DIP Financing: A Workable Solution for Businesses Facing Bankruptcy

Content

A new report shows bankruptcies are defining business conditions this year.

According to Epiq Bankruptcy, a U.S. bankruptcy filing data provider, Commercial Chapter 11 filings increased 105 percent in May 2023 compared to last year.

These bankruptcy rates highlight businesses’ struggles to remain profitable and maintain business financing through a period of high-interest rates and inflation.

In the face of this challenging environment, there is a solution available when you find the right financing partner.

Read on to see how rising rates of Chapter 11 bankruptcies are linked to the cycle of restricted credit availability. Then, learn about easy-to-acquire alternative business financing options that connect struggling businesses to the working capital needed to fund recovery plans and return to profitability.

Why are bankruptcies rising?

The rate of Chapter 11 filings coincides with rising overall commercial bankruptcy filings, reports Epiq. Overall commercial bankruptcy rates increased 31 percent in May 2023 to 2,324 versus the 1,771 registered in May 2022. Small business filings – classified as subchapter V elections within Chapter 11 – reported a 31 percent increase to 149 in May 2023 versus 114 in May 2022.

Raising interest rates is the Federal Government’s central strategy to lower the inflation rate. However, as interest rates increase, the likelihood of borrowers being able to repay loans declines, and banks become more cautious about extending credit – especially to businesses sliding towards insolvency.

It’s a “catch 22” situation. Without adequate working capital, business operations weaken, increasing their chances of default. That, in turn, further decreases lender confidence. As the frequency of large corporations filing for bankruptcy increases, traditional lender confidence continues to diminish, further decreasing the availability of credit.

According to a Biz2Credit Small Business Lending Index, small business loan approval percentages at big banks dipped slightly in May from the already low rate of just 13.5% recorded in the previous month of April. Fortunately, non-bank business financing options are available to struggling companies. Reputable and experienced alternative lenders provide easy to acquire financing options to businesses in financial distress.

Chapter 11 might not be the end of your business

Of the 680 businesses filing for Chapter 11 bankruptcy proceedings in May 2023 (up from 332 filings in May 2022), most will remain in business and undergo restructuring.

Businesses that opt for Chapter 11 bankruptcy proceedings are permitted to continue operations but must follow (and find ways to fund) a strict restructuring plan.

For example, Vice Media is currently restructuring ahead of a planned sale. While Vice has more than 5,000 creditors, three creditors involved in the restructuring bid process have committed $225 million to the company. These funds are used to restructure debt and reorganize operations. In other cases, businesses may seek financing from specialty providers of debtor-in-possession financing to help maintain operations under Chapter 11 bankruptcy proceedings.

How can businesses fund recovery?

If a company files for Chapter 11 bankruptcy protection, it may be able to take advantage of DIP financing. DIP financing can help a company reverse course, support restructuring, and return it to profitability. It’s typically available to companies where lenders believe the company has a credible chance and a viable plan to turn itself around.

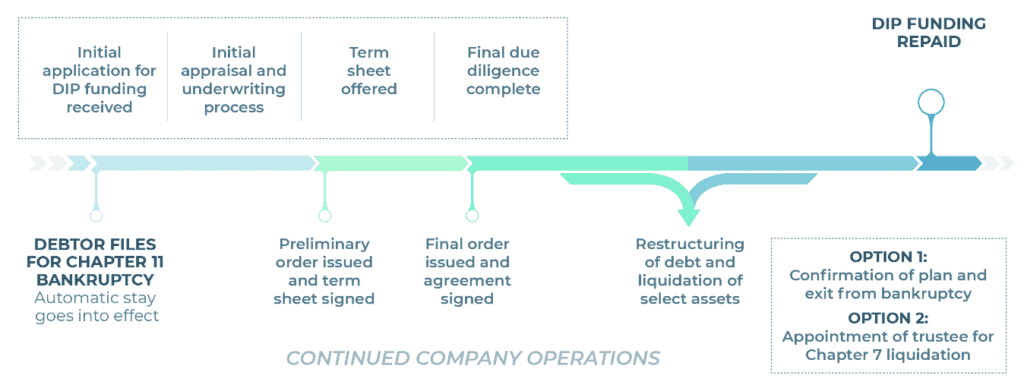

For businesses filing for Chapter 11 bankruptcy, a typical “debtor-in-possession” (DIP) financing agreement proceeds like this:

In DIP financing, the assets pledged as collateral must be sufficient to cover the business bankruptcy loan. Here’s how the DIP Chapter 11 Loan process works:

- The company seeks approval from the Bankruptcy Court to engage with a lender that is willing to finance its turnaround.

- Following standard DIP financing terms, the lender gains “priority” security interest in the collateral, a market-rate or premium rate of interest, an approved budget, and other related lender protections.

- The company’s existing creditors will need to consent to the new loan. However, if they feel they will be made worse off and object to the new loan, the Bankruptcy Court will have to be convinced that the existing lenders will be adequately protected before deciding whether to approve the loan or not.

Here’s how alternative finance companies can offer DIP financing with more accessible funds to struggling businesses, even amid rising corporate insolvencies:

1. Fast, easy qualification processes

Alternative lenders assess funding approvals based on the business’s quality of collateral rather than its credit status. Valuable assets, such as accounts receivable, and any available equity in unencumbered inventory or equipment can provide the security needed to arrange a funding agreement.

Funding decisions are made in days, or maybe a few weeks as compared to bank financing which could take months to approve. Onboarding, and first funding takes place quickly once the agreement is signed.

2. Accelerated invoice payments

Accounts receivable financing (also referred to as invoice factoring) can be one of the most flexible ways to obtain funding and recapitalization during the Chapter 11 bankruptcy process.

In an invoice factoring arrangement, a factoring company buys your business’s accounts receivable invoices at a discount in exchange for immediate payment. Upon receiving your invoices for financing, the factoring company verifies documents and transfers funds within 24 hours – or even quicker.

Immediate payment of accounts receivable alleviates the stress and strain of irregular cash flow without incurring further debt. As a result, invoice factoring has become a go-to alternative to traditional debt financing.

3. Large investment funding

For large investments needs to support restructuring, an asset-based lending arrangement can provide a significant injection of capital upfront. Leveraging the equity value in accounts receivable, inventory, or equipment such as CNC machines, leading alternative lenders can advance funds up to $50MM.

4. Expanding funding limits

Unlike the strict credit limits imposed by traditional lenders, alternative lending offers flexible funding limits. For instance, invoice factoring users can have the credit limit raised if their business begins to grow and generates more invoices to creditworthy customers. Your credit limit can be adjusted without applying for a new funding agreement to scale with your business and to keep pace with the cost of business expansion.

Conclusion

Businesses of all sizes are facing unprecedented pressure as record inflation; rising interest rates and softening demand are conjuring a perfect storm of harsh economic conditions. The frequency of commercial bankruptcy is escalating.

If your company is experiencing financial distress, it is important to consult an experienced bankruptcy attorney and restructuring or turnaround specialist to determine your viable options. You may be able to do a workout or other restructuring process outside of bankruptcy. However, if you determine that Chapter 11 bankruptcy is your best option, DIP financing may provide a strong opportunity to help turn your company around.

Alternative funding solution companies are filling the lending gap left by traditional lenders. Alternative finance companies are equipped to provide the funds needed to navigate financial crises or fund debtor-in-possession agreements. These funds can help finance restructuring, including operations & overhead costs, payroll, retention of restructuring professionals, and payments to critical pre-petition creditors.

Whether your company has filed for Chapter 11, or is heading that way, look for a leading alternative finance company with experience in distress financing. Their suite of financing options provides the funds needed to navigate financial crises or fund debtor-in-possession agreements.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.