Like any other business, your trucking company must run at a profit, or it will quickly fail. It sounds like stating the obvious, yet it’s surprising how many operators make the critical mistake of hauling loads without properly considering profit. This is especially true during times of low freight volume when truck company owners are willing to jump on any load to fill empty capacity. To help your trucking company succeed, use a trucking profit calculator to determine the profit and loss of each load before your trucks haul.

Maximizing your fleet’s profitability

Planning for each haul to generate a profit is the ideal, but we don’t live in an ideal world. What’s more critical is ensuring each “round trip” is profitable. Ensure the outbound leg makes money; otherwise, why haul the load? The real challenge is getting your trucks home profitably, or at least without negating the overall profit of the round trip. If you can’t find a profitable load to cover the backhaul, hauling underpaying freight minimizes loss, but this needs to be avoided as best as possible. Use your experience, networking contacts, and resources to hunt down good-paying freight.

Know your costs – use a trucking profit calculator for the outbound and inbound hauls to maximize the profits from a complete round trip.

A golden rule in trucking

To generate profit, trucks need to keep moving with revenue-generating freight, and freight needs to pay for ALL costs associated with the haul plus more. One of the golden rules in trucking is “know your costs before you haul.” This means knowing your cost-per-mile and keeping your rate-per-mile higher. However, competition is fierce – there’s little time to weigh costs against revenue before accepting a load, as your competition may quickly seize the opportunity. eCapital helps solve this dilemma with a simple-to-use trucking profit calculator that can quickly assess cost vs. revenue.

Whether taking loads off a load board, accepting freight from a broker, or negotiating a new contract, use the trucking profit calculator before committing to a haul.

How to use a trucking profit calculator

Using a trucking profit calculator is fast and simple. Here’s how it works:

- Enter the dollar amount of revenue to be earned by hauling a load.

- Enter the loaded and empty miles associated with the haul.

- Enter your trucking company’s unique cost-per-mile rate.

The trucking profit calculator instantly displays an output showing the dollar amount representing a profit or loss.

Keep Moving with Freight

There are almost 3 million tractor-trailer rigs on the roads and highways of this country, all looking for freight to haul. At times, such as during the post-pandemic spot market boom, finding freight was so easy you could name your rate – but that was then, and this is now! In today’s market, trucking company owners must search every avenue available to move outbound freight and fill backhaul capacity.

Knowing how to find freight is typically the first big test for startups, challenges companies that just lost a dedicated lane, and is essential for carriers to fill their backhauls. For most, the answer is load boards, the online mecca for available freight. However, be careful, know your cost-per-mile, and use the trucking profit calculator before committing to a load.

Load boards are busy marketplaces where you must act quickly to secure freight or lose it to a competitor. It is a place where you need to know your numbers, otherwise you roll the dice every time you book a load. Don’t gamble with your business – use a trucking profit calculator to ensure a load is worth hauling.

Example: A load from Los Angeles to Detroit is posted online for $4,618.

That’s a big bite of revenue…do you take it? If you hesitate, it’ll disappear off the load board and end up on someone else’s rig. If you take it, it may lose you more money than it’s worth.

How many loaded miles is that? How many deadhead miles? How does that translate to rate-per-mile? That’s a lot of questions to be answered quickly before the opportunity disappears off the load board. To make a profitable decision, you must use a trucking profit calculator to make fast and accurate calculations before acting.

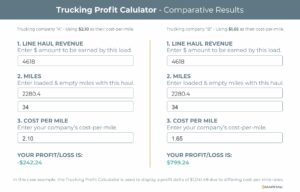

eCapital’s trucking profit calculator is fast and simple to use, allowing you to assess the opportunity quickly. The following graphic illustrates the trucking profit calculator’s ability to instantly display outcomes. In this case example, the profit/loss results between two trucking companies chasing the same freight but with two different cost-per-mile rates are compared.

Lowering cost-per-mile is key to profitability

Lowering your trucking company’s cost-per-mile is one of the most effective ways to outpace your competition, secure more freight, and show profit at the end of the month. Reducing your company’s running costs and fixed costs involves considerable effort and commitment, but the results significantly impact trucking profit calculator output as margins increase.

Trucking companies can use a number of tactics and strategies to lower costs. The type and age of the equipment you run, the technologies you engage, and the fuel-saving strategy you follow are all part of a 3-dimensional puzzle to save costs.

However, each change you make impacts other areas of the business. To solve the puzzle, you need to create a series of “what if” scenarios and use the trucking profit calculator to determine how the end result of each change impacts your profitability. For instance:

- What if you upgrade to late-model equipment and add tire pressure monitoring; what effect will it have on fuel, tire and maintenance costs?

- What if you use a fuel card program to save 12 cents a gallon? How much will I save in a month?

To calculate these changes and gauge the overall cost effect, companies need to compute what their cost-per-mile will be with each change. To do this, use a cost-per-mile calculator and input your trucking company’s fixed costs and variable costs. Use the data from your company’s accounting books and tax preparation reports to enter the data. The calculator instantly computes the data and outputs an “all-in” cost-per-mile (CPM) unique to your business. Knowing this cost, is the only way to set a freight rate that will generate enough revenue to pay expenses and generate a profit.

Profit is Good, But What About Cash Flow?

Profit is good, but it can’t be realized without proper cash flow. More than 80% of small business failures are due to cash flow problems. Trucking companies are particularly challenged by a lack of funds as customers are typically slow to pay, and banks are reluctant to support the industry. To solve this particular issue, many trucking companies depend on freight factoring to solve the cash flow dilemma.

Conclusion

The trucking industry requires careful financial management to ensure profitability, especially during periods of low freight volume. Utilizing a trucking profit calculator is essential for assessing the bottom line result of each load before you haul.

Trucking companies should seek freight through all possible avenues, including load boards and brokers. Be prepared to make swift decisions or risk losing the freight to a competitor. That being said, ensure loads are profitable before you haul to avoid month-end frustration at bottom-line results. Make all efforts to lower running and fixed costs, and use the trucking profit calculator regularly to verify profitability before you haul.

Additionally, maintaining healthy cash flow is vital, as many small trucking businesses face challenges with timely payments. To address cash flow issues, freight factoring has become a popular solution, allowing companies to manage expenses effectively while ensuring they remain competitive in a demanding market.

Contact us to learn more about helpful resources, such as eCapital’s break even, cost-per-mile, and trucking profit calculators, plus freight factoring, to ensure effective cash flow management and to be profitable.

Key Takeaways

- Truck company owners must search every avenue available to move outbound freight and fill backhaul capacity.

- Often, there’s little time to weigh costs against revenue before accepting a load, as your competition may quickly seize the opportunity.

- Don’t gamble with your business – use a trucking profit calculator to quickly ensure a load is worth hauling.

- eCapital’s trucking profit calculator instantly computes all costs associated with the haul to display a profit or loss result. This information is critical to aid the decision to accept or pass on a load.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.