Running a business in 2023 can feel daunting, especially when daily headlines forecast gloomy economic conditions.

On May 15th, 2023, seven companies declared bankruptcy within 48 hours, matching a record set during the 2008 financial crisis. Tightening lending standards and rising interest rates are causing defaults to spike across the country, but fast access to business financing is still available through alternative lenders.

The filing for Chapter 11 protection by major firms such as Vice Media and healthcare firm Envision highlights the struggle businesses face in re-negotiating overwhelming debt loads that piled on during the era of ultra-low interest rates.

These high-profile insolvencies are ringing the alarm bells at American businesses of all sizes.

Each instance of default lowers traditional lender confidence, and working capital becomes even harder to access through conventional channels.

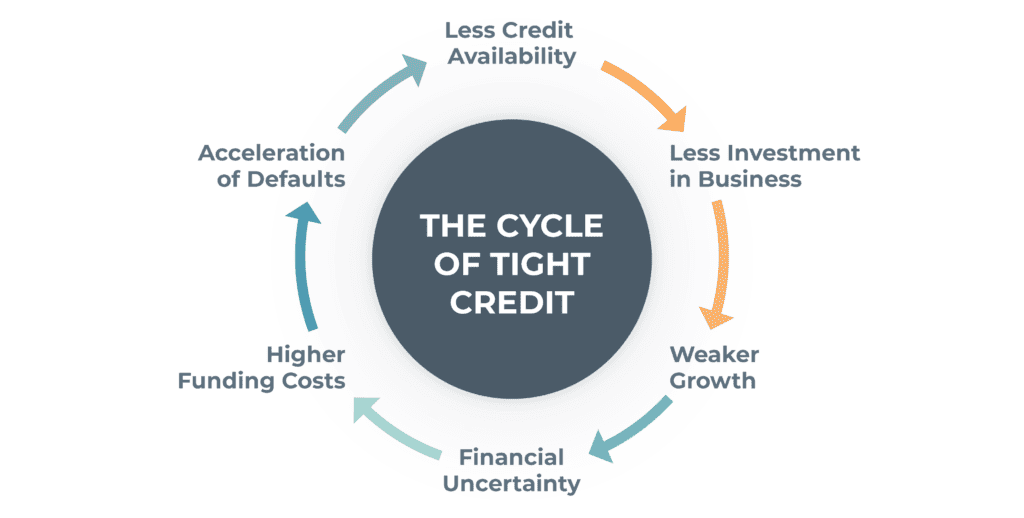

Read on to see how high-profile bankruptcies are linked to the cycle of restricted credit availability and discover easy-to-acquire alternative funding options despite tightening lending standards. Learn to prepare your business for unexpected financial events and challenges by accessing flexible funding solutions from non-bank lenders.

Understanding the “credit crunch”

Raising interest rates is the Federal Government’s central strategy in its fight to lower the inflation rate. However, as rates increase, the likelihood of borrowers being able to repay loans declines, and banks become more cautious about extending credit. As large corporations file for bankruptcy, traditional lender confidence continues to decrease. It’s a challenge financial insiders call a “credit crunch.”

The Federal Reserve conducted a survey in April 2023 to measure any changes in the standards, terms, and demand for bank loans after this spring’s Silicon Valley Bank and Signature Bank seizures. 47% of banks surveyed stated they tightened lending standards during the first three months of 2023 for businesses with annual sales of less than $50 million.

As the credit crunch intensifies, businesses still need cash to conquer these difficult times. A recent small business credit report showed that while 25% of American small businesses applied for loans, lines of credit, or cash advances in 2021, 40% did so in 2022. However, less than half of those 2022 applications were fully approved.

Without adequate working capital, business operations weaken, increasing their chances of default. That, in turn, further decreases lender confidence.

Where can businesses still find funding?

The current market conditions are placing businesses in a difficult situation. Rising costs and sinking demand are challenging revenues and profitability. Meanwhile, access to working capital is needed to support operations and fuel recovery plans.

Fortunately, as traditional lenders are shrinking the credit market, alternative funding solution companies are filling the lending gap, providing the funds needed to restructure struggling companies or fund operational costs. According to a Grand View Research Report, the alternative finance market is poised to boom over the next decade at a compound annual growth rate (CAGR) of 23.6% from 2022 to 2030.

Here’s how alternative finance companies can offer more accessible funds to struggling businesses, even amid rising corporate insolvencies:

-

1. By accelerating invoice payments

- Alternative finance companies can exponentially shorten the time it takes for your business to get paid by offering an invoice factoring solution.

In an invoice factoring arrangement, a factoring company buys your business’s accounts receivable invoices at a discount in exchange for immediate payment. Upon receiving your invoices for financing, the factoring company verifies documents and transfers funds within 24 hours – or even quicker.

Immediate payment of accounts receivable alleviates the stress and strain of irregular cash flow without incurring debt. As a result, invoice factoring has become a go-to alternative to traditional debt financing.

-

2. Through an expedited qualification process

- As traditional lending agreements become ever more challenging to qualify for, qualification speed has become a top feature of alternative financing deals. That means less time waiting for the approval process to be completed and first funding to begin.

Most invoice factoring agreements, for example, can be approved within days and first funding is completed shortly after that. Once the account is set up, funds are transferred and accessible within hours of submitting new invoices for financing.

Alternative finance companies can also expedite qualification for other lending services, such as asset-based lending. Traditional lenders may take multiple months to assess the value of collateral assets to approve credit and determine your loan amount. Meanwhile, alternative finance companies have streamlined the underwriting process and provide direct access to decision-makers. This direct line of communication helps to accelerate asset valuations and approvals.

-

3. By delivering 24/7 access to your funds

- Urgent repairs, unexpected bills, or last-minute purchases can’t always wait until the next business day. Often, unexpected events require immediate attention to be managed effectively. The best alternative finance companies can deliver funds 24/7 through easy-to-access online platforms, meaning you can withdraw the cash whenever you need it, day or night. This also means you’ll have 24/7 access to monitor account balances, track transactions, and view credit limits to maximize efficiency in cash management.

-

4. Through cost-effective and flexible funding limits

- Alternative financing agreements are designed to be cost efficient and flexible. For example, a revolving line of credit ensures funding up to a specified limit, but you only pay on the amount you’ve drawn. If your business spends $40,000 of an approved $60,000 credit limit, you only pay interest on the amount you access.

Unlike the strict credit limits imposed by traditional lenders, alternative lending offers flexible funding limits. For instance, invoice factoring users can raise their credit limit if their business grows and generates more invoices to creditworthy customers. Your credit limit can be adjusted without applying for a new funding agreement to scale with your business and to keep pace with the cost of business expansion.

Conclusion

As rising instances of bankruptcy contribute to an already tricky borrowing environment, businesses must find new ways to secure flexible financing options to overcome instability. Alternative finance companies are providing those flexible funding solutions with easy qualification requirements that allow companies to navigate the challenges of adverse economic conditions.

Look for a leading alternative finance company with a suite of financing options and experience in your industry to provide the funds you need, and the flexibility necessary to help you survive and prosper under challenging conditions.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.