a default in payment. It would be best if you took the time to understand the types and levels of protection against default that you are buying. Default against insolvency only protects against a specific case of risk. Broader default protection may offer a more obvious value proposition that may be well worth the additional cost.

Overall, you can’t make a wrong choice when choosing between these two types of factoring. When considering recourse factoring vs. non-recourse factoring, take into account cost vs. risk. Recourse factoring costs less, but balanced against non-recourse it has higher risk.

Tap into an accounts receivable engine

No matter which type of factoring you choose, reputable factoring companies like eCapital provide efficient accounts receivable management free of charge. This value-added service reduces the risk for both the factor and for your company. A trained team of specialists performs courteously and effectively to protect your customer relationships as they improve your accounts receivable turnover. Reducing overall risk is one of the benefits of invoice factoring.

Summary on recourse vs. non-recourse factoring

Recourse and non-recourse factoring are the two major types of invoice factoring — each appeal to different businesses.

Recourse factoring is the most cost-effective. It is best suited for companies having customers with good credit scores and verified payment histories. On the other hand, non-recourse factoring is ideal if you have many customers with low credit scores and compromised payment histories.

The supplementary bad debt protection provided with non-recourse factoring is a little more costly and has stricter terms and conditions than recourse factoring. Thus, some of your clients that may qualify for recourse factoring may not be eligible for non-recourse factoring.

Most factoring companies limit non-recourse factoring services to debtors (your business customers) that adhere to the 5 Cs of credit:

- Character

- Capacity

- Capital

- Collateral

- Conditions

Each factoring company has different requirements for non-recourse factoring services; therefore, choosing the factor with favorable terms and conditions is essential.

While there isn’t a wrong choice between these two types of factoring, ensure that the factoring company you choose to partner with understands how your business works and the cash flow problems to be solved. The right factoring company for your business will consider your company’s size, the cash flow gap to be filled, and your clients’ behavior before recommending which type of invoice factoring to use.

About eCapital Non-Recourse Factoring

Since 2006, eCapital has been a trusted financial partner for thousands of small to mid-size trucking companies in all stages of development. Our customer base continues to grow as our reputation for reliable funding, dedicated service, and effective risk management endures. eCapital’s non-recourse factoring agreements are a prime example of our customer-centric — eCapital accepts responsibility for unpaid invoices as long as you have done your part and got the shipment where it is needed to be.

As a leading industry innovator, eCapital integrates emerging technologies with a forward-thinking approach to solve business problems. Working in collaboration with our clients, eCapital shapes customized factoring facilities to meet your business’s working capital needs and cash flow requirements.

For more information about recourse vs. non-recourse factoring and which type is best suited to solve your company’s cash flow issues, visit eCapital.com

Key Takeaways

- The two most basic forms of factoring agreements are recourse and non-recourse.

- These forms of factoring focus on the assignment of liability for unpaid invoices.

- The three distinct differences between recourse and non-recourse factoring are bad debt liability, factoring costs, and qualification requirements.