Maintaining a healthy cash flow is crucial for any business, yet it’s one of the most common challenges companies face. Whether covering payroll, purchasing inventory, or investing in growth opportunities, businesses often need quick access to funds to bridge gaps or seize opportunities. This is where cash flow loans come into play—a flexible and efficient financing solution designed to support businesses in managing their operational needs.

The unsecured loan market has experienced significant growth in recent years, powered partly by technology based (fintech) lenders. In this blog, we’ll explore what cash flow loans are, how they work, and why they’re an indispensable tool for businesses.

What Are Cash Flow Loans?

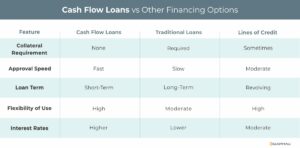

Cash flow loans are a type of unsecured financing designed to provide businesses with working capital based on their projected future cash flow. Unlike traditional loans that require collateral, such as real estate or equipment, this type of financing focuses on the business’s revenue-generating capacity and financial stability.

Key Features of Cash Flow Loans:

- Unsecured: Typically, this type of financing does not require physical collateral, as approval is based on cash flow projections and business performance.

- Short-Term: Meant for immediate needs with repayment periods ranging from months to a few years.

- Quick Access: Faster approval and disbursement compared to traditional bank loans.

How Do Cash Flow Loans Work?

- Application: Businesses apply by providing financial statements, revenue data, and cash flow projections.

- Evaluation: Lenders assess the business’s cash flow, revenue history, and ability to meet repayment obligations.

- Loan Approval: Based on these assessments, lenders approve a loan amount, often determined as a multiple of monthly cash flow.

- Disbursement: Funds are disbursed quickly, typically within a few days of approval.

- Repayment: Borrowers repay the loan through fixed payments, which may include interest and fees.

Who Benefits from Cash Flow Loans?

This type of financing is ideal for businesses that:

- Have strong cash flow but lack physical collateral.

- Need immediate capital for short-term operational needs.

- Experience seasonal revenue fluctuations and need to bridge gaps.

- Seek to capitalize on growth opportunities requiring quick funding.

Advantages of Cash Flow Loans

- Quick Access to Funds

- Businesses can access financing within days, making cash flow loans ideal for urgent needs like payroll or inventory restocking.

- No Collateral Required

- By focusing on cash flow, these loans eliminate the need for businesses to pledge assets, reducing risk.

- Flexible Use

- Funds can be used for various purposes, including operational expenses, marketing campaigns, or supplier payments.

- Simplified Application Process

- Less documentation is required compared to traditional loans, streamlining the approval process.

- Supports Growth

- Businesses can seize opportunities, such as bulk purchasing or expanding into new markets, without being hindered by immediate cash flow constraints.

Challenges of Cash Flow Loans

- Higher Interest Rates

- Due to the unsecured nature of these loans, lenders may charge higher interest rates than secured financing.

- Shorter Repayment Terms

- The repayment period is typically shorter, which may strain cash flow if not managed effectively.

- Dependence on Cash Flow

- Approval relies heavily on cash flow health, making it difficult for businesses with inconsistent revenue to qualify.

- Fees and Costs

- Some cash flow loans come with additional fees, such as origination or prepayment penalties, which can increase the overall cost.

Common Uses of Cash Flow Loans

- Managing Payroll

- Ensures employees are paid on time during periods of slow revenue or delayed receivables.

- Purchasing Inventory

- Allows businesses to stock up on inventory ahead of busy seasons.

- Bridging Receivables Gaps

- Covers expenses while waiting for customers to pay outstanding invoices.

- Expanding Operations

- Funds marketing campaigns, hiring, or infrastructure upgrades to support growth.

- Emergency Expenses

- Addresses unexpected costs, such as equipment repairs or urgent supplier payments.

Real-World Example: Cash Flow Loans in Action

Scenario: A small e-commerce business experiences a spike in orders during the holiday season but needs additional funds to purchase inventory and hire temporary staff.

Solution: The business secures a $50,000 loan, which is approved and disbursed within three days. The funds allow them to restock inventory and manage increased operational demands.

Outcome: The business generates record-breaking holiday sales, repays the loan within six months, and maintains strong customer satisfaction through timely order fulfillment.

How to Choose the Right Cash Flow Loan

- Evaluate Lenders

- Research reputable lenders with transparent terms and competitive interest rates. Review their company websites and check customer reviews to assess customer satisfaction.

- Understand Costs

- Review interest rates, fees, and repayment schedules to ensure the loan aligns with your cash flow capacity.

- Have a Clear Purpose

- Define how the funds will be used and ensure they will generate returns that justify the cost of borrowing.

- Assess Cash Flow

- Ensure your cash flow projections support timely repayment without jeopardizing operations.

Conclusion

Cash flow loans are a versatile and powerful financing option for businesses looking to manage short-term challenges or invest in growth opportunities. By focusing on a company’s cash flow rather than collateral, these loans provide a lifeline to businesses that may struggle to secure traditional financing.

With advancements in financial technology, this type of financing is becoming more accessible through online platforms and AI-driven assessments. These innovations streamline the application process, making it easier for businesses of all sizes to access funding when needed.

Consider a cash flow loan if your business needs quick, flexible funding. With careful planning and management, this type of financing can be a valuable tool to drive success and ensure operational stability.

Contact us today to explore the many financing options available to help meet your business needs and grow.

Key Takeaways

- Whether covering payroll, purchasing inventory, or investing in growth opportunities, businesses often need quick access to funds to bridge gaps or seize opportunities.

- Cash flow loans are a flexible and efficient financing solution designed to support businesses in managing their operational needs.

- These loans are a type of unsecured financing.

- Lender approval is based on the business’s revenue-generating capacity and financial stability.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.