Taking out a loan or line of credit for your business required commitments, not just for the you, but for the lender as well. For this reason, lenders impose covenants to control borrower actions, and require regular reporting to monitor the ability of the borrower to repay the debt. If, at any time during the loan, your lender becomes uneasy about your business’s financial situation, they may take action to reduce the risk of default.

Their first action is often to issue a forbearance letter. This is usually the first communication you’ll receive from a lender that expresses their concern about your ability to repay a loan or a line of credit. Although it is not a reason to panic, it is a serious indication that your business financing is in jeopardy of being recalled. Immediate action on your part is required.

Knowing how to manage this event is critical to the financial stability of your business. Learn what a forbearance letter is, what it means for your business, and actions you should take if you receive one.

What is a forbearance letter?

The word “forbear” means “to refrain from doing something”, which is exactly what the lender is doing. A forbearance letter is the lender’s way of saying:

“We will refrain from demanding immediate repayment of the loan, or seizing pledged collateral to satisfy the loan, if you agree to the following additional terms and conditions.”

Let’s look more closely at each of the powerful phrases in this simple message to clearly understand their meaning and consequences.

- We will refrain from demanding: This refers to the lender’s willingness to NOT demand either of two actions that they can enact at any time of their choosing – immediate payment and seizing pledged collateral, as long as you agree to additional terms in the letter.

- Immediate repayment of the loan: If invoked, this would mean you’d be given 10 days to repay the loan!

- Seizing pledged collateral: In this case, if invoked, your security assets would be effectively liquidated, and the proceeds will be contributed to the balance owed.

- To satisfy the loan: The lender has the right to pursue legal proceedings to impose further actions needed to satisfy the loans full repayment.

- If you agree to the following additional terms and conditions: The letter is actually part of a forbearance agreement. This agreement will clearly define additional terms and conditions that must be agreed to and complied with by you, for the lender to refrain from recalling the loan. While each forbearance agreement is different, several terms and conditions are common. These include the following:

- Decreased funding. If you have a line of credit, your lender may reduce your available credit limit or freeze future credit increases until the issues raised by the lender are addressed.

- Request for additional information. Your lender may request additional reports and collateral, in addition to what is already included in the original loan agreement.

- Additional fees. Your lender may charge you extra fees for spending additional time to monitor your financing performance. Some of these fees may need to be paid up front, while others may be paid monthly.

What does this mean to your business?

In short, a forbearance letter is part of a new lending agreement. The goal of a forbearance agreement is not to forgive or cancel the debt, but rather to provide temporary breathing room to help the business get their finances back in order and restore lender confidence. If the lender continues to have concerns, they may act at any time with a demand notice. Either way, the borrower still remains responsible for paying the debt in full – it just becomes a question of if you have to repay it now (immediately) or if you can continue to pay it out over the remainder of the term.

What you need to do first

The first action item in this case is for you to fully grasp exactly what the letter is telling you. To do this, it is highly recommended that you consult with an independent legal advisor to ensure complete comprehension. Start by understanding the problem.

There are several reasons why you may receive a forbearance letter, so start by determining the details of your situation:

- Non-adherence of repayment schedule. The most obvious reason you would receive a forbearance letter is that you’re not making on time payments, or if you defer or alter one or more payments.

- Violating loan covenants. Loan covenants are additional terms and conditions of a loan agreement to define what the borrower must do and cannot do. Lenders monitor covenants regularly to ensure the borrower remains creditworthy throughout the loan period. Violating covenants could trigger an immediate issuance of a forbearance letter and agreement. Banks include covenants in loan agreements to help ensure the loan will be repaid by the borrower.

- Missed reporting requirements. A lender may require you to submit various types of reports on a monthly, quarterly, or annual basis. Common reports include complied financial statements, audited financial statements, tax returns and other corporate filings. Failing to adhere to reporting schedules, or providing inadequate reports are also triggers for a lender to issue a forbearance agreement.

- Change in your business’s financial performance. You don’t need to have missed a payment, violated a covenant, or overlooked a reporting requirement for a lender to send a forbearance letter. All it takes is for the lender to conclude, in their opinion, that your business’s financial health is trending downward.

What are the next actions to take?

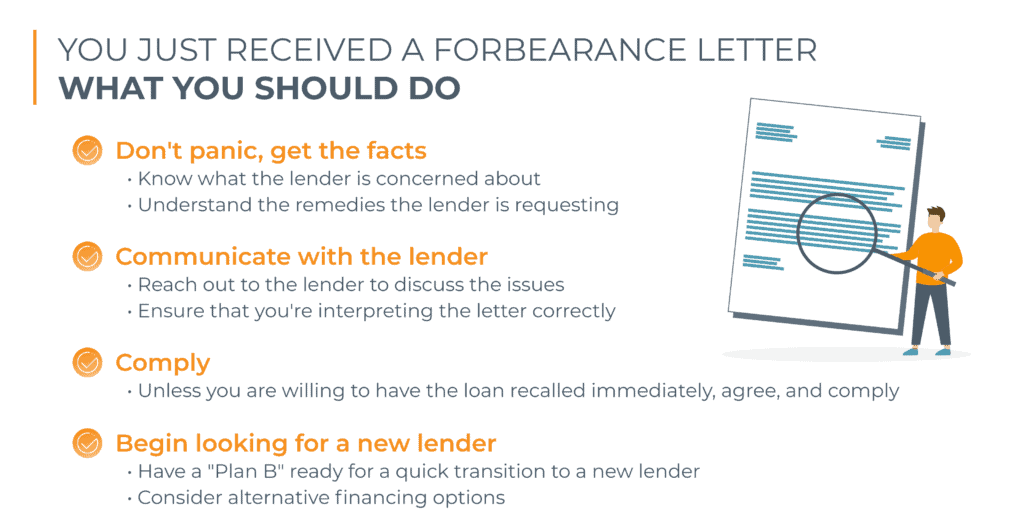

One of the keys in addressing the issue is to keep taking action – don’t become complacent and hope everything works out. Follow these next steps:

- Don’t panic, get the facts. It’s understandable if receiving a forbearance letter causes anxiety. But remember, it is a precursor to a loan recall, not a demand for the loan to be repaid – not yet! Consult with your legal counsel to know exactly what specific condition(s) the lender is concerned about, and the remedies that the lender is requesting.

- Communicate with the lender. You’ll want to consider complying with the forbearance letter as soon as possible. After gaining full understanding of the lender’s concerns and new requirements, reach out to the lender to discuss the issues. Ensure that you’re interpreting the letter correctly and that there are no misunderstandings.

- Comply: Unless you are willing to have the loan recalled immediately, agree, and comply with the new terms and conditions.

- Begin looking for a new lender. Meanwhile, you should immediately begin searching for a new lender, even if it appears that your existing lending relationship is salvageable and will continue.

When the credit market is tight, you should always have a “Plan B” ready in the event that your current source of financing quickly dries up. This is especially true after receiving a forbearance letter from your lender!

Consider alternative forms of financing

If your existing lender has concerns about the current financial health of your business, chances are that other conventional lenders will have the same risk apprehensions. When searching for “Plan B” solutions, consider looking at alternative forms of financing so that you have a workable solution in place in the event that your loan is recalled.

Alternative business financing options, such as invoice factoring and asset-based lending, are relatively easy to qualify for, with fast approvals, onboarding, and funding speeds. These covenant light funding options feature flexible terms that are tailored to meet your company’s needs and ability to pay.

- Invoice factoring This type of financing allows businesses to sell their invoices, or accounts receivable, to a third-party in exchange for a fee. This funding arrangement delivers cash immediately to the business upon selling a product or service. Once an invoice is issued and submitted for financing, funds are transferred within 24 hours instead of waiting several weeks or months for the customer to pay. With instant positive cash flow, business can easily access the working capital needed to support operations, pay bills, and meet financial obligations such as regular loan payments.

- Asset-based lending ABLs are business lines of credit that are secured based on the value of your business assets. Accounts receivable, machinery, equipment, inventory and real estate assets that exist on your balance sheet is capable of yielding a certain amount of cash. For example, your business could borrow up to 90% of their accounts receivable, and 75% on the appraised value of inventory, and M&E..

Conclusion

If a borrower is in financial distress and has defaulted under the terms of a credit agreement, or shows signs of weakening financial performance, the lender may propose a new lending arrangement. A forbearance letter is part of a restructured agreement that acknowledges the lender’s right to enforce upon its security but will hold off for a period from doing so if the lender agrees to meet new terms and conditions.

The purpose of a forbearance agreement is to allow the borrower an opportunity to restructure. It provides additional time for the borrower to try and stabilize its business and regain the lender’s confidence.

For the borrower, it also creates an important window for you to seek alternative business financing (in the event that you are unable to meet the new demands of the lender). Don’t waste this time!

Consult with professional advisors, work to keep the lender satisfied, and reach out immediately to arrange a quick transition to a more flexible alternative lender if and when its needed.

eCapital’s team of industry experts work to thoroughly understand your business before recommending tailored funding solutions to meet your capital requirements. Whether it’s a rapid asset-based line of credit or a strategic long-term financing plan, our skilled, dedicated, and friendly team structures specialized alternative funding that is as unique and distinct as your business.

For more information about how our experienced team supports businesses’ capital requirements through all stages of development, visit eCapital.com.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.