Modern tools built for today’s financial demands

At eCapital, we know that managing cash flow efficiently is critical to success. For over 19 years, we’ve been advancing the most innovative financing platform that accelerates access to working capital, helping businesses optimize their cash cycles and fuel growth with confidence.

One platform for every specialty financing need

Manage working capital, supply chain finance, asset-based lending, and more—all through a single, powerful platform built to scale with your business.

Technology that grows with your business

We continuously enhance our platform to give you the innovative tools you need to navigate every stage of your business with confidence.

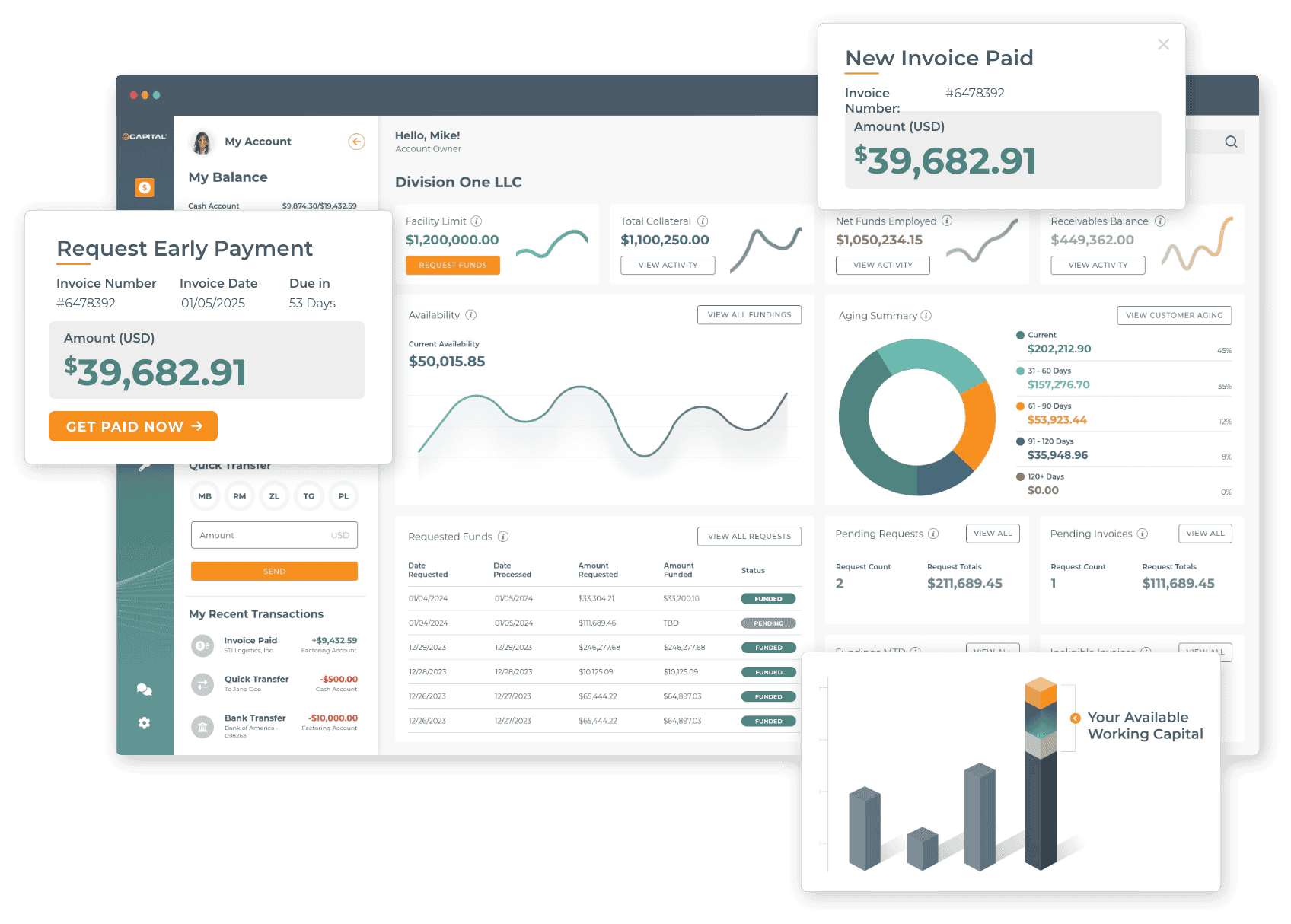

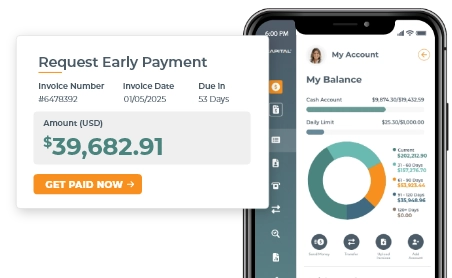

24/7 access to manage finances, anytime, anywhere

Our clients have 24/7 control to quickly transfer funds to their traditional bank account or third parties.

FINANCING WORKSPACES

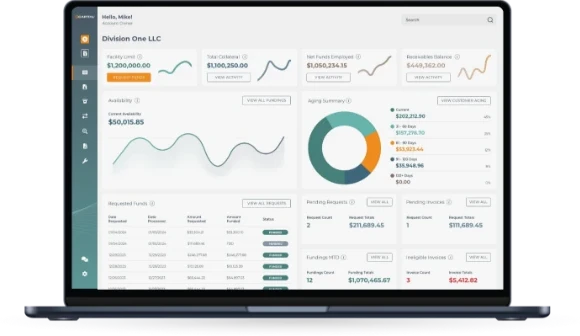

A modern financing platform that scales with your industry, your growth, and your financial goals

Seamless access to capital backed by your assets

Unlock working capital with a streamlined, tech-enabled asset-based lending experience built for growing businesses. Our platform leverages your receivables, inventory, and equipment to deliver the liquidity you need—quickly, securely, and on your terms.

- Instantly monitor your borrowing base and available credit

- Access funding tied to receivables, inventory, or equipment

- Move funds on your schedule—day or night

- Automate draw requests and eliminate paperwork

- Track account balances, advance rates, and collateral in real time

- Stay in control with intuitive dashboards and reporting

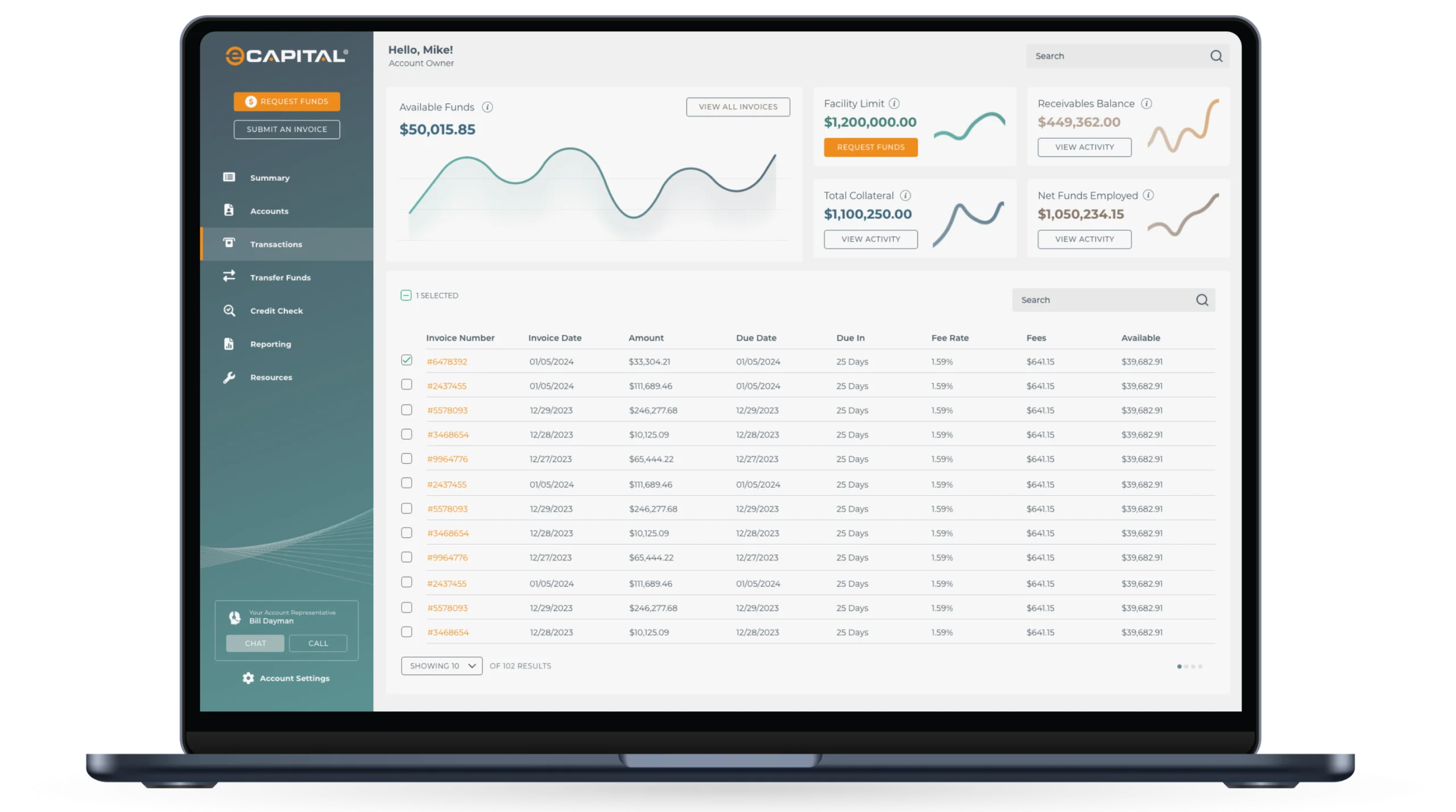

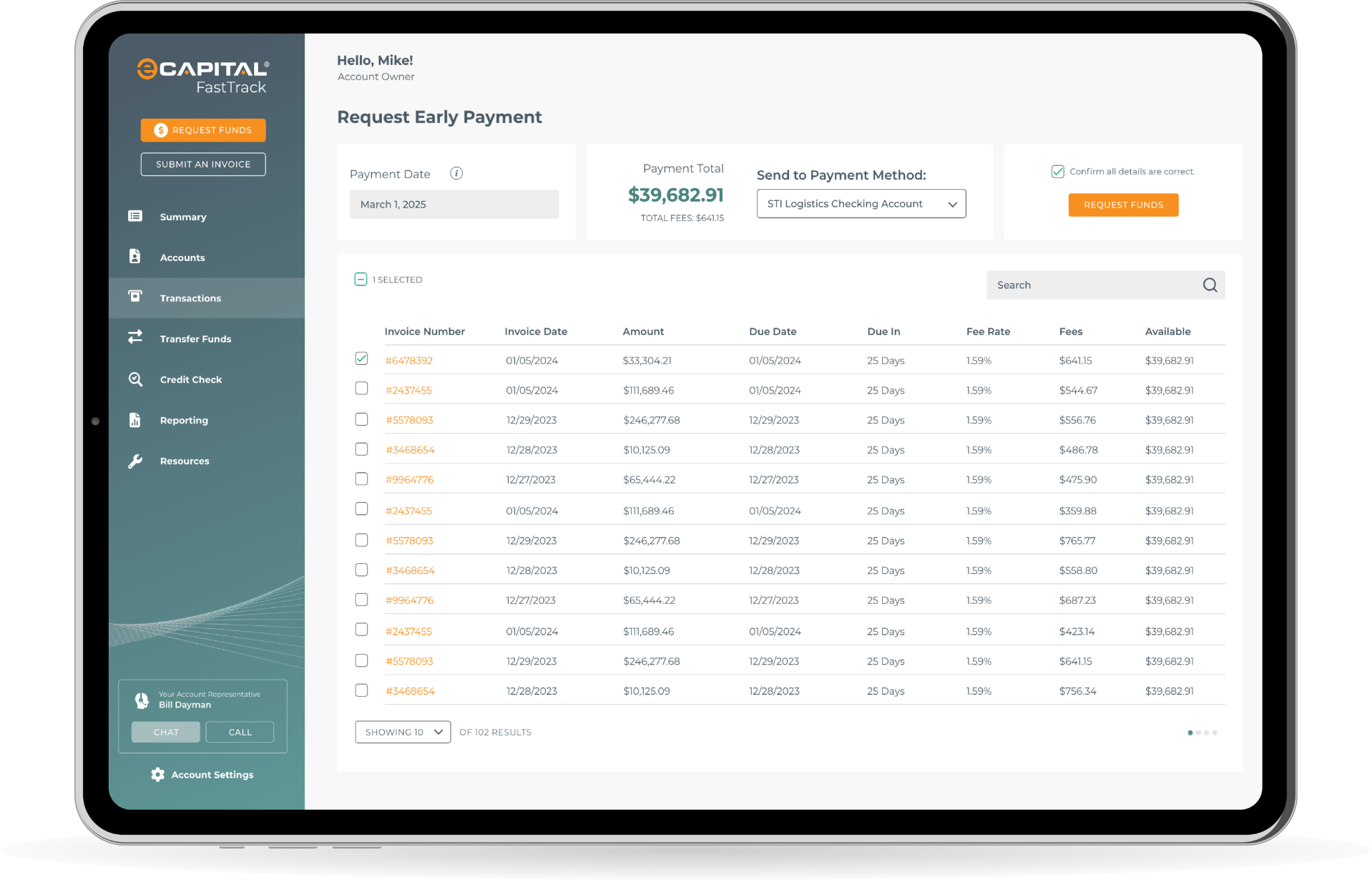

Effortless invoice financing always at your fingertips

Gain instant access to working capital with a frictionless, technology-driven experience designed for speed and efficiency. Our intuitive platform streamlines invoice financing, giving you real-time insights, automated approvals, and faster funding so you can keep operations running smoothly.

- Instantly upload invoices from your phone for fast funding.

- Request payments in as little as 1 hour or the same day.

- Move funds on your schedule, 24/7.

- Transfer money effortlessly to 3rd parties with just a few taps.

- Access Visa commercial cards and set smart spending limits.

- Track invoices, funding status, and aging reports in one place.

Streamlined supply chain funding at your command

Bridge the gap between payables and receivables with a technology-driven supply chain finance experience that strengthens supplier relationships and preserves your working capital. Our platform makes it easy to extend payment terms while giving suppliers the option to get paid early—without disrupting your cash flow.

- Initiate early payments to suppliers through a few simple clicks

- Extend payment terms without compromising supplier liquidity

- Track approved invoices, payments, and settlements in real time

- Automate approvals and streamline reconciliation

- Improve Days Payable Outstanding (DPO) without increasing risk

- Access real-time insights across your entire supplier network

OUR TECHNOLOGY

Shaping the future of specialty finance

At eCapital, we built a platform with AI and machine learning (ML) at the core—giving you the speed, flexibility, and intelligence to thrive in a changing world. Our technology adapts in real time, improving access to working capital, reducing manual bottlenecks, and helping you make smarter financial decisions faster.

- Real-time funding decisions powered by AI, accelerating access to capital when you need it most.

- Dynamic credit management that adjusts to the performance of your business—not static underwriting rules.

- Predictive insights that help identify future working capital needs before challenges arise, keeping your operations resilient.