IN-TRANSIT FINANCING

On-demand financing while your inventory is in motion

Seamless in-transit financing solutions designed to optimize cash flow, reduce delays, and keep your supply chain moving efficiently from start to finish.

Seamless in-transit financing solutions designed to optimize cash flow, reduce delays, and keep your supply chain moving efficiently from start to finish.

Built for businesses managing complex logistics and shifting timelines, this financing solution unlocks capital tied up in goods while they’re in transit—keeping your cash flow steady and your supply chain moving from origin to destination.

Access working capital tied up in inventory that’s in transit—no need to wait for delivery or sale to fund operations and growth.

Bridge long lead times and global shipping delays with financing that keeps your supply chain moving and your cash position strong.

Manage cash flow more predictably across borders and timelines with financing tailored to your supply chain cycle

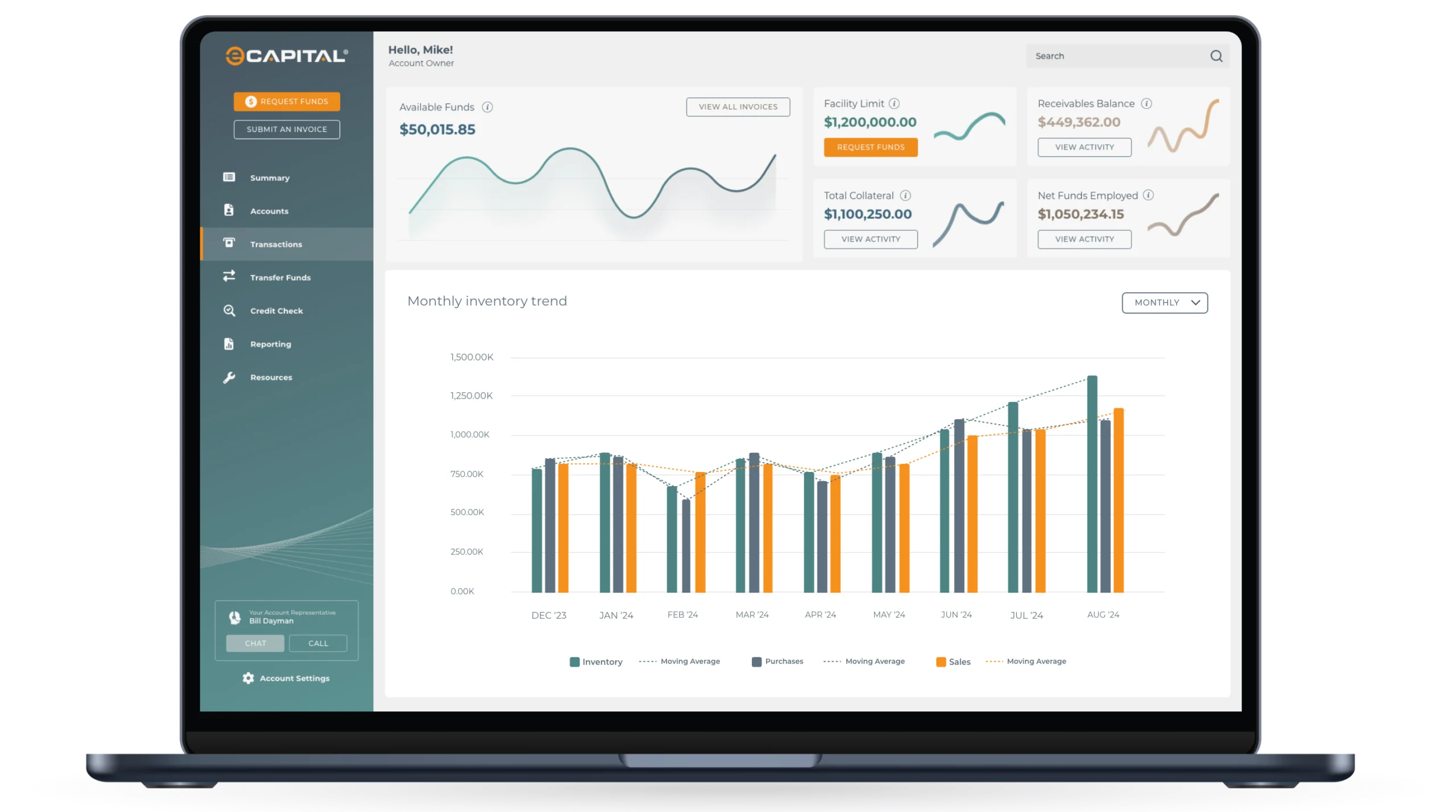

Clients choose eCapital when they need an engaged, solutions-oriented, long-term credit partner with proven capacity, creativity, and continuity. Our expertise is customization—whether on a $5 million or $150 million facility, employing a meticulous, hands-on strategies.

Our tight-knit group of financing experts are agile and client-centric, yet backed by extensive resources with the scale to conquer any challenge. This means we are going to be a better credit partner through every business cycle, bringing capabilities and passion—as patient, flexible problem-solvers—other providers simply do not have. Our track record speaks for itself.

"*" indicates required fields

In-transit financing is a working capital solution that provides funding based on the value of goods currently being shipped. It allows businesses to access capital before inventory is received—bridging the gap between production and delivery.

A lender advances funds against goods that are in motion, using documentation such as purchase orders, invoices, or bills of lading. Once the goods are delivered or sold, the financing is repaid, often from sales proceeds or an ongoing credit facility.

This solution is ideal for importers, exporters, manufacturers, distributors, and wholesalers—particularly those with global or long-lead-time supply chains. It’s commonly used in industries like retail, consumer goods, automotive, and electronics.

Improves cash flow while goods are en route

Reduces strain from long shipping or production cycles

Allows for earlier supplier payments or bulk purchases

Supports seasonal builds and just-in-time inventory strategies

Helps avoid delays in fulfillment or production due to cash constraints

Typically required documentation includes purchase orders, bills of lading, supplier invoices, and shipping details. Some lenders may also require proof of insurance or contracts with end buyers.

Not exactly. Purchase order financing provides capital based on confirmed customer orders (usually before production), while in-transit financing applies once the goods are in shipment. They can be used together as part of a supply chain finance strategy.

In-transit financing can also be referred to as:

Goods-in-Transit Financing

Transit Inventory Financing

Supply Chain Shipment Financing

Logistics-Based Financing

In-Motion Working Capital

Pre-Inventory Financing