For trucking companies, operational interruption can seriously impact on customer relations and your bottom line. Having preventative programs in place to avoid disruption is a key strategy to ensure the success of your trucking company.

Just like regular maintenance ensures the reliability of your working equipment, invoice factoring ensures reliable cash flow and access to the working capital needed to support operations. As accessing working capital every day is essential to keep trucks moving, invoice factoring has become a mainstream funding solution for trucking companies.

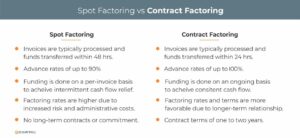

Invoice factoring is a flexible financing option available in various types to meet the unique needs of different industries and business models. Spot factoring and contract factoring are two popular types, but each is suited to certain industries. The key difference is that spot factoring is best used by industries that typically issue large invoices irregularly, whereas contract factoring is best suited for industries that regularly issue invoices to customers.

This article will explain the key differences between spot factoring vs contract factoring and help guide you to the best option for your trucking business.

How does invoice factoring improve cash flow?

Maintaining reliable cash flow is a major challenge for trucking businesses. While customers demand timely deliveries, many are slow to pay, with freight bills taking an average of 40 days to settle. Some shippers are making strategic changes to implement even longer payment policies, further straining carriers’ cash flow.

Invoice factoring is the practice of selling invoice receivables (freight bills) at a discount in exchange for immediate payment. This provides improved cash flow, ensuring payment for delivery is received in time to pay for the operating expenses associated with the next day’s haul. To ensure this flow of incoming cash is consistent and outpaces outgoing expenses, factoring companies that specialize in trucking provide freight factoring. This transportation financing solution is not spot factoring but a form of contract factoring.

What is spot factoring vs. contract factoring?

Invoice factoring is a general term that classifies various forms of accounts receivable financing under one umbrella. These many derivations have evolved and are tailored to specific industries’ needs. The products and services available are wide-ranging and varied but can be categorized and separated by distinct types. For trucking companies, spot vs. contract factoring is one of the main types to consider.

Spot factoring: Used by businesses to sell an individual invoice at a discount to receive immediate payment for that particular invoice. It is an option, not an obligation. Spot factoring allows businesses to pick and choose which invoices they would like to have funded. Once a factoring arrangement is in place, a business can factor invoices as often or as little as needed to maintain positive cash flow. There are no long-term contracts or monthly minimums, so spot factoring is a very flexible form of funding.

The downside of spot factoring is that it is more expensive than contract factoring and does not give you continuous cash flow or the multitude of support services designed specifically for trucking companies. It also provides a lower advance rate and a higher factoring rate than contract factoring. Another downside to spot factoring is that it typically only works on large invoices in order to be worth the factoring company’s time and effort. As freight bills are generally considered small compared to other industry invoices, individual invoices from a trucking company usually do not qualify for spot factoring. Generally speaking, spot factoring is best suited for industries with large projects, such as a construction company.

Contract factoring: Used by businesses to create positive cash flow and maintain regular funding through the peaks and valleys of seasonal fluctuation and market demand. It is an arrangement where a business factors most of its invoices for a specified term.

Trucking is a volatile industry with massive, often unpredictable changes in freight demand and capacity. This dramatic swing in demand causes a roller coaster effect in cash flow. The result is tremendous stress on a trucking company’s ability to meet expense payments on time and fund the daily over-the-road expenses needed to keep equipment moving. As spot factoring is designed to finance large single invoices, it is best used by industry types such as construction or engineering. Contract factoring is ideal for the trucking industry as it is designed to finance batches of invoice submissions at a time.

As trucking fleets issue invoices after every delivery, batch financing, a feature of contract factoring, is more suitable and cost efficient than spot factoring. The best factoring companies offer freight factoring to best meet the trucking industry’s constant demand for fast, easy-to-manage financing.

Whereas spot factoring is an off-the-shelf funding solution, Freight factoring is a specific form of contract factoring designed exclusively for the transportation industry. The benefits are vast compared to spot factoring. For trucking companies, these include:

- Significantly lower factoring rates to improve profitability.

- High advance rates – more of your money in your hands when you need it.

- Fast funding – within 24 hours of submitting an invoice.

- Easy qualification – the process is quick and simple if your customer base is creditworthy.

- Risk mitigating tools and advice – avoid hauling for customers with poor payment history.

- Fuel cards, and other cost-saving services.

What is Non-Recourse Factoring?

Another option to consider when shopping for invoice factoring is non-recourse factoring. Unlike traditional factoring, in non-recourse factoring, the factor assumes the risk of non-payment by the original debtor. If the debtor doesn’t pay the invoice, the business is not required to repay the factor. This method allows businesses to obtain immediate liquidity without the liability of potential non-payment by their customers. Not all companies that offer non-recourse factoring cover the same liabilities. You can find some things to look out for in our blog Top 8 Things to Understand Before Signing A Non-Recourse Factoring Agreement.

Why choose a freight factoring company?

Trucking is a unique business that needs road experience, good managerial skills, and continuous funding to operate well. Because it is a capital-intensive industry, reliable funding ranks high as a daily concern for many owners of trucking companies. After all, if no funds are available to pay drivers or put fuel in the tank, your truck(s) will be left idle with places to go but no means to get there. To succeed, truck company owners need a dependable source of funding that provides easy access to working capital when it is most needed – every day!

Freight factoring companies are specialists in transportation financing. They understand your business – how it works, the challenges you face every day, and the need for convenient, reliable funding that’s easy to manage. The products and services these specialized factoring companies provide for trucking are designed to seamlessly provide reliable funding, cost effectively, and without hassle.

When you partner with a freight factoring company, you get the backing of several professional teams to support your business. An industry experienced accounts receivable team manages collections courteously to protect your company’s customer relations while maximizing efficiency. A credit department is on hand to guide you through risk management and help protect your company against bad debt (customers who won’t pay). A dedicated team is assigned to your company to coordinate activities on your account, streamline processes, and ensure ease of use. To further support managing your business, freight factoring companies provide a bucket full of extra tools, information, and additional services. These include:

Tools:

- Credit Check Tool: Cost-free online tool for unlimited credit checks on customers’ ability to pay.

- Cost-Per-Mile Calculator: Perform regular calculations to ensure your company is performing profitably.

- Profit and Loss Calculator: Easily calculate your profit and loss margin on every load.

Information:

- KPIs: Know the key performance indicators to monitor your company’s performance.

- Information Blogs: Advice, tips and insights to help your business succeed.

Additional Support Services:

- Cost-Saving Services: Save big with fuel cards and a list of industry suppliers providing discount pricing.

- Fuel Advances: Get paid before you deliver to cover over-the-road expenses.

Conclusion

Spot factoring may seem an attractive funding solution to those first investigating this alternative form of financing as it is a less formal arrangement. However, spot factoring is typically used by businesses that need short-term cash flow solutions for specific invoices, often due to seasonal fluctuations, one-time contracts, or immediate financial needs. For owners of trucking companies, it has severe limitations that eliminate it as a viable means to improve cash flow. Because of its singular nature, spot factoring does not create steady cash flow. It is designed to quickly access large amounts of cash based on large outstanding invoice receivables. For construction companies or staffing agencies, spot factoring is an excellent option to move on to the next project phase or gear up for a new contract. Trucking companies face a different set of conditions and therefore need a different funding solution. High daily operating expenses demand access to working capital on a regular basis. Freight factoring was designed specifically to meet this need.

For trucking companies looking to finance growth, contract factoring is by far the better option vs spot factoring. Over the past few decades, accessing a business loan or line of credit from the bank has become harder and harder. In contrast, freight factoring companies have made it easier to qualify for financing and have expedited the process to allow for first funding within a few days of receiving an application and subsequent funding is transferred in hours. The most significant benefit is that funding limits grow as your business grows – the more invoices you generate, the more funding becomes available.

Contact us for more information about spot factoring vs contract and how freight factoring is the ideal funding solution for your trucking business.

Key takeaways

- As accessing working capital every day is essential to keep trucks moving, invoice factoring has become a mainstream funding solution for trucking companies.

- Spot factoring and contract factoring are two popular types, but each is suited to certain industries.

- Spot factoring is best suited for industries with large projects, such as construction companies. Contract factoring is best suited for the trucking industry as it is designed to quickly finance batches of invoice submissions, maintaining daily access to working capital.

- Freight factoringis a specific form of contract factoring designed exclusively for the transportation industry. The benefits are vast compared to spot factoring.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.