Imagine having a business financing option that provides immediate access to funds without incurring debt. Now imaging if that financing was flexible with minimal loan covenants and expandable credit limits. A Factoring Line of Credit is a specialized financing facility designed to provide maximum financial support with minimum restrictions and built-in accounts receivable management to restore and maintain positive cash flow.

Regardless of whether it’s riding through a pandemic, battling against freight shortages, or going flat out to keep up with demand, maintaining positive cash flow is a constant challenge for truck company owners. Conventional financing methods, such as loans or standard lines of credit are typically inaccessible to trucking companies, as traditional lenders are generally unwilling to invest in the volatile transportation industry.

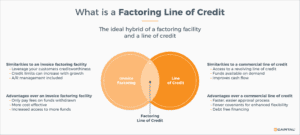

Factoring Line of Credit was designed exclusively by specialized non-bank lenders to help trucking companies gain control of their cash flow with cost effective and reliable access to working capital. This hybrid financing tool combines the best features of a commercial line of credit with the benefits of freight factoring, offering a unique and powerful way to manage cash flow.

In this article, we’ll explore what a Factoring Line of Credit is, how it works, and why it might be the ideal solution for your trucking business to prevent cash shortages.

What is a factoring line of credit?

A Factoring Line of Credit is the ideal hybrid of a commercial line of credit and a freight factoring facility. Like a commercial line, it allows you to access funds as needed and pay fees only on the amounts drawn.

The process involves selling accounts receivable invoices to create a cash reserve from which you can draw. While it functions like a banking line of credit, it is a factoring facility, not a loan, and therefore does not incur debt.

How Factoring Line of Credit works

Managing a Factoring Line of Credit is convenient, quick, and easy:

- Invoice submission: You deliver a load, invoice the customer, and submit a copy invoice to the factoring company.

- Cash advance: The factoring company advances you a significant portion of the invoice value, up to 95%, creating a cash reserve.

- Accessing funds: You can draw from this reserve as needed, paying fees only on the amounts you actually use, akin to how you would with a traditional line of credit.

- Collection and Settlement: The factoring company manages collections. Once your customer pays the invoice they then release the remaining balance to you, minus their service fees.

What can a trucking business do when they can’t qualify for traditional financing?

Trucking is a difficult industry, with low margins, high expenses, and frequent occurrences of fraud. Imagine walking into a bank and requesting an operating line of credit without offering your company’s hard assets, real estate, or personal assets as collateral. Your loan application would be flatly rejected and you’d likely be laughed out of the building.

Now, picture finding a financial institution where none of these traditional securities are required. Instead, they evaluate the credit strength of your customer base to determine security. This would be a fundamental change in business financing opening the door to unlimited possibilities.

Factoring Line of Credit leverages your company’s strongest assets, uncollected invoice receivables, as security against default. To enhance financial strength further, a Factoring Line of Credit maximizes flexibility with minimum loan covenants and the potential for increasing credit limits.

Using the combined credit strength of their customer base, trucking companies can easily qualify for a Factoring Line of Credit to gain fast, reliable funding.

How is Factoring Line of Credit different from a bank loan?

- Your access to funds grows with your business.

- There are no regular payments, fees are paid on funds drawn.

- The service includes professional management of accounts receivable and collections. That translates to reduced headaches and administrative costs.

Why use Factoring Line of Credit?

Key Takeaway

Businesses that manage to secure a traditional business line of credit are often handicapped by the restrictive bank covenants that govern the loan agreement. Bridging a difficult transition or stretching the business to meet growth opportunities is not an option under these conditions. In this arrangement, the bank has more control over the company than the business owner.

Factoring Line of Credit is designed exclusively for trucking companies providing a highly flexible form of financing without restrictive covenants. It provides a cost-effective funding option for trucking companies that:

- Are unable to get a traditional bank loan.

- Have violated their bank loan covenants.

- Are experiencing a difficult transition.

- Manage seasonal variations in volume.

- Want to expand to meet growth opportunities.

Banks screen companies very carefully before agreeing to lend them money. Their sole interest is to protect the interest of the bank. It is common for banks to reject loans solely based on the industry the business belongs to; trucking is one such industry. Freight factoring companies such as eCapital have a completely different approach. Our focus is to empower trucking companies by accelerating their access to cash flow. With this as our primary purpose, we then provide additional support with professional accounts receivable management, credit search tools and cost-saving services to protect your bottom line.

Invoice Factoring vs. Line of Credit: Why choose?

A Factoring Line of Credit helps stabilize your finances, ensuring you have the necessary funds to meet payroll, purchase supplies, and manage other essential expenses without interruption. In addition to the advantages already listed in this article, Factoring Line of Credit offers even more:

- Faster and easier approval process.

- Pay fees only on the funds you use.

- Enhanced business stability with easy access to capital and autonomous control of funds.

- Monitor transactions, balances, and credit limits in real time with a robust online account management portal.

Conclusion

In today’s competitive business environment, having the right financial tools can make all the difference. A Factoring Line of Credit offers a flexible, efficient, and debt-free way to manage your cash flow and support your business growth. By leveraging your accounts receivable, you can access the funds you need when you need them, providing a solid foundation for sustained success. If you’re looking for a financing solution that adapts to your business needs, a Factoring Line of Credit is an ideal solution for your trucking business to prevent cash shortages.

Key Takeaway

- A Factoring Line of Credit is a specialized financing facility designed for trucking companies to restore and maintain positive cash flow.

- Only pay fees on funds withdrawn, plus a small administration fee.

- This specialized credit facility maximizes flexibility with minimum loan covenants and the potential for increasing credit limits.

- Qualification is easy for trucking companies with creditworthy customers.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.