MAXIMIZE YOUR WORKING CAPITAL WITH HELP FROM THE FLEET FINANCE EXPERTS

Get quick access the funds you need to fuel growth, recover or seize opportunities, backed by the expertise and guidance of industry-leading professionals.

Get quick access the funds you need to fuel growth, recover or seize opportunities, backed by the expertise and guidance of industry-leading professionals.

For over 17 years, we’ve been dedicated to revolutionizing the way transportation companies manage their cash flow. At eCapital, we specialize in providing fleet owners of all sizes with incredible financing solutions to access immediate working capital. With our cutting-edge finance management tools and industry expertise, trucking companies can finally get access to the funds they need to fuel growth, recover or seize opportunities.

Experience the unmatched convenience, flexibility, and personalized service that eCapital offers, allowing you to focus on what matters most: optimizing your fleet’s performance, delivering exceptional service to your clients, and propelling your success to new heights.

There is hidden value in the assets of your transportation business. Our customized mix of financing solutions can help you access that value, fast, offering you more working capital, improved cash flow management and true scalability.

When you work with eCapital, our dedicated team of decision makers use their expertise to solve your problems fast, getting you the quick funding you need to optimize financial performance, drive growth, and achieve long-term success in a highly competitive market.

Our team of experts, with extensive knowledge of the transportation industry, are laser-focused on listening to your situation and bringing valuable financing expertise and insights to the table to get your business the most money.

We understand the unique challenges, regulations, and trends trucking companies face each day, and offer customized financing advice, solutions and support specifically designed to address the needs of fleet owners.

Improve your business operations by partnering with a financing provider who understands the unique needs of fleets in the freight industry and can provide a creative mix of solutions to improve your bottom line.

Our revolutionary, bundled approach offers numerous advantages, such as immediate access to cash via modern factoring, cost-effective fuel savings and a range of business management tools designed specifically to enable the operational success of trucking companies. Additionally, we offer asset-based solutions that support your plans for business expansion or recovery.

Whether you’re expanding your fleet or rebuilding after setbacks, we offer customized financing solutions that align with your goals. With our expertise and tailor-made solutions, you can access the funding and support necessary to optimize your operations, upgrade your equipment, and stay ahead of the competition. Don’t let financial constraints hold you back – embrace the power of our creative financing solutions to propel your business towards success.

Whether you’re going through a period of growth or need some leveraging during a turnaround scenario, eCapital can help with our various financing solutions. Here’s an example of a few clients we’ve helped:

OVERVIEW

Financial solutions rescue a struggling refrigeration trucking operation, steering it away from bankruptcy and propelling it toward rapid growth within a challenging market.

PROBLEM

A refrigerated trucking operation encountered significant cash flow challenges stemming from poor market conditions and the implementation of net-90+ terms by several carriers. These factors strained their finances, pushing the business to the brink of bankruptcy. Despite exhausting available options, their bank refused to provide additional working capital, worsening the situation. With just a two-week window remaining, action was required to salvage the business and chart a path toward sustainable growth.

SOLUTION

In response to the imminent bankruptcy threat, we moved quickly to onboard the three-truck operation within two weeks. We provided significant working capital and advanced technology solutions, resolving the cash flow issues. With improved creditworthiness, the operation accessed more working capital, leading to the acquisition of eight new refrigerated trailers and the ability to attract experienced drivers. The integration of our technology, particularly the eCapital Connect™ platform, empowered the operation to manage its finances independently and thrive in the challenging market. Within 6 months, this business moved from a three-truck operation to an 11-truck powerhouse in the refrigerated trucking space.

OVERVIEW

Switching financing companies helps a fleet increase the speed at which they’re able to factor their receivables to fuel growth.

PROBLEM

A standard shipping transporter based in Texas had been hauling across 32 states with a fleet of over 125 vehicles for many years. However, they were dissatisfied with the level of service provided by their previous factoring provider. They knew it was time for a change but hesitated due to the size and complexity of their business. The thought of switching providers overwhelmed them, as they feared it would be too difficult and could disrupt their operations.

SOLUTION

Considering the scale and intricacy of their operations, we took the time to truly understand their business. We stepped in and crafted a tailor-made program specifically designed for their unique situation. Our team of transportation industry experts effortlessly guided them through the entire transition process, from facilitating the buyout to seamlessly switching them over to our proprietary account management software. Because of our custom approach and unwavering support, we were able to transform their factoring experience, setting them up for success in the transportation industry.

OVERVIEW

Equipment refinancing helps a fleet of Chassis trailers get the cash needed for important growth.

PROBLEM

Having reached the max in facility size at their current factoring company, this Chicago-based trucking company’s growth trajectory had stalled. As a fleet of 200 trailers, 180 were owned outright, leaving 20 brand new trailers under bank loans. The trucking company was experiencing extreme cash strain. They needed more cash to not only keep the business running but position them to meet their business goals that year.

SOLUTION

This trucking company reached out to eCapital, who reviewed the business statements and helped them understand their options. We first extended the fleet’s facility limit to accommodate the company’s growth in A/R. We then were able to refinance the debt owed on the remaining 20 trailers in the fleet, which provided the company with the immediate cash needed for their business. In refinancing the existing equipment, the fleet was able to reinvest in their business and regain competitive advantage in the market.

Every business has resources that can be leveraged to create working capital. Through our growing suite of financing products, we can provide the right solution to meet your capital needs head on.

Get access to revolving funds to support your business goals.

LEARN MORE

Overlay Link

eCapital is an award-winning, industry-leader in the transportation industry. Here are a few more reasons why businesses choose eCapital as their transportation finance partner:

We offer a number of specialty financing solutions for our fleet clients such as: confidential, non-notification factoring and bulk factoring.

We’re ready and able to provide the funding your business needs now and into the future. As your business grows, so does the financing available to you.

We make life for our fleet clients easier by providing a variety of integration options to our cutting-edge platform, from .csv uploads to TMS API connections.

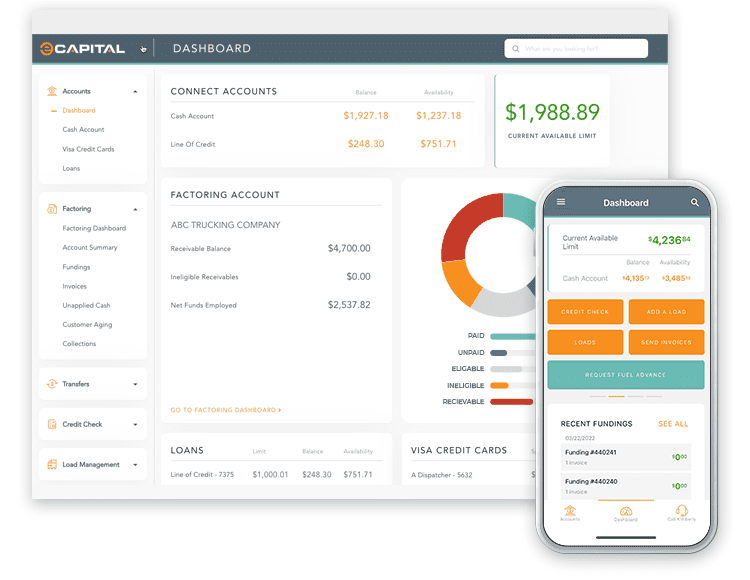

Manage your money your way. With eCapital Connect, our proprietary account management software, you are in control of your finances at anytime, day or night.

Upon first consultation, your fleet gets immediate access to a dedicated team of experts to help get the most out of your financials.

Our rates are the most competitive in the industry. We know what it takes to maximize your working capital and will customize a solution to meet your needs.

eCapital Connect for fleets is your one-stop shop for account management and now you have even more control over your funds:

For over 17 years, we have helped more than 22,000 transportation companies grow their businesses. We want to do the same for you. Take a look at the latest reviews from our trucking customers on TrustPilot!

Financing a fleet typically involves a combination of capital investment, loans, leasing, or specialized financing options. Here are some common methods for financing a fleet:

When considering fleet financing options, it is important for fleet owners to carefully evaluate their business’s financial situation, goals, and needs. Consulting with financial advisors or experts in fleet financing can provide valuable insights and help identify the most suitable financing method for their specific circumstances.

Fleet financing refers to the financial arrangements and methods used to acquire and manage a fleet of vehicles or equipment for commercial purposes. It involves securing the necessary capital to purchase or lease a fleet and managing the associated financial aspects throughout the fleet’s lifecycle. Fleet financing is commonly used by businesses that rely on transportation, such as logistics companies, delivery services, trucking companies, and rental car agencies.

Fleet financing can encompass various financial options and strategies.

Factoring for fleets can be a beneficial financing option for many fleet businesses, depending on their specific circumstances and needs. Here are some factors to consider when evaluating if factoring is a good idea for your fleet:

However, it’s important to carefully evaluate the terms, fees, and conditions associated with factoring agreements. Consulting with our financial advisors or factoring specialists can provide valuable insights and help determine if factoring is a good idea for your fleet.

Equipment refinancing is a type of asset-based lending where the equipment serves as collateral for the loan. The purpose of refinancing is typically to obtain a significant injection of working capital or to restructure debt. Refinancing can be used to fund growth, support a turn around strategy, or consolidate multiple loans, making it easier to manage debt more efficiently and improve financial stability.

Equipment financing is a type of business financing used to acquire equipment (new or used) needed for the operation of a business. This financing is typically used when a business needs to acquire equipment but does not have the funds to purchase it outright. The lender will provide funds to purchase the equipment and the business will make regular payments (including interest) over the term of the loan until the equipment is fully paid off.

Asset-based lending can be a valuable financing option for fleets, providing several benefits and support to fleet businesses. Here’s how asset-based lending can help fleets:

It’s important for fleet businesses to carefully evaluate the terms, fees, and conditions associated with asset-based lending agreements. Each fleet’s specific financial situation and asset value should be considered, and consulting with our financial advisors in fleet financing can help assess the viability and suitability of asset-based lending for a particular fleet.