How to Leverage your Staffing Company Breakeven Point

Content

How to Leverage Your Staffing Company’s Breakeven to Guide Growth and Maximize Profits

Tracking the metrics that measure profitability is of vital importance to operate a successful staffing company. One of the more telling of these metrics is the breakeven point – a simple calculation used to determine the minimum output that must be exceeded for a company to be profitable.

Typically, the breakeven point is used by manufacturers to work out how much revenue they need to generate or how many units they need to sell to cover business costs. Very little information on this subject is dedicated to the service industry. This article intends to introduce the importance of the breakeven point to staffing companies and describe the process to calculate and leverage breakeven analysis to guide growth and maximize profits.

What is the breakeven point?

A company’s breakeven point is when the total costs of the business equal total revenue. A business that has reached the breakeven point has not generated a profit, nor do they have a loss – it is the point where a company recovers all business expenses. Once a company surpasses this point, it has become profitable.

Why calculate the breakeven point?

Calculating the breakeven point is a financial management tool used to determine how many billable hours are needed to cover the staffing company’s cost of doing business. Analysis of a company’s breakeven point provides the baseline for key pricing decisions (bill rate) and capacity planning.

Leveraging data from a breakeven analysis will also assist business owners to:

- Set budgeting goals

- Set revenue and profitability targets

- Determine if the company can still be profitable if its fixed costs increase

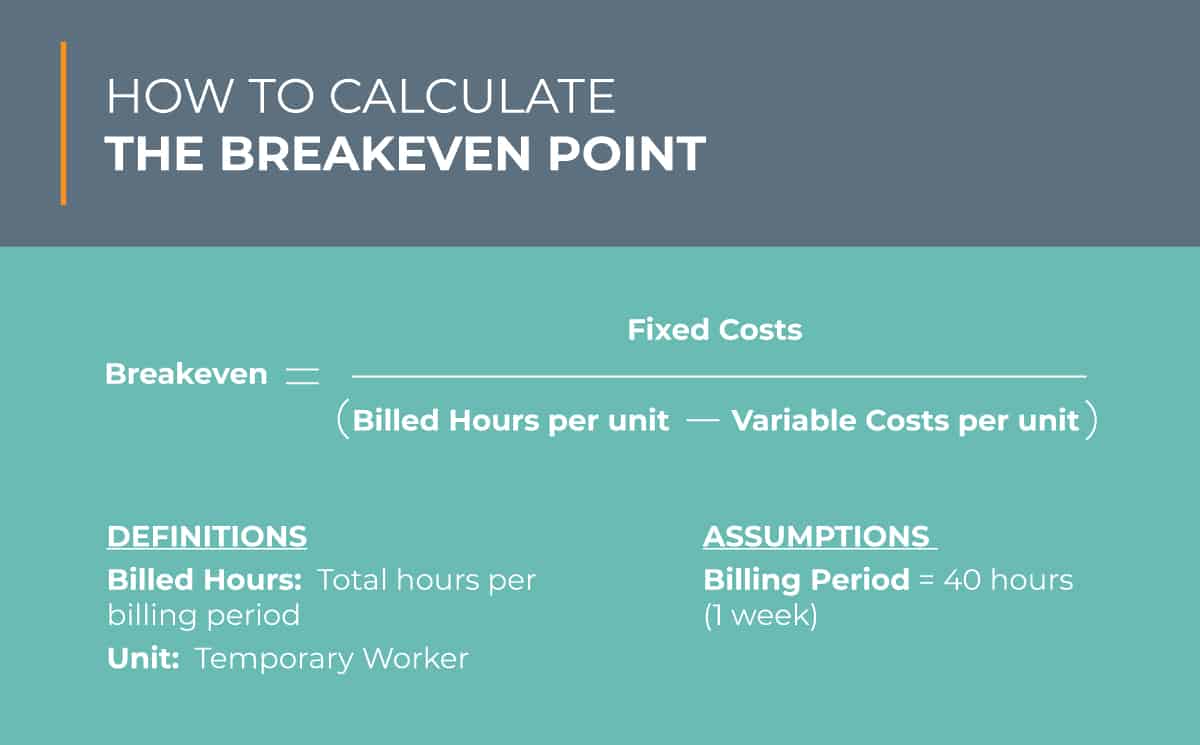

How to calculate the breakeven point?

Note: Staffing Companies that place temporary workers in various job positions with different bill rates must conduct separate calculations for each bill rate to determine their breakeven points. To best prepare for the calculations, organize your pool of temporary employees into separate groups defined by their bill rate. For example, list employees with a bill rate of $22 per hour in Group 1, and employees with a bill rate of $25 per hour in Group 2.

The components of the breakeven formula

The breakeven formula is simple to calculate but determining the exact data to reflect the formula’s components is a bit more complicated. To perform accurate breakeven point calculations be sure to identify and record all costs and revenues associated with the company’s operations. Convert costs to represent the billing period (i.e.: one week), then proportionally allocate these costs to each bill rate group.

Let’s take a closer look at the formula’s components using one week as the billing period:

Fixed Costs

These costs do not change no matter the number of job placements the staffing company manages. Examples of fixed costs for a staffing company are:

- Office space and office equipment leases

- Phone and utility bills

- LinkedIn paid membership

- Software licenses

- Core staff non-commission salaries

To perform the calculation: Total fixed costs for a one-month period must be divided by four to convert to a weekly amount. This amount must then be proportioned and allocated to bill rate groups reflecting the number of temporary employees per group.

For example, a staffing company with 20 employees in Group 1 billed at $22.00 per hour, and 30 employees in Group 2 billed at $25.00 per hour will proportion 40% of fixed costs to Group 1 and 60% of fixed costs to Group 2.

Billed Hours Per Unit

Billed hours per unit is the total amount billed to clients at the end of a billing period for a single temporary employee within a specific bill rate. It combines the employee pay rate and the company’s markup. The average staffing company markup for temporary employees can range anywhere between 20% – 75%.

Variable Costs

These are costs that increase as the number of job placements rise. Examples of variable costs for a staffing company are:

- Temporary workers’ base pay rate

- Payroll burden

- Core staff commission salaries

To perform the calculation: Total variable costs for a one-month period must be divided by four to convert to a weekly amount. This amount must then be proportioned to reflect the number of temporary employees per bill rate (in similar fashion as with fixed costs).

Accurate costing data

Calculation of the breakeven point will require the staffing company to record business costs accurately. In many cases, business owners fail to consider all costs associated with their staffing business and unknowingly underprice the company’s services. Regularly calculating the breakeven point using complete and accurate costing data will reveal if billing rates are priced correctly to be profitable, maintain desirable margins, and support growth.

Leveraging the Breakeven Point

Managing profit margins: A breakeven analysis will reveal how many billable hours per bill rate is required for the company to cover all fixed and variable costs. Suppose analysis shows the company is performing below expected profitability levels. In that case, adjustments to output volume (number of job placements), an increase in billing rates, or a reduction in costs are required to increase margins.

Fixed costs are relatively easy to identify, assess and make strategic decisions to control. Variable costs are a bit more difficult to manage. A staffing company can control variable costs by paying lower wages to employees, staying in states where SUTA is low, and hiring employees in lower-risk work comp categories.

Guiding business development: At every stage of development, a business must be aware of its profitability in a measurable way. By applying the breakeven point calculation to what-if scenarios, business owners can predict the future profitability or loss resulting from any number of variables in cost, price, and number of job placements. The ability to project forward and predict the profitability of future planned activities provides a clear path forward to guide growth. Staffing companies can determine which industries or clients are most profitable, establish sales benchmarks, adjust costs, and set budgets to achieve desired goals. Performing breakeven analysis regularly will provide the measures and projected data needed to do this effectively.

Navigating the challenges of growth

Any company that does not know its breakeven point can suddenly face difficult problems such as servicing a contract at a loss or experiencing a gap in cash flow. Growth typically incurs heavy investment upfront pushing a company into unprofitable territory until revenues catch up to outpace costs. Performing breakeven analysis will predict how deep and how long this period of underperforming profitability lasts. With this knowledge, staffing companies can plan strategies for navigating the cash flow challenges of growth. According to US Bank, 82% of small business fail due to cash flow issues. Having the ability to accurately predict changing cash flow needs allows a staffing company to plan accordingly. For most staffing companies, payroll funding (invoice factoring) is the ideal cash flow solution to bridge the common financing gaps associated with growth.

Conclusion

Breakeven analysis is an internal management accounting tool that determines the relationship between cost, volume, and profit. Focusing on the company’s breakeven point is an effective tactic to maximize profits and guide growth. Combining this effort with payroll funding to bridge anticipated financing gaps is a solid strategy to manage cash flow and maximize profitability.

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.