Invoice factoring is simply a cash flow solution that turns invoices into quick cash without adding any additional debt. Common in several industries, invoice factoring allows companies to use the cash to pay for upfront costs, rather than waiting 30, 60, or even 90 days for a payment. Many companies rely on factoring to access the working capital they need to grow their business.

So how does invoice factoring work and how can you get started?

Below is a list of the top 10 frequently asked questions regarding invoice factoring:

Factoring FAQ #1

Will factoring hurt my company’s credit score?

No. Since invoice factoring does not make your company incur any debt, factoring will not hurt your credit score.

Factoring FAQ #2

Can I factor past due invoices?

Most companies allow you to factor invoices up to 30 days old.

Factoring FAQ #3

How are funds transferred to my business?

In most cases, you can get funds wired to your company bank account, get an electronic payment through ACH, get an express code, or receive a check by mail.

Factoring FAQ #4

Does invoice factoring require personal guarantees?

Unlike traditional bank loans, invoice factoring does not require personal guarantees.

Factoring FAQ #5

How will my customers know where to send their payments?

Your customers will receive a notice of assignment to pay the factoring company directly. Typically, they will receive a copy of the invoice clearly stamped with information about where to send the payment.

Factoring FAQ #6

Do factoring companies contact my company’s customers?

Yes, usually through a one-time notice of assignment alerting the customer to send payments to the factoring company. Factoring companies understand the importance of maintaining business relationships and will professionally handle all communications with your customer.

Factoring FAQ #7

What happens if a customer sends a payment to my company instead of my factoring company?

The funds should be immediately forwarded to the factoring company.

Factoring FAQ #8

Can my start-up qualify for factoring services?

Absolutely! Because factoring focuses on the credit of your customers, it is a great way for a start-up business to grow their working capital.

Factoring FAQ #9

Will my customers think my business is struggling if I factor?

Factoring is an accepted form of financing in the business world. When a company factors, it will put them in a stronger financial position, which helps build trust in your business.

Factoring FAQ #10

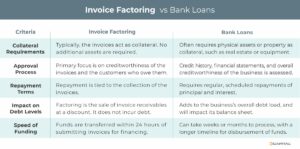

How is factoring different from a bank loan?

The approval process for invoice factoring is quite simple, as compared to the lengthy approval processes often associated with bank loans. Also, unlike a bank loan, factoring does not create debt.

Conclusion

By understanding how invoice factoring works, its benefits and drawbacks, and how to choose the right factor, businesses can make informed decisions about whether this financing option is right for them. Whether you’re looking for immediate cash flow solutions or need to manage accounts receivables more effectively, invoice factoring can be a valuable tool in your financial strategy.

Contact us today to request a free financing consultation and see how we can help support your business expansion plans.

Key Takeaways

- Many companies rely on factoring to access the working capital they need to grow their business.

- By understanding how invoice factoring works, its benefits and drawbacks, and how to choose the right factor, businesses can make informed decisions about whether this financing option is right for them.

- In this blog, we address the top 10 most frequently asked questions regarding invoice factoring.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.