Your trucks are your business – they’re either generating revenue or draining reserves. When equipment breaks down, critical decisions are needed to get it back on the road quickly.

Truck maintenance has become an uptime-first priority. Fleets are leaning more heavily on predictive, data-driven tools and on-the-road service models as they contend with rising repair costs, technician shortages, and older equipment staying in service longer.

Keeping a fleet in top condition, from maintenance to compliance and eventual replacement, can quickly strain even the best-run operation. The key isn’t just managing immediate expenses; it’s building a stable and flexible financial structure that regulates cash flow, allows for emergency funding, and supports growth.

Achieving financial stability and flexibility for trucking companies begins with strong cash flow management. This article is part of a guide to equip fleet owners and managers with practical financial strategies to maintain reliable operations, and drive profitability.

About the guide:

A Trucker’s Guide to Cash Flow Management is a strategy blueprint and best-practice resource designed to help fleet owners and managers optimize working capital, control costs, and build financially resilient operations that keep trucks moving and business profitable.

In this article, we explore the challenges of equipment maintenance, compliance, and replacement, and how tailored financial strategies provide the working capital needed to keep trucks road-ready and operations profitable.

The hidden complexity of fleet maintenance

Truck and trailer maintenance is more than oil changes and tire checks. It’s an ongoing system of inspections, repairs, and upgrades that requires careful scheduling and financial foresight.

The maintenance challenge: When freight volumes surge or cash flow tightens, it’s tempting for operators to delay maintenance, trading short-term savings for long-term costs. Delayed maintenance often leads to breakdowns, higher costs, safety risks, and lost revenue.

Rising costs of parts and labor: The average cost per mile for maintenance and repair has increased significantly over the past five years. These costs can erode already thin margins. But, far worse, a single major breakdown can disrupt cash flow for weeks and turn a revenue generating truck into a cash drain.

The constant pressure of compliance: Trucking companies face a complex web of regulatory compliance requirements. From meeting DOT and FMCSA safety standards to adapting to stricter emissions regulations, staying compliant requires continuous investment in inspections, equipment upgrades, and documentation.

Equipment renewal: Even the best-maintained trucks eventually reach the end of their service life. New trucks offer greater efficiency but comes with steep price tags, while used equipment may save upfront costs but pose higher maintenance risks. Fleet owners and managers must balance cost, reliability, lifecycle value, and their cash flow position to assess ROI between new and used equipment.

Maintenance, repairs, compliance, and equipment replacement are unavoidable. How you finance them determines your uptime and profitability. Having a financial strategy that enables fleets to maintain, upgrade, or replace equipment is vital to ensure service reliability, profitability, and long-term success.

Financial strategies providing steady access to working capital

Managing trucks and trailers is as much a financial challenge as an operational one. Many fleet owners struggle not because they lack business, but because their cash is tied up in slow-paying freight bills. Implementing financial strategies that leverage cash flow solutions such as freight factoring and asset-based lending (ABL) can provide the working capital needed to cover maintenance, stay compliant, and invest in new equipment without disrupting operations.

Freight factoring is one of the most effective tools for trucking companies to maintain liquidity without taking on new debt. By converting invoices into immediate cash, factoring gives carriers the ability to access working capital within hours of delivering a load.

Asset-based lending (ABL) offers another strategic advantage for fleets with larger balance sheets or owned equipment. This flexible financing strategy provides a revolving line of credit secured by a company’s assets, typically accounts receivable, or equipment. Unlike traditional bank loans that rely on fixed financial covenants, ABL aligns credit availability with the real value of a company’s assets, expanding borrowing capacity as the business grows.

Together, freight factoring and ABL form a complementary financing strategy. Factoring supports short-term cash needs, while ABL underwrites long-term asset management and expansion.

Building a sustainable fleet strategy

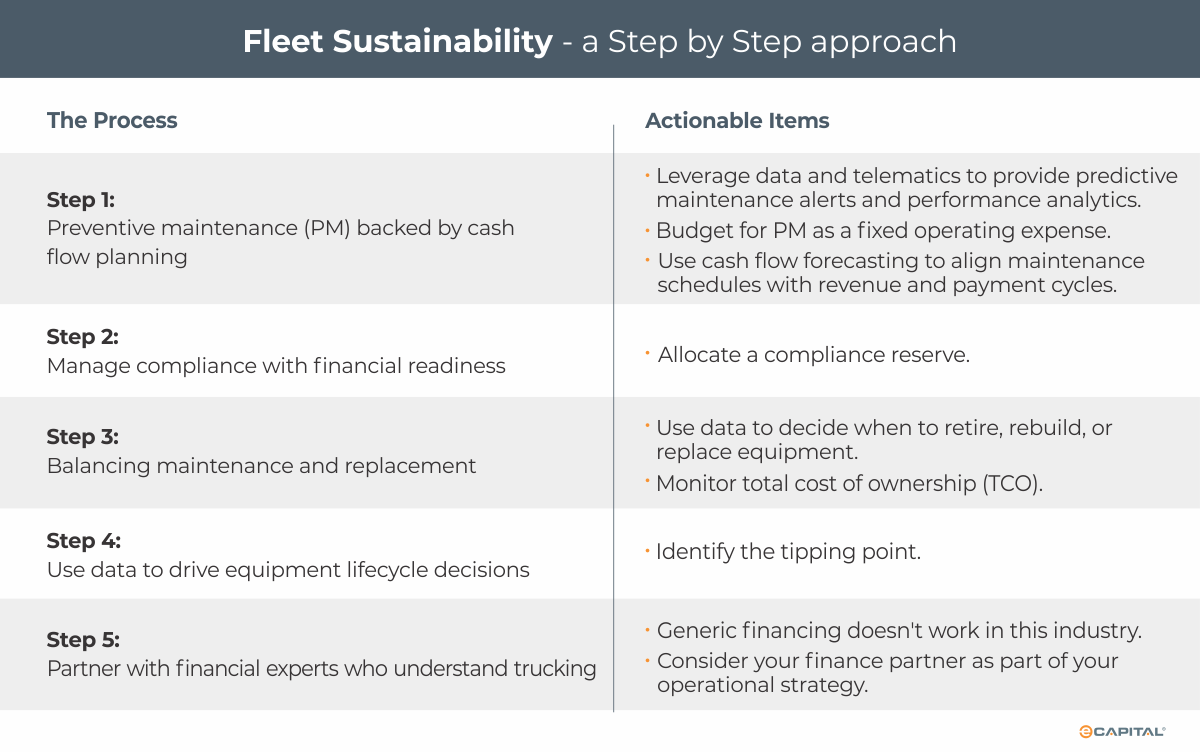

Equipment management isn’t just about fixing what’s broken, it’s about anticipating what’s next. Successful fleets take a proactive, financially informed step by step approach to ensure equipment is road-ready, compliant, and operating at peek performance.

Step 1: Preventive Maintenance (PM) Backed by Cash Flow Planning

- Leverage data and telematics: Fleet management systems provide predictive maintenance alerts and performance analytics that help reduce downtime, extend equipment life, and enhance performance to improve profitability.

- Budget for PM as a fixed operating expense: Treat regular maintenance as a non-negotiable cost of staying operational.

- Use cash flow forecasting: Align maintenance schedules with projected revenue and payment cycles. This ensures you always have liquidity to cover inspections and repairs.

Don’t compromise preventative maintenance if cash flow is stagnated. Leverage freight factoring to stay on schedule when customer payments are slow.

Step 2: Manage Compliance with Financial Readiness

- Allocate a compliance reserve: Set aside a percentage of revenue specifically for regulatory requirements, inspection fees, and technology updates.

Regulatory compliance is mandatory and non-negotiable. When cash is tight, use flexible financing to cover funding gaps, ensuring operational readiness and compliance are not deferred.

Step 3: Balancing Maintenance and Replacement

- Utilize technology: Modern telematics and fleet management platforms provide insights into fuel efficiency, maintenance intervals, and cost per mile. Use this data to decide when to retire, rebuild, or replace equipment.

- Monitor total cost of ownership (TCO): Beyond purchase price, fleets must calculate depreciation, maintenance, fuel, and financing costs to determine when replacement makes financial sense.

Freight factoring and ABL unlock cash from invoices or assets, giving fleets the liquidity to purchase or upgrade equipment without straining cash flow.

Step 4: Use Data to Drive Equipment Lifecycle Decisions

- Identify the tipping point: Regularly monitor and assess data to know when repair costs exceed replacement benefits.

Step 5: Partner with Financial Experts Who Understand Trucking

- Generic financing doesn’t work in this industry: Partner with financial experts who understand trucking. Experienced transportation financing companies understand the industry’s challenges, and opportunities, providing expertise and fast, flexible access to capital.

- Consider your finance partner as part of your operational strategy: Ensure funds can be deployed same day, credit limits can grow with business volumes, and financing is flexible, not subject to rigid covenants.

A disciplined financial strategy ensures that you can meet essential and recurring costs without disrupting day-to-day operations or taking on unnecessary debt. The goal is to keep your equipment performing at peak efficiency while maintaining steady access to working capital.

Conclusion

Fleet maintenance, compliance, and replacement all rely on one core resource – working capital. Effective cash flow management turns these expenses into manageable, predictable investments rather than sudden financial shocks.

When you combine preventive maintenance discipline with modern financial tools like freight factoring and ABL, you build a resilient, future-ready fleet. Trucking companies that perform reliably, stay compliant, and maintain dependable cash flow gain a competitive advantage and improve profitability over time.

Contact us to explore practical financial strategies to maintain reliable operations, and drive profitability.

Next in the Series: Understanding Overhead Costs in Trucking: What It Really Takes to Stay Profitable

- Overhead remains one of the most misunderstood and poorly managed aspects of small and mid-market transportation operations.

- Too often, overhead is treated as a static number rather than a dynamic system.

- The challenge lies in understanding how overhead behaves over time, especially as a business grows or market conditions shift.

- Growth without financial discipline increases risk.

- In an industry shaped by thin margins and unpredictable timing, disciplined cash flow management turns overhead from risk into a manageable part of growth.

View the complete Table of Contents.

Key Takeaways

- Equipment maintenance, repairs, compliance, and replacement are unavoidable. How you finance them is a significant factor in determining your uptime and profitability.

- Successful fleets take a proactive, financially informed step by step approach to ensure equipment is road-ready, compliant, and operating at peek performance.

- A disciplined financial strategy ensures that you can meet essential and recurring costs without disrupting day-to-day operations or taking on unnecessary debt.

- The goal is to keep your equipment performing at peak efficiency, maintain steady access to working capital, and ensure profitability.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.