A new survey shows businesses’ view of the lending market is shifting as new avenues for fast funding become available.

A survey sponsored by Carl Marks Investment bank reveals that businesses believe banks are tightening credit. 86% of respondents said traditional lenders are applying more pressure to their middle market borrowers to remain creditworthy and show less tolerance when they miss financial targets.

83% of respondents said alternative lenders are less aggressive than banks when dealing with a borrower facing financial challenges.

Read on to understand why banks are restricting credit and how alternative forms of financing can help businesses fill the gaps.

Why are traditional lenders restricting credit?

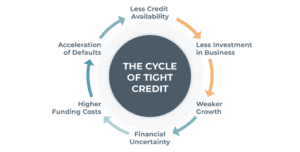

The Federal Government’s primary approach to combat inflation is raising interest rates, but this strategy challenges borrowers and banks alike. As interest rates climb, borrowers struggle to repay loans. That forces banks to exercise greater caution when extending credit. It’s a trend financial insiders refer to as a “credit crunch.”

In April 2023, the Federal Reserve conducted a survey to assess changes in lending standards, terms, and loan demand following the recent seizures of Silicon Valley Bank and Signature Bank. The survey revealed that 47% of banks tightened their lending standards for businesses with annual sales below $50 million during the first quarter of 2023.

Our economy is compounding the problem

Amidst this intensifying credit crunch, businesses find themselves in need of cash to weather these challenging times. According to a recent small business credit report, 40% of American small businesses sought loans, lines of credit, or cash advances in 2022, a significant increase from 25% in 2021. However, less than half of the applications submitted in 2022 received full approval.

That’s where alternative financing comes into play.

Why has alternative financing exploded in popularity?

Alternative financing companies are growing in popularity and are now quickly filling the credit gap left by traditional lenders’ hesitance.

The industry has boomed in size and scope, with alternative lenders providing niche services customized to industries such as staffing firms or trucking companies.

Here are a few ways alternative finance companies connect businesses with easier and faster access to working capital.

By accessing working capital tied up in invoices

Waiting for customers to pay their invoices can be a significant challenge for businesses managing cash flow.

On average, it takes over 40 days for business customers to settle outstanding invoices. However, there’s a solution that can provide quick access to funds: invoice factoring. You can receive immediate payment and improve your cash flow by selling your unpaid invoices to an alternative finance company at a discount.

The process has been significantly expedited thanks to advanced technology, including algorithms and customized computer programs that swiftly verify invoices against purchase orders and delivery receipts. This allows alternative finance companies to approve funding requests and transfer funds within hours.

By unlocking the maximum value of your assets

Your business’s equipment, real estate, and more hold an untapped value that can be utilized through asset-based lending (ABL). Unlike traditional lending options, ABL offers more flexibility, faster approval and funding, competitive rates, and less emphasis on credit history. With ABL, you can secure a loan based on the value of your assets, such as inventory, equipment, real estate, and accounts receivables. Alternative finance companies specializing in ABL have streamlined processes and offer minimal lender oversight. This makes it easier for businesses to access capital to increase cash flow and fuel growth.

By providing more flexible lines of credit

Lines of credit are essential for managing short-term cash flow needs. Compared to traditional lenders, alternative finance companies are often more willing to provide lines of credit to businesses with lower credit scores or less established credit histories. These lines of credit come with flexible underwriting standards, faster funding times, higher credit limits, and require less collateral. They allow businesses to draw funds as needed, with minimal reporting requirements and covenants. This allows businesses to qualify quickly and access the cash they need.

By turning equipment equity into cash-on-hand

Equipment refinancing offers a way to tap into the equity in your working equipment. By leveraging the value of your long-term assets, you can obtain the necessary funds to improve operations, reduce debt, pursue new contracts, or invest in strategic initiatives. Equipment refinancing provides several advantages, including fast qualification and provision of a term sheet, high appraisal values with up to 75% advance rates, streamlined funding processes, and flexibility in managing debt.

Conclusion

Businesses face restricted lending requirements in an increasingly challenging borrowing landscape, making accessing traditional financing options difficult. But many of those same businesses need flexible funding solutions more than ever. This is where alternative finance companies come into play, offering easy qualification requirements and a wide range of financing options tailored to specific industries.

By exploring these alternative financing options and implementing strategic cash flow management techniques, businesses can address the challenges of slow payments, unlock the value of their assets, increase flexibility, and optimize their cash flow to thrive in today’s dynamic business landscape.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.