Factoring accounts receivables to optimize cash flow and gain immediate access to working capital is a sound business decision. But knowing whether its best to use recourse or non-recourse factoring is essential to structuring the optimum factoring solution to meet your company’s goals. This decision is best made with a full understanding of what factoring is, assessing the creditworthiness of your customers, and determining the appropriate risk tolerance for your organization.

As economic uncertainty, high-interest rates, and sticky inflation continue to batter business performance levels, commercial bankruptcies have reached a 13-year high. Non-recourse factoring is a mainstream business financing solution structured to insulate businesses from loss due to bad debt. Although it costs slightly more than recourse, non-recourse factoring can be a lifeboat during economic volatility.

In this article, we provide a brief overview factoring including what it is, how it works, and why it is essential. We also cover the difference between recourse and non-recourse factoring, and how to determine which is best for your business.

What is Factoring?

Although factoring can be called by many names and varies widely by terms and conditions, it is generally referred to as accounts receivable factoring. Defined as the selling of invoice receivables at a discount in exchange for immediate cash, it is also widely known as invoice factoring.

Factoring is a form of short-term financing available to businesses that sell on credit terms. Although it can be tailored and specialized to meet the specific requirements of industries such as transportation (freight factoring) or staffing, its top-level category is separated into its two main types: recourse factoring and non-recourse factoring. Understanding the difference and selecting the best type to suit your company is one of the first considerations when choosing a factoring facility to fund your business.

Recourse vs Non-Recourse Factoring

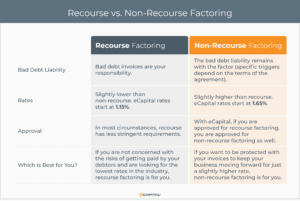

Whether in the US, Canada, the UK, or elsewhere on the globe, the main category that differentiates between types of factoring is “recourse” vs “non-recourse”. The distinction between these two categories is the level of assumed risk:

Recourse Factoring: a factoring agreement in which a client company sells its invoices to a factoring company with the understanding that if the invoice exceeds the recourse period (usually 60 to 90 days) and remains unpaid for any reason, the client company will buy back the invoice.

Non-Recourse Factoring: a factoring agreement in which, if the debtor does not pay the invoice due to insolvency during the recourse period, the factoring company assumes the risk of non-payment, and the client company is not liable for payment.

Whether your company should choose recourse or non-recourse factoring depends on the credit strength of your customer base. Except for the protection as described above, both recourse and non-recourse factoring provide the same features and benefits:

Features:

- Invoice receivables converted to cash within 24 hours.

- Funding grows with sales. The more you invoice, the more funds become available.

- Dedicated account manager.

- Cost-free A/R management.

Benefits:

- Easy qualification provides fast onboarding and first funding.

- Supports growth to expand into new markets, fulfill a big order, or acquire new customers.

- Improved cash flow to better manage seasonal fluctuations.

- Tailored solutions to meet your unique needs.

Non-recourse factoring has all the same features and benefits as recourse factoring, but due to its additional protection, it is slightly more costly. However, non-recourse factoring may be the better option for companies with a high concentration of accounts receivables with a single customer or customers in volatile industries. While non-recourse factoring can offer numerous risk-mitigating advantages, weighing features and benefits against costs is essential to determine which factoring option is best before signing a non-recourse factoring agreement.

A complete understanding of how non-recourse factoring works will better prepare you to know if this option is right for your business.

How Does Non-Recourse Factoring Work

Non-recourse factoring is a straightforward process for converting account receivables into immediate cash:

- The factoring company purchases your account receivables by paying an “advance” to your company of up to 90% of the face value of each invoice. The balance is held as a “reserve.”

- Your factor then manages collections and pays your company the reserve once your customer (the debtor) pays the factoring company the total value of the invoice without dispute.

- If the invoice is not paid during the recourse period due to debtor bankruptcy, non-recourse factoring protects your business from repurchasing the invoice.

The factoring company pays the advance within 24 hours of purchasing each invoice by depositing funds directly into your company’s account. The reserve is released and similarly paid to your company upon your customer paying each invoice in full to the factor. Factoring clients can view and monitor all transactions in detail and in real-time by accessing their factoring accounts online. All transactions, balances, and reporting capabilities are available through an online client portal for full transparency.

Which Businesses Benefit from Non-Recourse Factoring?

Factoring is a commonly used financial transaction but can be referred to by several names. No matter how it’s labeled, factoring is an ideal funding solution to provide access to working capital for any size company in any stage of development.

Start-ups: Because qualification is based on the creditworthiness of your customers, not your company itself, start-up companies with no credit history are eligible. Companies in the early stages gain a large benefit from non-recourse factoring by knowing that outstanding invoices are paid.

Growing Companies: The more invoices you generate to creditworthy customers, the more funding you receive. This is ideal for growing companies to expand operations, take on new clients, and reach new markets. Growth can be a risky stage in business development – a single case of bad debt can stress financial health. Non-recourse factoring ensures higher credit protection to minimize financial stress.

Companies in Transition: Changing ownership, taking on new partners, or refinancing due to a bank recalling its loan can be a tough time for companies. An experienced and reputable factoring company will work with you, your bank, a new partner, or owner to facilitate an easy transition and keep operations running as the financial details are worked out. Being experienced in commerce and banking, factoring companies are the ideal agents to ensure a smooth transition in a timely fashion to meet demanding timelines and funding requirements. Non-recourse factoring provides additional financial stability during these difficult times.

Why Use Non-Recourse Factoring?

Business owners face many challenges and obstacles that stand as barriers to success. Having available funds to meet operational demands and grow the business is one of the top-of-mind concerns for SMBs. Limited access to working capital does not need to be one of these concerns. Whether you choose recourse or non-recourse factoring, having an invoice factoring facility creates a regular and dependable funding source, providing easy access to working capital.

Working with a reputable factoring company experienced in providing a full range of factoring products and other business financing alternatives opens the door to multiple avenues to support growth. Consult with a factoring specialist to help assess the creditworthiness of your client base, discuss your organization’s risk tolerance, and determine if recourse, non-recourse factoring, or another funding solution is best for your business.

Conclusion

Heightened levels of commercial bankruptcies continue to threaten the health of balance sheets as B2B businesses wait for debtors to pay their invoices. A single case of bad debt can stress financial structures in this era of low growth, low margins, and high operational costs.

Non-recourse factoring is an ideal funding solution to optimize cash flow and ensure heightened protection against the dangers of bad debt. Work with an experienced and reputable factoring company to determine the best business financing solution for your company.

For more information about how non-recourse factoring can simplify your working capital needs, visit www.eCapital.com.

Key Takeaways

- Economic uncertainty, high interest rates, and sticky inflation continue to batter business performance levels. Bad debt threatens company balance sheets as debtors face high levels of commercial bankruptcy.

- Non-recourse factoring is a mainstream business financing solution to optimize cash flow and increase access to capital while shielding businesses from bad debt due to debtor bankruptcy.

- Learn if non-recourse factoring is right for your business.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.