Traditional business loans may not always be the ideal solution for established businesses looking to finance growth, acquisitions, or restructuring. Conventional lenders, such as banks, typically impose strict lending terms and may limit the company’s cash flow flexibility. Often, the debt covenants that become part of traditional loan agreements impose financial measures that must be met and restrict the borrowing company’s ability to stretch resources. As a result, conventional lending strategies can curb a company’s financial agility, which is crucial for adapting to changing market conditions or restructuring efforts.

Enterprise value loans offer a viable alternative funding solution for undercapitalized businesses seeking flexible financing. Qualification for this type of funding focuses on the overall value of a company, including its intangible assets such as brand equity, intellectual property, and goodwill. Funds can be used for various purposes, including restructuring, acquisitions, and working needs.

This blog explores enterprise value loans, how they work, their benefits, and why they’re an attractive option for businesses aiming to leverage their full potential.

What Are Enterprise Value Loans?

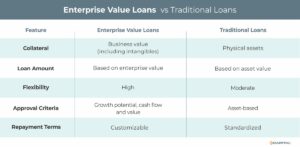

Enterprise value loans are a type of financing based on the total value of a business, considering both tangible and intangible assets. Unlike traditional loans that rely solely on physical assets as collateral, these loans assess the business’s overall worth, including its market position, customer relationships, and future earning potential.

Key Features of Enterprise Value Loans:

- Value-Based: Loan amounts are determined by the enterprise value of the business.

- Flexible Use: Funds can be used for growth initiatives, mergers, acquisitions, or restructuring.

- Tailored Financing: Terms are customized to align with the borrower’s business objectives and financial health.

How Do Enterprise Value Loans Work?

- Business Valuation: A detailed valuation is conducted to determine the enterprise value, including tangible assets, cash flow, and intangible assets.

- Loan Application: The business applies for a loan, presenting its financials, business plan, and valuation report.

- Approval Process: The lender assesses the business’s value, growth potential, and repayment capacity.

- Fund Disbursement: Once approved, funds are disbursed to the borrower for the specified purpose.

- Repayment: The loan is repaid through structured payments, typically aligned with the business’s revenue streams or cash flow.

Who Can Benefit from Enterprise Value Loans?

Enterprise value loans are ideal for:

- Mid- to Large-Sized Businesses: With substantial intangible assets or established market positions.

- Private Equity Firms: Looking to leverage a business’s enterprise value for acquisitions or portfolio growth.

- Businesses in Growth Phases: Needing capital to expand operations, enter new markets, or invest in R&D.

- Mature Companies: Pursuing restructuring or recapitalization strategies.

- Asset-Light Industries: Industries such as technology, media, and professional services, where intangible assets are significant.

Benefits of Enterprise Value Loans

- Access to Significant Capital

- Leverages the full value of the business, including intangible assets, to secure larger loan amounts.

- Flexible Financing

- Funds can be used for a wide range of purposes, from acquisitions to working capital.

- Preserves Ownership

- Unlike equity financing, enterprise value loans allow businesses to retain ownership and control.

- Tailored Terms

- Financing structures are customized to align with the borrower’s cash flow and financial goals.

- Supports Growth

- Enables businesses to pursue strategic opportunities without depleting reserves or selling assets.

- Strengthens Financial Position

- Provides liquidity for debt consolidation or recapitalization, improving financial stability.

Challenges of Enterprise Value Loans

- Valuation Complexity

- Determining enterprise value requires thorough assessments and may involve subjective factors.

- Higher Risk Perception

- Lenders may perceive higher risk due to the reliance on intangible assets, leading to stricter terms.

- Repayment Obligations

- Loan repayments must align with cash flow, requiring strong financial management.

- Industry Limitations

- Not all industries or businesses qualify, particularly those without significant intangible assets or growth potential.

- Cost of Financing

- Interest rates may be higher compared to traditional loans due to perceived risks.

Industries That Use Enterprise Value Loans

- Technology

- Leverages software, intellectual property, or customer base value.

- Healthcare

- Uses brand equity and patient goodwill for growth or acquisitions.

- Media and Entertainment

- Monetizes audience reach, copyrights, and content libraries.

- Professional Services

- Capitalizes on client contracts and market reputation.

- Consumer Brands

- Utilizes brand equity and customer loyalty for expansion.

Real-World Example: Enterprise Value Loan in Action

Scenario: A mid-sized SaaS company with strong recurring revenue and a loyal customer base wants to acquire a smaller competitor to expand its market share.

Solution: The company secures an enterprise value loan based on its $50 million valuation, including both tangible and intangible assets. The lender provides $10 million in funding to complete the acquisition.

Outcome: The acquisition increases the company’s revenue and market position, enabling it to repay the loan and achieve sustainable growth.

How to Use Enterprise Value Loans Strategically

- Focus on Valuation

- Work with valuation experts to ensure your enterprise value is accurately assessed.

- Align with Strategic Goals

- Use funds for initiatives that enhance revenue, market share, or operational efficiency.

- Monitor Cash Flow

- Ensure repayment terms align with your business’s financial performance.

- Choose the Right Lender

- Partner with lenders experienced in enterprise value-based financing.

- Leverage Intangible Assets

- Highlight key value drivers like intellectual property, customer contracts, and market position during the application process.

Tips for Choosing an Enterprise Value Loan Provider

- Industry Expertise

- Select leading specialty lenders familiar with your industry and its unique value drivers.

- Transparent Terms

- Ensure loan terms, interest rates, and fees are clear and competitive.

- Valuation Support

- Work with providers who offer or partner with reliable valuation services.

- Flexibility

- Look for tailored financing options that align with your business needs.

- Reputation

- Choose lenders with a proven track record and strong client relationships. Assess lender websites for service capabilities and check client reviews to help determine customer satisfaction levels.

Conclusion

Enterprise value loans are a transformative financing option for businesses seeking to leverage their full worth, including intangible assets, to secure growth capital. By focusing on the overall value of a business, these loans empower companies to pursue strategic opportunities, enhance market position, and achieve long-term success.

If your business has significant intangible assets or a strong market position, enterprise value loans could be the key to unlocking your growth potential. Partner with the right lender, ensure accurate valuation and take the next step toward realizing your business goals.

Contact us to consult our experienced financial specialists to strengthen your company’s financial structure, maximize access to credit, and fuel growth opportunities.

Key Takeaways

- Traditional business loans may not be ideal for established businesses seeking growth or restructuring, as they often come with strict terms and financial covenants that limit cash flow flexibility and financial agility.

- Enterprise value loans are financing options based on a business’s total worth, including both tangible and intangible assets, rather than just physical collateral.

- Featuring few loan covenants, this type of flexible financing empowers companies to pursue strategic opportunities, enhance market position, and achieve long-term success.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.