For many SMBs, business financing is necessary for accessing essential capital. It can empower companies to initiate, sustain, and scale their operations. The ability to acquire and manage cost-effective business financing, particularly during high-interest rate periods, can significantly impact a company’s success or failure.

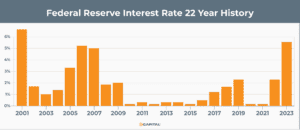

The cost of debt is rising! To combat ongoing inflation, the Federal Reserve hiked the interest rate by 0.25% to reach 5.5% on July 26, 2023, marking the highest rate in 22 years. Despite this action, further rate increases are predicted by some analysts before year-end to cool demand and stabilize prices.

For many businesses already struggling with rising payroll and supply costs, increasing debt costs creates a perfect storm, often resulting in financial distress. This economic climate has left many undercapitalized businesses with the urgent task of seeking funding options to meet their operational requirements without taking on more debt or diminishing their equity.

Learn how to acquire business financing during the nation’s highest interest rate period in over 22 years without incurring debt or diminishing equity.

How rising interest rates impact financing

In a little over 18 months, the lending market has undergone a dramatic transformation. Starting from the spring of 2022, the US Federal Reserve has implemented 11 consecutive rate hikes, shifting from an era of near-zero interest rates to the highest rates seen in more than two decades. This swift and significant rate increase is occurring alongside economic contraction and rising inflation.

Financing challenges have intensified! Company credit card holders grapple with increased interest payments, while businesses with upcoming loan renewals anticipate substantially higher payments. Moreover, existing lines of credit for some businesses might face constraints as traditional lenders adopt a more cautious approach.

In this economic environment, businesses must find cost-effective and flexible financing solutions to fulfill their working capital needs without increasing debt or compromising control of the company by diluting equity.

Where can businesses find flexible funding?

Fortunately, as traditional lenders are shrinking the credit market, alternative lenders are filling the gap, providing flexible funding solutions to help businesses access the working capital they need when they need it.

Alternative finance companies offer niche financing solutions custom-made for businesses pursuing growth opportunities, expansion strategies, or struggling to overcome financial distress. One such solution is invoice factoring – a cash flow enhancement strategy ideal for companies needing fast, reliable access to working capital without incurring debt. Let’s explore invoice factoring and how it’s become a go-to business financing strategy across multiple industries.

Invoice factoring: a non-debt solution

Invoice factoring is an alternative financing solution for B2B businesses that regularly issue invoice receivables to creditworthy customers. This financing method turns outstanding accounts receivables into immediate cash. Invoice factoring is the selling of invoice receivables at a discount in exchange for immediate payment. It is designed to unlock the money your business has already earned so you can access working capital within hours instead of waiting 30 or 60 days for your customers to pay.

Because invoice factoring is the selling of assets (invoice receivables), it does not accumulate debt or dilute equity. Fees for advanced funds are based on a percentage of the invoice face value rather than following a formula that necessitates regular debt payments. This financing solution is designed with costs that adjust according to the business’s output. This means fees are reduced if business slows and the volume or amount of invoice receivables decreases. Conversely, if the business grows, funding increases, but the factoring fee remains constant at the initially agreed percentage rate outlined in the factoring contract. As a result, the cost of invoice factoring is more controlled. Fees are tied to the business volume, in contrast to monthly debt servicing expenses, which can significantly rise over time as interest rates climb.

A growing number of business owners and financial executives favor invoice factoring as an easy-to-manage funding solution with multiple benefits.

Some of the significant benefits of invoice factoring include the following:

Easy qualification: Traditional lenders base loan approvals on the borrowing company’s business performance levels and credit score. This approach minimizes the lender’s risk but restricts most SMEs from qualifying for financing in a contracting credit market. Alternative lenders take an entirely different approach to qualify businesses for invoice factoring. These lenders integrate technology-driven methodologies to quickly access vast databases and assess the credit strength of the company’s customer base – the debtors responsible for invoice payments. This method provides a more equitable analysis, helping to qualify companies with creditworthy customers despite having underperforming business levels and less-than-perfect credit records.

Fast access to working capital: Advanced funds, typically 80-90% of the invoice value, are transferred directly to the company’s cash account within hours of the invoice being submitted and verified. The remaining 10-20% is held in reserve until the customer pays the invoice. Once the invoice is fully paid, the reserve amount is rebated, less the factoring fee and any additional costs as stated in the factoring agreement.

No impact on your credit score: Invoice factoring is not a loan – it is the selling of an asset. No debt is incurred, and therefore, there is no impact on your credit score.

Funding keeps pace with business growth: The more invoices your business generates to creditworthy customers, the more funds become available.

Full transparency and accountability: Tech-enabled invoice factoring companies provide a robust online account management portal to allow client businesses 24/7 access to real-time data. Monitor account balances, track transactions, and view credit limits to help keep a watchful eye on your business’s financial health.

Streamlined efficiencies: Dedicated account managers help onboard new clients, streamline services, and clear the tracks of any issues that may impact regular funding.

Enhanced credit protection: Invoice factoring companies have experienced credit teams and managers to help manage enhanced risk management practices. Their expertise and access to expansive databases provide the resources to assist in identifying potential risks associated with new business customers and help to avoid bad debt.

Operational agility: Businesses with easy access to working capital have more financial flexibility to adapt to changing economic conditions. Further, when new business opportunities develop, invoice factoring’s flexibility allows credit limits to increase as the client business’s size or volume of invoices grows.

Conclusion

For many SMBs, financing is vital for accessing the capital needed to propel their business forward. As interest rates continue to climb, traditional bank financing has become an escalating and challenging business burden. Each interest rate hike increases the cost of borrowing new money, further tightens the credit market, and often jeopardizes the financial security of companies renewing business financing. How effectively businesses acquire and manage cost-effective financing during high-interest rates can make or break a company.

As banks raise rates, tighten lending standards, and restrict access to credit, alternative lenders are moving in the opposite direction to increase access to working capital. Leveraging business assets and the credit strength of a company’s customer base, leading alternative lenders can extend credit to businesses in multiple industries via innovative financing options such as invoice factoring.

Invoice factoring is a non-debt financing solution that allows businesses to leverage the value of outstanding invoices to unlock the cash needed to maintain stability or chart a path toward recovery. In an environment characterized by restricted credit and elevated interest rates, invoice factoring provides fast access to working capital and additional benefits to enhance sustainability. Easy to qualify for and simple to manage, invoice factoring offers enhanced credit protection and operational agility to support financial stability and growth.

Many SMEs now consider invoice factoring as their preferred funding solution to cost-effectively manage business financing without incurring debt or diluting equity during the highest interest rates in 22 years.

Key Takeaways

- The acquisition and management of cost-effective business financing, particularly during high-interest rate periods, can significantly impact a company’s success or failure.

- For businesses already struggling with rising payroll and supply costs, the addition of increasing debt payments often results in financial distress.

- Many SMBs need to find a flexible financing solution to fulfill their working capital needs without accumulating debt or diluting equity.

- Invoice factoring is a non-debt financing solution.

- A growing number of business owners and financial executives favor invoice factoring to cost-Debt-Free effectively manage business financing.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.