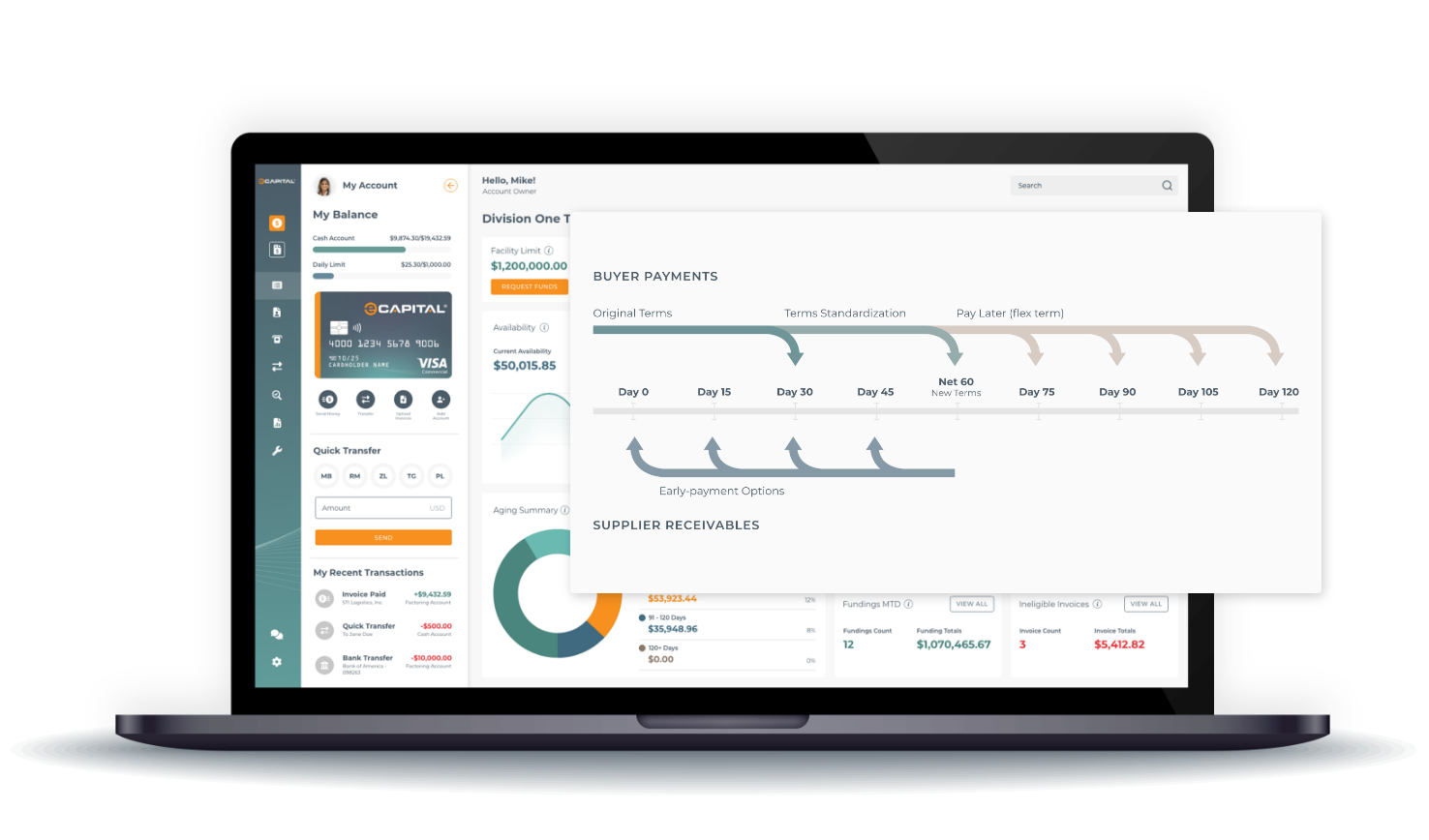

eCapital FastTrack is the only supply chain finance platform that seamlessly combines both accounts payable and accounts receivable funding into one simple, easy-to-use interface.

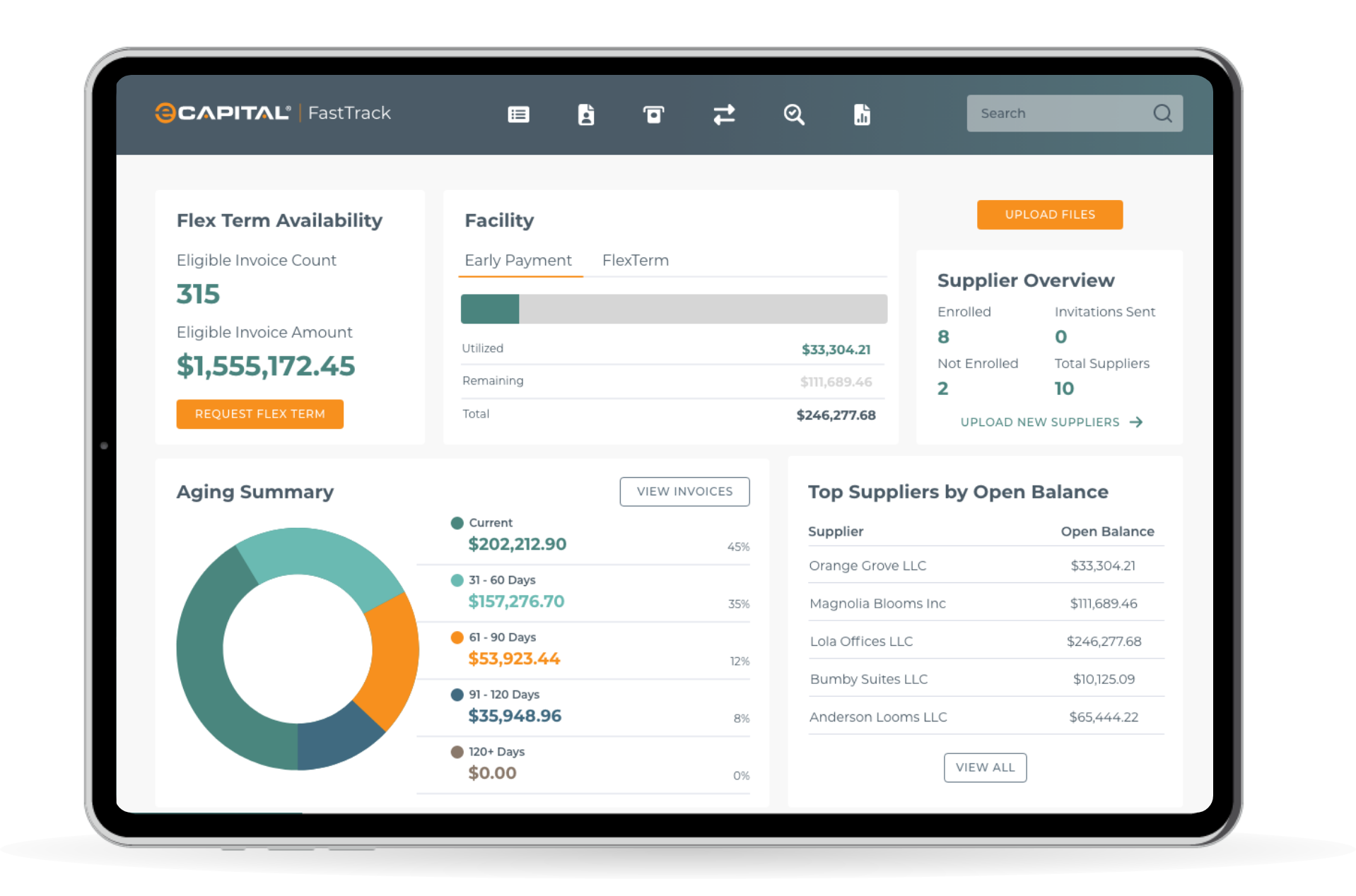

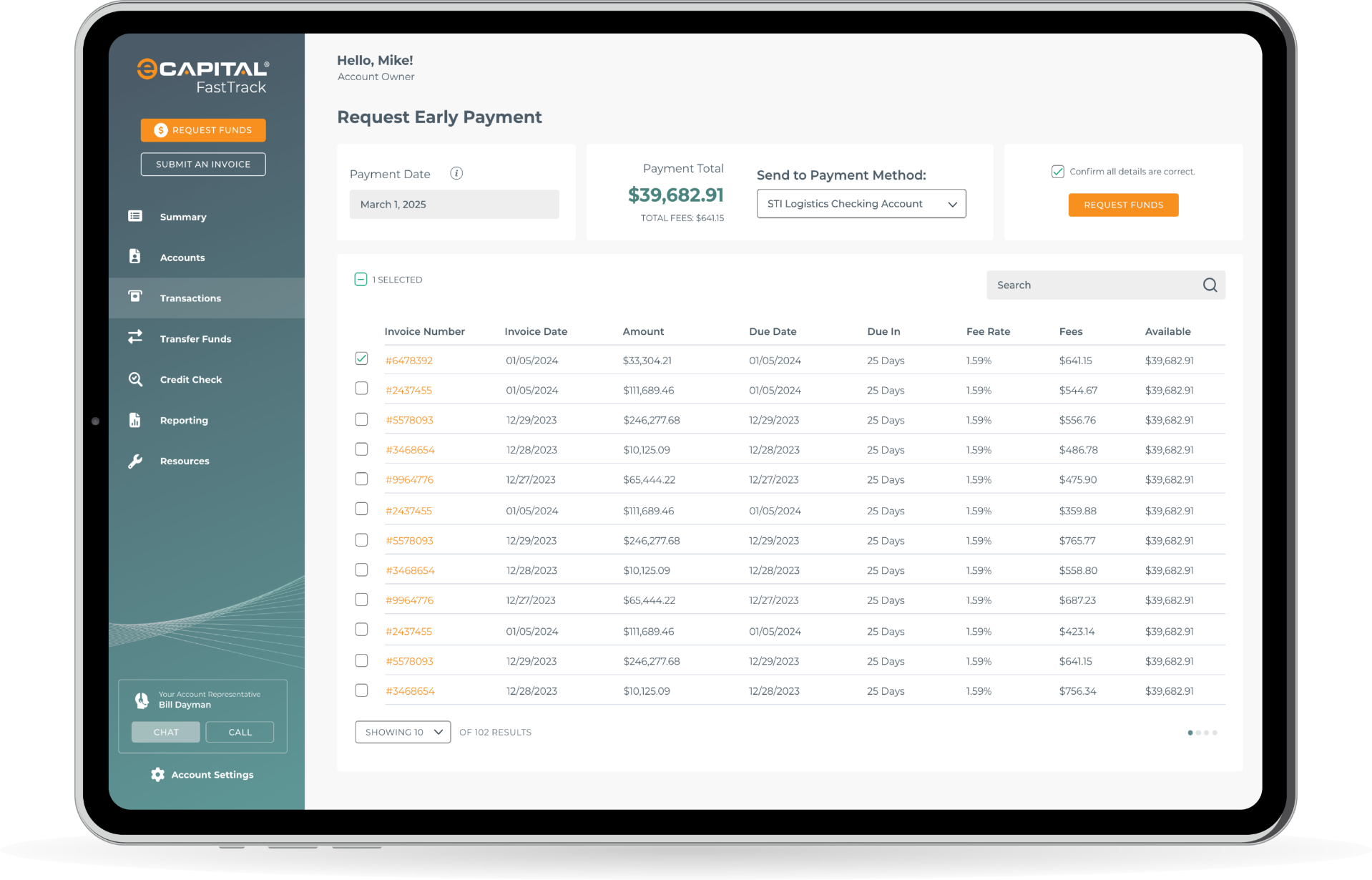

Designed to meet the dynamic needs of growing businesses, FastTrack empowers clients to accelerate incoming cash flow, extend payment terms to suppliers, and optimize working capital—all from a centralized, intuitive platform.

With real-time visibility, flexible funding options, and automated transaction management, FastTrack streamlines the entire finance workflow—helping businesses improve liquidity, strengthen supply chain relationships, and scale with confidence.