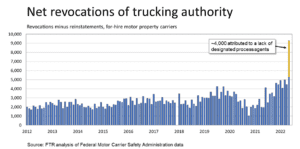

Unfavorable conditions are pushing small truckers out of business at an unprecedented rate. According to Real Truckers, 47% of new authorities issued in January 2022 are no longer active as of August 2022. Further, FTR’s revocation data, which analyzes public FMCSA data, shows that 2022 Q3 has been the highest on record for trucking authority cancelations.

The most common reasons new truckers are being forced to leave the industry include the recent steep increases in cost per mile, dropping freight rates, and shippers taking longer to pay, leaving carriers struggling to manage cash flow.

Conversely, new trucking companies that have taken affirmative action to improve their cash flow and secure more access to working capital appear to be rebuffing this trend. For example, eCapital is reporting that an astounding 87% of their freight factoring customers who received their authority in January 2022 are still active as of August 2022. The company’s internal data confirms that 30% more truckers avoid losing their authorities by leveraging flexible funding solutions such as freight factoring to improve cash flow.

This push to secure better working capital access makes even more sense when you consider that in the broader economy, poor cash flow management is responsible for 82% of business failures overall.

So, what’s the secret to retaining your authority and weathering the storm in this volatile trucking market? Real Truckers & eCapital have worked together to investigate this question and identify possible solutions. Based on our research, here are four recommended actions that trucking companies can take to help them maintain their trucking authority in the face of unfavorable market conditions.

4 Key Actions to help you Retain Your Trucking Authority Right Now

1. Get a Clearer Understanding of Your Cash Flow

Cash flow refers to the net balance of cash moving into and out of a business at a specific time.

Cash is constantly moving into and out of a trucking business. For example, when a trucker accepts a load, money flows out from the company through expenses such as fuel, food, shelter, maintenance, etc. When that trucker delivers a load, provides an invoice, and receives payment, cash flows into the business from its customers. Wash, rinse, repeat.

At any specific time, cash flow can be positive or negative.

Positive cash flow means a company has more money moving into it than out of it.

Negative cash flow indicates a company has more money moving out of it than into it.

Waiting 30, 60, or 90+ days for money from customers to move into your business negatively impacts cash flow, which puts enormous stress on yourself and your trucking business. In trucking, it’s essential to shorten the time to receive outstanding invoice payments and add a safety net to handle the fluctuations between positive and negative cash flow.

Key takeaway: Always maintain a clear picture of where your cash flow is at today, and in the foreseeable future. Maintaining positive cash flow is essential to the financial success of your trucking company.

2. Align yourself with a Modern Factoring Company

A traditional factoring company (versus a modern factoring company) is a third-party organization that will pay for your unpaid invoices using conventional means. Cash flow solutions are generally restricted to invoice factoring only, with limited access to other working capital solutions. These funding processes tend to be governed by legacy technology and legacy money transfer systems which delay the speed of funding.

By comparison, modern factoring companies take a more holistic approach to solving cash flow problems. Beyond simply factoring your invoices, modern factors can provide greater access to working capital through lines of credit and commercial credit cards. Leveraging advanced technology, modern factoring companies can also accelerate the speed of funding, resulting in access to more money in less time. Further, additional support services and tools are often provided to help customers optimize profitability, mitigate bad debt and grow their businesses.

Key takeaway: Modern factoring companies provide more money, faster, and with additional services to help you grow your trucking company at a time when others are at risk of losing their authorities.

3. Enhance Factoring with a Line of Credit

Modern factoring companies that specialize in trucking can provide industry-specific funding solutions that shorten the speed of funding from fast to immediate once invoices have been submitted and approved for financing. But growth opportunities or an emergency roadside repair can exhaust capital resources despite having positive cash flow. In these circumstances, an additional source of working capital can provide a major benefit.

Modern factoring companies can address this need by adding a pre-approved line of credit to their clients’ factoring accounts. These lines of credit give truckers the safety net they need to keep their business moving when they’re up against the constant demands of a capital intense industry.

Key takeaway: Trucking companies with lines of credit at their disposal can take advantage of growth opportunities and keep moving despite unexpected expenses such as roadside repairs.

4. Make Good Credit Decisions

Dealing with unreputable or insolvent brokers or customers is an unfortunate part of the trucking industry. Thoroughly vetting new customers to determine their ability to pay is critical before you haul. Modern factoring companies offer expertise, simple-to-use online tools, and access to their credit databases to help choose reputable customers and mitigate bad debt. A further source of credit protection is non-recourse factoring. This specific factoring arrangement guarantees invoice payments in the event of a customer becoming insolvent.

Key takeaway: Bad debt can derail a trucking company. Find and use proven online credit tools to make better credit decisions. If you are still concerned about creditworthiness, consider non-recourse factoring to protect against unpaid invoices due to insolvency.

Conclusion

The economic forecast is unclear. Some economists are projecting a contraction in 2023, while others anticipate slight growth at 0.1% to 1.0%. What lies beyond 2023 is anyone’s guess. What is clear is that trucking is the workhorse of the economic engine. Over-the-road freight transportation will always be an essential service despite the rapidly changing peaks and valleys of demand. Trucking companies that have the strength to ride through market volatility will be better positioned to maximize their stability in tough times, and then reap the rewards of an economic resurgence when it comes.

The key to sustainability and retaining your trucking authority is to take affirmative action to improve your trucking company’s cash flow and secure easy access to working capital. Evidence shows that leveraging the four key actions published in this article will increase your likelihood by extraordinary 30% of maintaining your authority and running a successful trucking business.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.