DIP Financing Can Help a Company Through Bankruptcy and Restore Profitability

Content

- What is DIP financing, and how can it help?

- When is DIP financing available?

- What is the process of DIP financing?

- A real case example of success

- Selecting an experienced lender is critical for success

- How is asset-based lending used in DIP financing?

- How is accounts receivable factoring used in DIP financing?

- Can companies emerge from bankruptcy stronger than ever?

- Conclusion

- Key Takeaways

Businesses in financial distress typically find that sources of traditional funding shrink when they need it the most. As a business’s financial health deteriorates, obtaining further credit may become restricted. Worse, the lender may recall credit completely if the business breaches loan covenants. If a company defaults on credit payments, a loan recall is inevitable, often leading to bankruptcy. Filing for bankruptcy isn’t necessarily the end for distressed businesses – it can provide an opportunity for restructuring and a fresh start. This is where debtor-in-possession (DIP) financing can help.

DIP financing can help a company reverse course, give it restructuring support, and return it to profitability.

What is DIP financing, and how can it help?

Typically structured as interim revolving credit facilities, DIP financing provides companies undergoing bankruptcy proceedings with essential funding to continue operations and restructure their finances. This specialized form of financing is primarily associated with Chapter 11 bankruptcy proceeding, which help companies navigate through the process and emerge stronger.

While Chapter 11 is the most common scenario for DIP financing, similar concepts may exist in other jurisdictions or bankruptcy frameworks.

When is DIP financing available?

There are several stages in financial distress that lead to bankruptcy. Each of these stages has a funding solution to help restore financial health. Knowing the warning signs and strategies to avoid insolvency helps to avert distress in its early stages. Receiving a forbearance letter from your lender requires immediate action, but knowing what you should do can save your company from filing for Chapter 11 protection.

However, due to the harsh economic conditions that persist, businesses are now operating in an era of high bankruptcy rates. If your company files for Chapter 11 bankruptcy protection, it may be able to take advantage of DIP financing.

This specialty financing is not typically available to firms that intend to liquidate their assets and cease operations entirely. Instead, it is a type of funding available to companies undergoing bankruptcy proceedings that intend to continue operations and have a viable plan that lenders believe gives the business a credible chance to turn itself around.

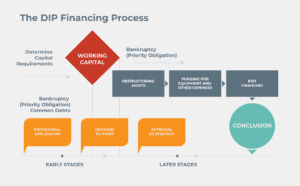

What is the process of DIP financing?

Here’s how the DIP Chapter 11 loan process works:

- When the company locates a lender willing to finance its turnaround, it seeks approval from the Bankruptcy Court.

- Standard financing terms include a priority security interest in the collateral, a market-rate or even premium rate of interest, an approved budget, and other related lender protections. Current lenders may object to the loan if they feel they will be made worse off.

- The Bankruptcy Court will be the one to decide whether to approve the loan or not.

The following is required when a company in Chapter 11 bankruptcy has existing secured loans and wants to borrow on a secured basis that is equal or senior to the existing loans:

- It must obtain consent from the current lender(s) for the new loan.

- It will have to convince the Bankruptcy Court that the existing lender(s) will be adequately protected, and the new loan will not make them worse off.

In these scenarios, current lenders are often willing to consent for another lender to take priority security interest for several reasons. Firstly, it may help ensure the continued operation of the business during bankruptcy, which can ultimately preserve the value of the assets securing their loans. Additionally, consenting to DIP financing may offer the current lender additional protection or repayment options, and it may facilitate a faster and smoother bankruptcy process, potentially leading to a quicker recovery of their debt.

A real case example of success

The case of Orchard Supply Hardware Stores Corporation exemplifies the intricate negotiations and strategic decisions involved, such as securing DIP financing, facilitating a sale to Lowe’s, and navigating objections from unsecured creditors. This case highlights the complex dynamics among debtors, lenders, and creditors in bankruptcy proceedings, offering valuable insights for future restructuring endeavors.

Selecting an experienced lender is critical for success

While many traditional lenders provide this specialized form of financing, non-bank lenders may be more flexible in their lending criteria and have a greater risk appetite than traditional banks.

However, this type of specialty financing can be quite complex. It involves multiple parties, intricate negotiations, and the need to balance various interests, such as those of the debtor, lenders, creditors, and potential buyers. Factors such as asset valuation, collateral, repayment terms, and court approvals add complexity to the process. Selecting a reputable lender experienced in this type of financing is critical to navigate these complexities and maximize the chances of a successful turnaround for the company.

How is asset-based lending used in DIP financing?

Asset-based lending (ABL) can play a significant role in DIP financing by providing funding secured by the company’s tangible assets. In this scenario, the lender extends credit to the bankrupt company, using assets such as accounts receivable, inventory, equipment, or real estate as collateral. ABL often provides more flexibility than traditional loans and may provide greater borrowing capacity based on the value of the assets.

How is accounts receivable factoring used in DIP financing?

Accounts receivable factoring (invoice factoring) can be utilized as part of DIP financing by providing immediate access to cash flow during bankruptcy proceedings. Companies undergoing Chapter 11 restructuring may sell their accounts receivable to a factoring company at a discounted rate, converting outstanding invoices into immediate working capital. Because it is based on the sale of assets, this infusion of liquidity helps the company navigate bankruptcy without incurring further debt.

Can companies emerge from bankruptcy stronger than ever?

Yes. The process of refinancing and restructuring during bankruptcy can be complex, but if managed well, it can breathe new life into companies that otherwise may face liquidation. Read about eight well-known companies that faced bankruptcy yet emerged stronger than ever.

Conclusion

If your company is experiencing financial distress, it is essential to consult an experienced bankruptcy attorney and restructuring or turnaround specialist to determine your viable options. You may be able to do a workout or other restructuring process outside of bankruptcy. However, if you determine that Chapter 11 bankruptcy is your best option, DIP financing may provide a solid opportunity to help turn your company around.

Key Takeaways

- Filing for bankruptcy can provide an opportunity for restructuring and a fresh start.

- DIP financing can help a company reverse course, give it restructuring support, and return it to profitability.

- While many traditional lenders provide this specialized form of financing, non-bank lenders may be more flexible in their lending criteria, have a greater appetite for risk, and often provide expertise to help navigate the bankruptcy process.

- Selecting an experienced lender is critical for success.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.

Fact-checked by:

Fact-checked by: