It’s a tough economy! Demand is low, costs are high, and interest rates have skyrocketed. Too many businesses face extreme challenges as they battle to maintain operational efficiencies and financial health. After working hard for many years to grow your business, you may now find yourself trying to develop financial strategies for business turnaround, resilience, and growth success.

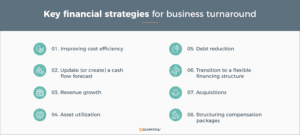

While trying to steer an underperforming business back on course is undoubtedly stressful, you can set yourself up for future success by taking action today to turn things around. If your business is underperforming, consider the following 8 key financial strategies for business turnaround to help tighten your belt, increase efficiencies, smooth out your cash flow, and improve your access to the working capital you need.

Financial strategies for business #1:

Improving cost efficiency

Decreasing costs is one of the quickest financial strategies for businesses to improve performance. Here are some ideas:

- Renegotiate supplier contracts. Similar to a loan, signing a longer term contract with a vendor may provide an opportunity to negotiate a lower per-month price. Also, ask about early payment discounts that could knock a few percentage points off your overall bill. Another tactic to consider is periodically putting vendor contracts out to bid to ensure you receive the best possible pricing. Long-time vendors can become complacent over time, and the bid process is an easy way to encourage suppliers to sharpen their pencils. These financial strategies for business cost reductions can have significant positive impact on cash flow and your business’s overall financial health.

- Eliminate redundancies. Repeating identical tasks can lead to frustration among employees and may also create operational inefficiencies if multiple employees are engaged in duplicative work. Assessing whether upgrading your technology can reduce redundant tasks and accelerate automated processes is crucial for optimizing financial strategies for business.

Financial strategies for business #2:

Update (or create) a cash flow forecast

Identifying gaps in your cash flow is essential for enhancing your business’s financial health. Employing a cash flow forecast enables you to pinpoint these gaps and forecast the flow of future funds into your business, supporting effective financial strategies for business growth.

The ultimate goal is to create predictable cash flow, which you can use to plan an accounts payable schedule.

Invoice factoring is one way to achieve fast, reliable, and predictable cash flow. This flexible financing strategy converts accounts receivable invoices into immediate cash, facilitating a straightforward funding process beneficial for enhancing financial strategies for business.

It’s a simple funding process:

- Invoices are submitted to a factoring company.

- The factoring company verifies the delivery of products or services against supporting documents.

- Advanced funds, up to 95% of the invoice face value, minus a small fee, are transferred within 24 hours of the invoice being submitted.

- The balance owing (the reserve) is held until the business’s customer pays the invoice amount in full to the factoring company. The reserve amount is then released and transferred to the business’s account.

Because it uses your existing invoices as collateral, qualifying for invoice factoring is quick and easy if you do business with creditworthy customers.

Financial strategies for business #3:

Revenue growth

One surefire way to increase your business’s financial health is to increase revenue. Here are some ideas:

- Increasing sales to current customers. Many businesses miss financial strategies for businesses to increase sales with existing customers. Consider whether cross-selling and upselling are tactics that would work each time an existing customer makes a purchase. The best part about this strategy is it’s usually faster and cheaper to reach out to current customers about buying more from your business.

- Find new customers. Build a sales funnel so you have a consistent flow of incoming prospects throughout the year. Converting even a small percentage of these leads into new, paying customers will help add more top-line revenue to your income statement and help offset the normal customer attrition process. This approach is integral to implementing effective financial strategies for business, ensuring sustainable growth and profitability.

Financial strategies for business #4:

Asset utilization

When your business buys an expensive piece of equipment, there’s an expectation that this investment will contribute to your bottom line. Asset utilization is a metric used to measure how efficiently you’re using your assets and how good you are at pulling value from them. For example, running three 8-hour shifts a day to keep machinery operating full-time produces a higher asset utilization than shutting the equipment down between regular workdays. A higher asset utilization rate typically translates into increased efficiency and better profit margins.

Another effective method to derive value from assets involves leveraging financial strategies for business, such as equipment refinancing. Leverage the equity value in working equipment, such as CNC machines, heavy equipment, and more, to quickly access capital that can be used to help turn around your company’s financial situation.

Financial strategies for business #5:

Debt reduction

Too much debt on your balance sheet can squeeze the bottom line of your income statement. Reducing your company’s debt will decrease both interest expenses and monthly payments, which will help improve your net profit and overall cash flow.

There are numerous financial strategies for business to reduce debt. If you require additional business financing without taking on more debt, consider the benefits of invoice factoring, as outlined in Strategy #2. Because invoice factoring is based on the sale of an asset, you are not using the asset as collateral. As a result, you are not incurring additional debt.

Financial strategies for business #6:

Transition to a flexible financing structure

Many traditional loans have rigid compliance rules that you must abide by or be at risk of violating the loan’s debt covenants. Financial strategies for business turnaround can include transitioning to alternative financing options for a more flexible financing structure. This strategy enables more business agility and resilience to changing economic conditions. Alternative lenders provide specialized funding options tailored to your business’s unique capital needs. Easy qualification, scalable credit limits to keep pace with growth, and covenant-light funding agreements are just a few benefits of alternative financing options.

Here’s a closer look at a few of the benefits of using a flexible financing solution:

- Covenant light funding agreements. Traditional loan agreements typically include restrictive covenants that are meant as a way to protect the lender. These covenants can impede business growth by limiting borrowers’ actions and access to more credit. Alternative financing options are generally covenant-light funding agreements with fewer restrictions. With minimal lender oversight, business owners are freer to execute strategic decisions and pursue growth opportunities.

- Expanded credit limits. Alternative lenders leverage previously untapped asset strengths to access additional sources of credit. As the business grows, it will generate more value in accounts receivable, inventory, or other assets such as M&E. Credit limits can expand as business volume and asset values increase.

- Access more capital in multiple ways. With flexible financing, numerous funding options exist to access the capital you need. The most used alternative financing options to support financial strategies for business turnaround are asset-based lending and the aforementioned invoice factoring. But, depending on the lender you choose to work with, other business funding options, such as equipment refinancing and commercial cards, are also available to increase your access to capital.

- Limited reporting required. Traditional loans may require you to submit reports or certified financial statements as evidence to the lender that your business abides by the loan’s terms of the agreement. On the other hand, flexible financing options, such as invoice factoring, typically have limited reporting requirements.

- Fast and easy qualification. A business possessing quality assets such as accounts receivable, or inventory can quickly and easily qualify for alternative business financing. The qualification process and first funding can be arranged in a few days or weeks, whereas traditional loan applications can sometimes take several months to complete.

Financial strategies for business #7:

Acquisitions

Many companies view acquisitions as an opportunity to help jump-start a new growth phase. An acquisition can lead to a boost in profitability and a reduction in operating costs, not to mention tax benefits and possible opportunities to enhance equity. An asset-based loan from an alternative lender can help facilitate this type of transaction by providing a large injection of cash, up to $50 million.

Financial strategies for business #8:

Structuring compensation packages

A business turnaround strategy often involves a restructuring of management. Attracting and retaining executive-level talent is an essential part of growing your company. But it can also be expensive.

Management restructuring can help revitalize your company in the long term, but in the short term, you could take a significant cash hit – it takes money to hire and fire! Funding hiring incentives and compensation packages are critical to the success of recruiting and retention initiatives. Plus, affording severance payouts is needed to release employees from their employment contracts properly.

Alternative business financing options can help access the capital you need and produce steady, predictable cash flow to support the costs of re-staffing.

Conclusion

Correcting diminished business performance levels and improving your company’s financial health depends on the development and execution of effective financial strategies for business. Implement strategies to reduce costs, improve cash flow, increase revenue, and maximize equipment utilization. Take actions to reduce debt and transition to a flexible financing structure to support initiatives such as acquisition strategies or restructuring of the company’s management team.

By adjusting to the harsh economic conditions businesses across all industries are now facing, agile and resilient businesses are finding new ways to prosper and grow. To ensure the greatest level of success, consult with business advisors and reputable alternative financing companies experienced in your industry. Their product, knowledge, and expertise in financial strategies for business will help you navigate the challenges of a down market and position your business to grow as the economy improves.

Contact us today to request a free consultation and see what financial strategies for business we can develop to improve your company’s health and performance.

Key Takeaways

- Too many businesses face extreme challenges as they battle to maintain operational efficiencies and financial health.

- If your business is underperforming, consider the following 8 key financial strategies for business turnaround.

- To ensure the greatest level of success, consult with business advisors and reputable alternative financing companies experienced in your industry.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.