FREIGHT BROKER FINANCING

Flexible financing that grows with your freight brokerage

From carrier payments to back-office support, our freight broker financing helps you streamline operations, build carrier trust, and keep freight moving.

From carrier payments to back-office support, our freight broker financing helps you streamline operations, build carrier trust, and keep freight moving.

eCapital gives brokers the financial freedom to grow with access to fast and reliable cashflow. We manage carrier payments, and collections so you can focus on booking more loads, strengthening relationships, and growing your brokerage.

Pay carriers in days, not weeks, while waiting on shipper payments that may take 30–60 days or more.

Offer quick pay options without using your own capital—improving reliability and load coverage.

Whether you’re booking 50 loads a week or 500, eCapital gives you the flexibility to grow without cash flow holding you back.

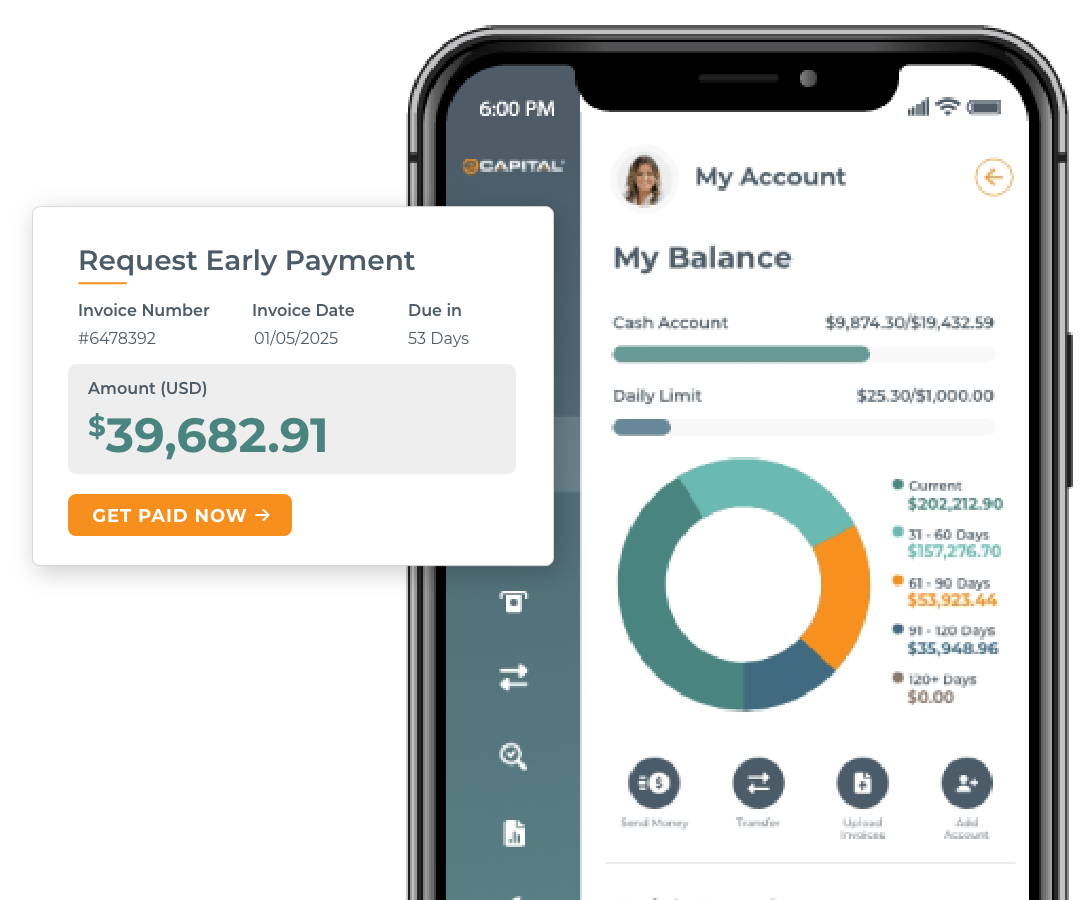

Manage your cash flow and simplify operations with technology built for the pace of trucking. The eCapital platform and mobile app make it easy to submit invoices, track payments, and access funds – anytime, anywhere. Get real-time insights, faster funding, and the tools you need to keep your business running smoothly.

A freight brokerage managing dozens of active carriers is struggling to retain trusted partners due to delayed shipper payments.

Shippers are taking 45–60 days to pay, but carriers need funds within a week. Delayed payments causes frustration and attrition among top-performing carriers.

eCapital implements a quick pay program that advances funds on approved invoices, enabling the broker to pay carriers within 24–48 hours. The solution improves carrier loyalty, reduces churn, and helps the brokerage secure more capacity during peak periods.

A fast-growing freight brokerage lands a new high-volume shipper but lacks the working capital to handle the increased carrier payments.

The business risks turning down a major growth opportunity due to cash flow constraints caused by long payment cycles.

Using confidential sales ledger financing, eCapital advances funds against approved receivables without alerting the shipper. This allows the broker to take on the new volume without disrupting cash flow or relying on a traditional line of credit.

A mid-sized broker experiences erratic shipper payment cycles, leading to unpredictable cash flow and difficulty in planning operational expenses.

Without steady income, the business struggles to meet overhead costs and maintain payroll, especially during slow weeks.

eCapital provides an asset-based lending facility tied to the company’s receivables. This gives the broker a revolving line of credit with predictable access to working capital—even when shippers pay late.

A newly licensed freight brokerage needs to establish carrier trust and build volume but has limited liquidity and no lending history.

Traditional financing is not available due to lack of operating history, and slow shipper payments create a bottleneck for growth.

eCapital offers freight factoring with a non-recourse structure, allowing the brokerage to offer fast, guaranteed payments to carriers. This builds credibility quickly, supports early growth, and enables the founder to scale with confidence.

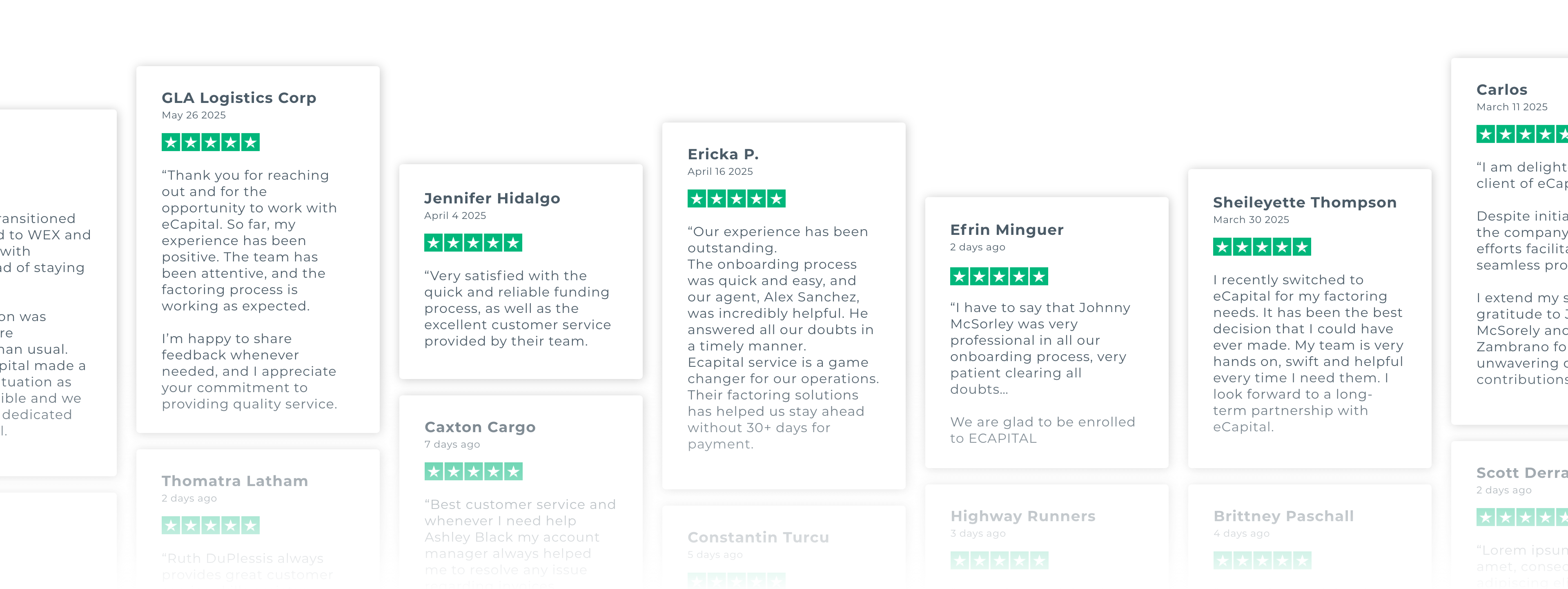

For over 18 years eCapital, a freight factoring company, has helped more than 30,000 businesses grow. We want to do the same for you. Take a look at the latest reviews from our customers.

Freight factoring bridges your cash flow gap by paying carriers and broker fees fast—without waiting weeks for shippers to pay. You submit your invoices and documents, and eCapital handles billing, collections, and payouts, keeping your brokerage running smoothly.

With eCapital, carrier payments can be made as quickly as within 1 to 5 days, or faster through Quick Pay options. This speed helps you build stronger relationships and retain more dependable carriers.

eCapital handles your entire billing and collections process—so you don’t have to chase payments or manage accounts payable. Plus, you get access to digital tools like load tracking, credit checks, and invoice management.

Yes, freight brokers can use factoring companies to improve cash flow and keep operations running smoothly. Factoring allows a broker to receive immediate payment on unpaid invoices by selling them to a factoring partner. Instead of waiting 30 to 60 days for shippers to pay, brokers can access funds quickly and use that capital to pay carriers, cover expenses, or invest in business growth.

By delivering faster payment options and fuel advances, factoring enables your brokerage to attract top carriers and offer more favorable terms—giving you a competitive edge when carriers choose who to haul for.

Absolutely. eCapital’s factoring solution scales with your business—from emerging brokerages to high-volume intermediaries. As your deals increase, available funding grows with you.

As part of our freight broker factoring solution, you get a full technology suite: mobile and online portals, unlimited free credit checks, load management tools, fuel programs, and a dedicated account manager to support you around the clock.

eCapital offers deep transportation expertise, flexible, tailored cash-flow solutions, and a friction-free funding process. Our platform improves your brokerage’s reputation among carriers and shippers—while giving you more time to focus on growth.