For B2B businesses that receive large customer orders but lack the immediate capital to fulfill them, Purchase Order (PO) financing provides a lifeline. This financing option helps businesses cover the cost of goods or services needed to complete orders, ensuring they can meet customer demand without disrupting cash flow.

This article explores PO financing, how it works, its benefits, and why it’s a valuable tool for growing businesses.

What Is Purchase Order Financing?

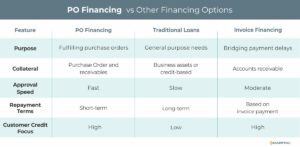

Purchase Order (PO) financing is a short-term financing solution that provides businesses with the capital needed to pay suppliers and fulfill customer orders. Rather than requiring businesses to front the costs of raw materials or finished goods, PO financing bridges the gap, enabling them to complete sales and deliver on promises.

Key Features of PO Financing:

- Order-Based: Financing is tied to specific customer purchase orders.

- Supplier Payments: Funds are often paid directly to the supplier.

- Short-Term Focus: Loans are repaid once the customer pays for the order.

How Does PO Financing Work?

- Order Submission: A business receives a purchase order from a customer.

- Application: The business applies for PO financing, presenting the customer order and supplier details to the financing provider.

- Approval: The provider evaluates the order and the customer’s creditworthiness to approve funding.

- Supplier Payment: Funds are disbursed directly to the supplier to produce or deliver the goods.

- Order Fulfillment: The business fulfills the order, and the customer pays the invoice.

- Repayment: The financing provider is repaid from the proceeds of the customer payment minus fees.

Who Can Benefit from PO Financing?

PO financing is ideal for businesses that:

- Experience cash flow constraints but have significant customer demand.

- Operate in industries with long production or delivery timelines.

- Receive large or unexpected purchase orders that exceed their current working capital.

- Seek to scale operations without diluting equity or taking on long-term debt.

Benefits of PO Financing

- Enables Business Growth

Allows businesses to take on larger orders and new customers without financial strain.

- Improves Cash Flow

Bridges the gap between paying suppliers and receiving customer payments.

- Supports Supplier Relationships

Ensures suppliers are paid promptly, strengthening partnerships.

- Quick Access to Funds

Offers a faster approval process compared to traditional loans, enabling businesses to meet tight deadlines.

- Preserves Ownership

Unlike equity financing, PO financing doesn’t require giving up a stake in the business.

- Increases Credibility

Meeting large orders on time enhances reputation and customer trust.

Challenges of PO Financing

- Higher Costs – PO financing fees can be higher than traditional loan interest rates.

- Customer Dependence – Approval is often based on the customer’s creditworthiness, not just the business’s.

- Order Limitations – Not all types of orders or industries qualify for this type of financing.

- Short-Term Solution – Designed for immediate needs, not long-term capital requirements.

- Risk of Non-Payment – If the customer fails to pay, the business remains responsible for repaying the financing.

Industries That Benefit from PO Financing

- Manufacturing – Cover raw material costs to meet large production orders.

- Retail and Wholesale – Fulfill bulk orders from major retailers or distributors.

- Technology – Fund the production of hardware or software for client orders.

- E-Commerce – Manage seasonal demand or large-scale online sales.

- Apparel – Purchase fabrics or finished goods to meet retailer demands.

Real-World Example: PO Financing in Action

Scenario: A middle-market clothing manufacturer receives a $2,500,000 purchase order from a major retailer but doesn’t have the funds to produce the required inventory.

Solution: The manufacturer secures PO financing, with the financing provider covering 75% of the production costs upfront by paying the supplier directly.

Outcome: The manufacturer delivers the order on time, receives payment from the retailer, and repays the financing provider, retaining profits for reinvestment and growth.

How to Use PO Financing Strategically

- Focus on Reliable Customers – Apply for financing against purchase orders from creditworthy customers to reduce risk.

- Plan for Seasonal Demand – Use PO financing to fulfill large orders during peak seasons without depleting cash reserves.

- Partner with Trusted Suppliers – Ensure suppliers can deliver quality goods on time to maintain customer satisfaction.

- Monitor Cash Flow – Align financing repayment with customer payment schedules to avoid cash flow disruptions.

- Diversify Funding Sources – Financing is available throughout the entire transaction cycle. Combine PO financing with other funding options, such as accounts receivable financing or invoice factoring for comprehensive financial support.

Tips for Choosing a PO Financing Provider

- Evaluate Costs – Understand fees and repayment terms to assess the total cost of financing.

- Check Customer Criteria – Ensure your provider evaluates customer creditworthiness effectively.

- Review Speed – Choose a provider that offers quick approval and disbursement to meet deadlines.

- Assess Flexibility – Look for providers that offer scalable financing for growing businesses.

- Verify Reputation – Partner with reputable providers experienced in your industry. Compile a shortlist of potential lenders and perform in-depth research. Explore their websites to assess their service offerings and check client reviews to evaluate customer satisfaction. Then, contact the lenders for a phone interview to gather more insights.

Conclusion

Purchase Order financing is a powerful solution for businesses needing upfront capital to fulfill large orders and keep production moving. It enables companies to take on new opportunities, pay suppliers on time, and meet customer demand without straining cash reserves.

But PO financing is often just the first step of a stronger financial strategy. For businesses also waiting 30, 60, or even 90 days to get paid after delivery, Accounts Receivables financing can unlock even more working capital — turning unpaid invoices into immediate cash to reinvest in growth.

If your business is experiencing cash flow constraints but has strong demand and solid receivables, consider how A/R financing can give you end-to-end support — from purchasing inventory to collecting payments.

Contact us to consult our experienced financial specialists to strengthen your company’s financial structure and fuel growth opportunities.

Key Takeaways

- B2B businesses that receive large customer orders, but experience cash flow constraints are often challenged to cover the cost of goods or services needed to complete orders.

- Purchase Order (PO) financing is a vital tool for businesses looking to fulfill large orders, manage cash flow challenges, and scale operations.

- This type of funding leverages the value of purchase orders to secure flexible financing, enabling businesses to manage the upfront costs for the raw materials or finished goods needed to complete sales and deliver on promises.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.