Asset refinancing offers a powerful and flexible solution for businesses seeking to boost cash flow, consolidate debt, or fund growth opportunities. By leveraging the value of existing assets, companies can access the capital they need without selling their property or taking on traditional loans.

In this blog, we’ll explore asset refinancing, how it works, its benefits, and how businesses can use it strategically to achieve financial stability and growth.

What Is Asset Refinancing?

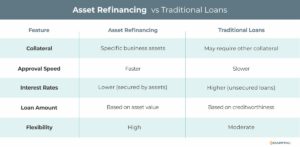

Asset refinancing involves using the value of unencumbered assets—such as equipment, vehicles, property, or inventory—as collateral to secure a loan or lease. This financing option allows businesses to unlock cash tied up in their assets while retaining their ownership and use.

Key Features of Asset Refinancing:

- Asset-Backed: Loans are secured against existing business assets.

- Flexible Use: Funds can be used for various needs, from operational expenses to debt consolidation.

- Preserves Ownership: Businesses retain ownership and operational control of the refinanced assets.

How Does Asset Refinancing Work?

- Asset Valuation: The lender assesses the value of the business’s assets to determine the loan amount.

- Loan Agreement: Terms are agreed upon, including the loan amount, repayment schedule, and interest rate.

- Fund Disbursement: The lender provides funds based on the agreed percentage of the secured asset’s value.

- Repayment: The business repays the loan over time, typically through fixed installments.

Types of Assets Used in Refinancing

- Machinery and Equipment

- Industrial equipment, production machinery, or tools used in operations.

- Vehicles

- Trucks, delivery vans, and other commercial vehicles.

- Property

- Real estate, such as warehouses, office buildings, or retail spaces.

- Inventory

- Stock that can be used as collateral for short-term debt financing.

- Accounts Receivable

- Outstanding invoices that can be refinanced to improve cash flow.

Benefits of Asset Refinancing

- Improved Cash Flow

- Converts the value of owned assets into liquid capital, allowing businesses to cover operational expenses or seize growth opportunities.

- Lower Interest Rates

- Secured loans typically have lower interest rates than unsecured options, reducing borrowing costs.

- Retained Ownership

- Businesses can access funds without selling their assets, maintaining operational continuity.

- Flexible Usage

- Funds can be used for a variety of purposes, including debt consolidation, payroll, inventory purchases, or marketing initiatives.

- Quick Access to Funds

- Asset refinancing often has faster approval and funding processes compared to traditional loans.

Challenges of Asset Refinancing

- Asset Depreciation

- The value of the asset may decline over time due to depreciation, which can affect loan terms and refinancing potential.

- Risk of Repossession

- If the business defaults on the loan, the lender may seize the asset.

- Valuation Limitations

- The amount of financing is limited to a percentage of the asset’s current value, which may not meet the business’s full funding needs.

- Fees and Costs

- Appraisal fees, administrative charges, and interest can increase the overall cost of financing.

When to Consider Asset Refinancing

- Boosting Liquidity

- Address short-term cash flow gaps or fund urgent expenses.

- Debt Consolidation

- Simplify and reduce the cost of existing debt by consolidating it into a single, lower-interest loan.

- Funding Growth

- Invest in new opportunities, such as expanding operations or launching new products.

- Operational Needs

- Cover day-to-day expenses like payroll, inventory purchases, or marketing campaigns.

- Managing Financial Challenges

- Navigate periods of financial difficulty without selling assets.

Industries That Benefit from Asset Refinancing

- Manufacturing

- Unlocks value from machinery and production equipment to invest in upgrades or expansion.

- Construction

- Refines heavy equipment like excavators or cranes to fund new projects or manage cash flow.

- Transportation

- Leverages commercial vehicles to access capital for fleet maintenance or growth.

- Retail and Wholesale

- Uses inventory to secure short-term financing for stock replenishment or operational costs.

- Healthcare

- Refinances medical equipment to fund technology upgrades or expansion initiatives.

Example: Asset Refinancing in Action

Scenario: A mid-sized manufacturing company owns $500,000 worth of machinery and needs $200,000 to fund a large order and manage payroll during a slow season.

Solution: The company refinances its machinery, securing a loan for $200,000 at a favorable interest rate.

Outcome: The funds enable the company to fulfill the order and maintain operations. Once the order is completed and paid, the company repays the loan, ensuring financial stability and customer satisfaction.

How to Choose an Asset Refinancing Provider

- Evaluate Lenders

- Research lenders who specialize in this type of financing and have a proven track record. Shortlist your choice of lenders and research more thoroughly. Check their company websites for service capabilities and examine client reviews to assess customer satisfaction.

- Understand Costs

- Review interest rates, fees, and repayment terms to ensure the loan aligns with your budget.

- Assess Asset Value

- Work with professionals to get an accurate valuation of your assets.

- Read Terms Carefully

- Ensure you fully understand the terms of the loan, including the consequences of default.

- Seek Expert Advice

- Consult with financial advisors to determine if asset refinancing is the right option for your business.

Conclusion

Asset refinancing is a versatile and practical financing option for businesses looking to unlock the value of their assets without sacrificing ownership. Whether managing cash flow, consolidating debt, or funding growth, this solution provides the flexibility and support needed to meet your financial goals.

By partnering with the right lender and using asset refinancing strategically, businesses can navigate financial challenges, capitalize on opportunities, and pave the way for long-term success. If you’re considering asset refinancing, assess your needs, evaluate your assets, and take the first step toward smarter financial management today.

Contact us today to learn about our flexible financing solutions to support companies in overcoming financial challenges and fostering long-term success.

Key Takeaways

- By leveraging the value of existing assets, companies can access the capital they need without selling their property or taking on traditional loans.

- Asset refinancing involves using the value of unencumbered assets as collateral to secure a loan or lease. This financing option allows businesses to unlock cash tied up in their assets while retaining their ownership and use.

- By partnering with the right lender and using asset refinancing strategically, businesses can navigate financial challenges, capitalize on opportunities, and pave the way for long-term success.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.