Company Driver vs Owner Operator – What's the Difference?

Content

There’s no doubt about it; the trucking industry has had a tough time over the past two years! However, change is in the wind – although it may be more of a breeze. Industry analysts predict America’s freight recession is nearing its end as the economy is expected to experience steady, moderate growth stretching into 2026 and beyond. For many professional truck drivers, this is a time to consider the risks and rewards of being an owner operator vs company driver.

Owner-operators have the potential for higher earnings and greater control over your business, allowing you to choose your routes and negotiate rates. However, this independence also carries significant risks, such as financial responsibility and the challenges of managing your own business. In contrast, company drivers enjoy more stability, less financial risk, and benefits. However, they have less autonomy and typically lower earning potential. Balancing these factors is crucial when deciding between a career as an owner operator vs company driver.

For company drivers who break out to become independent owner operators the real challenge is to start well, build momentum and get ahead of the competition. This guide is for professional truck operators to help navigate the decision of being an owner operator vs company driver.

Is This The Time to Start a New Trucking Company?

The trucking industry is cyclical and volatile, heavily influenced by broader economic conditions. Extreme peaks in demand, such as the post-pandemic spot market boom that earned independent owner operators excessive incomes, often lead to downturns, as seen in the current freight recession. However, what goes up must come down, and vice versa.

GDP growth is projected to increase by 2.7% in 2024 and 1.8% in 2025, with real GDP growth anticipated to hover between 1.7% and 2.1% from 2026 to 2028. This stable economic growth is likely to increase freight volumes and profitability. In this environment, earnings for owner operators vs company drivers can be significantly higher, billing up to 85-88% of load costs compared to $0.70–$0.75 per mile for company drivers.

Despite the anticipation of improving market conditions, the FMCSA is currently experiencing a high volume of authority revocations as numerous trucking companies exit the industry following the collapse of the spot market. This trend highlights the severe challenges of the industry – for efficient operations it indicates opportunity as capacity tightens and freight balances out. For those considering whether to become an owner operator vs company driver, the first question is, “Do you have the mettle to be your own boss?” Entrepreneurs with road experience, business savvy, and the drive to succeed will be poised to grow and profit. The second question is, “When to take the plunge?” Jumping in too early could mean facing stiff competition for low rates while waiting too long risks losing contracts to rivals as demand improves.

The Risk

Deciding to become an owner operator vs company driver should be a risk vs reward analysis. An accurate evaluation of the opportunity reveals a range of challenges – be realistic when assessing your adaptability and tolerance for risk.

When evaluating the opportunity of being an owner operator vs company driver, here are some challenges and risks to consider:

- Financial Burden: The costs for purchasing or leasing a truck, along with ongoing expenses like fuel, maintenance, insurance, and permits, means high upfront expenses for an owner operator vs company driver.

- Variable Income: An owner operator’s income can fluctuate significantly based on demand, freight rates, and market conditions, making financial planning difficult.

- Maintenance and Repairs: Owner-operators are responsible for all maintenance and repair costs, which can be unpredictable and costly for an owner operator vs company driver.

- Competition: Intense competition from other owner operators and trucking companies can drive rates down and make securing loads more challenging.

- Insurance Costs: Obtaining and maintaining adequate insurance coverage is a significant out-of-pocket expense for an owner operator vs company driver.

- Fuel Price Fluctuations: Volatile fuel prices can significantly impact profitability. Effective fuel management strategies, such as discount fuel cards, are more critical to an owner operator vs company driver.

- Credit Management: Managing credit and cash flow effectively is crucial for an owner operator vs company driver, especially during slower periods when income may decrease.

- Load Availability: Finding consistent and profitable loads can be challenging, particularly in a competitive market.

The Reward

Assessing risk versus reward will reveal the obvious benefits of being an independent owner operator vs company driver. Being your own boss and taking in over three times the average salary of an OTR company driver ranks high as an incentive to take the plunge.

Effective Cash Flow Management

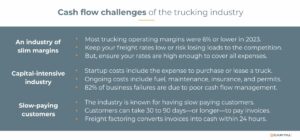

One of the most significant challenges for an owner operator vs company driver is the need for effective cash flow management. Trucking is a slim-margin business in a capital-intensive industry aggravated by slow-paying customers. Effective cash flow management is crucial for your trucking company’s success, reflecting your ability to pay bills and sustain operations. According to studies, 82% of business failures are due to poor cash flow management.

Let’s take a closer look at these issues and the strategies that can be used to create positive cash flow from the start:

Slim margins: Of the significant challenges facing an owner operator vs company driver, maximizing profit from slim margins is key to success. Most trucking operating margins were 6% or lower in 2023.

To be competitive, trucking companies need to keep their freight rates low or risk losing loads to the competition. It is imperative to know all your costs to ensure your rates are high enough to cover all expenses – it’s a tricky balance. Freight rates (income) are based on a “per mile” basis, and so should your costs. Calculate your cost-per-mile regularly, charge rates that will cover expenses and keep the margin slim enough not to outprice yourself and lose business.

A capital-intense industry: Trucking companies face high daily costs, with fuel being the largest expense, averaging 35% of overall operating costs. To improve profitability, many successful trucking companies implement fuel cost-saving programs, such as discount fuel cards. The best service providers offer cards that can be used at thousands of service stations nationwide and include credit terms for easier payment.

Slow-paying customers: Running a trucking company can be frustrating, especially when customers take 30 to 90 days—or longer—to pay invoices, or worse, don’t pay at all. The number of days for customers to pay their invoices is more of a concern to an owner operator vs company driver. To navigate this common issue, new trucking companies should consider the cash flow benefits of freight factoring, a strategy many successful firms use to improve their financial stability.

Freight factoring allows owner operators to:

- Convert invoice receivables into immediate cash.

- Access risk mitigating tools and credit advise.

- Benefit from cost-free collection services.

How does freight factoring work? It’s simple:

- Deliver a load, invoice the customer, and send a copy of the invoice to your factoring company.

- The factoring company verifies the invoice and transfers advance payment up to 95% of the invoice face value directly to your account within 24 hours. A small fee is deducted, and the remaining percentage is held as a reserve until your customer pays the invoice in full to the factoring company.

- The reserve is lifted and transferred directly to your account when the invoice is paid.

All transactions are recorded in real time and accessible 24/7 through your online client portal for full transparency. With freight factoring, your funding grows as your trucking business grows, allowing you to take on new customers, expand lanes, and increase your fleet with confidence in your working capital. When evaluating the risks and rewards of being an owner operator vs company driver, consider freight factoring as a funding solution to manage cash flow effectively.

Industry-experienced Professional Services

The most significant difference between an owner operator vs company driver that you will feel right off the bat is the absence of resources and financial support. As a company driver, loads were assigned, all expenses were covered, and a regular paycheck was paid out – as an independent owner operator that is no longer the case. You get to eat what you kill or starve trying. Improve your odds for success by aligning your company with industry experienced professional services to provide the resources needed to support your business. Freight brokers, insurance brokers, bookkeeping/accounting services, and equipment maintenance shops are essential relationships that you must establish. But your freight factoring account manager is the best friend you can take with you on the road.

Conclusion: Owner Operator vs Company Driver

Trucking is the backbone of the nation’s economy – through recession, crisis and boom periods, it is an essential service that will always be in demand. The next couple of years are anticipated to provide steady growth with opportunities for new trucking companies to grow and prosper. By leveraging the road experience you have accumulated as a company OTR driver, plus adapting the work practices and disciplines of successful business operators, your company should be well-positioned to be profitable. Work hard, work smart and enjoy the rewards of being an owner operator vs company driver.

For more information on freight factoring and how eCapital can support your trucking business, visit eCapital.com.

Key Takeaways

- The economy is expected to experience steady moderate growth stretching into 2026 and beyond.

- For many professional truck drivers, this is a time to consider the risks and rewards of being an owner operator vs company driver.

- Be realistic when assessing your adaptability and tolerance for risk before taking the plunge.

- Trucking is a slim-margin business in a capital-intensive industry aggravated by slow-paying customers. Effective cash flow management and working with industry-experienced professional services are crucial for your trucking company’s success.

- Adapt successful business operators’ work practices and disciplines, work hard, work smart, and enjoy the rewards of being an owner operator vs company driver.

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.