What Every Business Owner Should Know About Credit Utilization

Content

Having access to credit is a lifeline for a business. It provides the capital needed to cover day-to-day expenses, purchase inventory, hire additional staff, and expand as growth opportunities develop. But how a company utilizes credit can significantly impact the business’s overall health and future success.

Underused, taking on credit may slow progress toward strategic goals and allow competition to gain an advantage. Overuse of credit may expose your company to extensive payments and the risk of defaulting on loan obligations.

Learn what every business owner should know about credit utilization to set up long-term stability and success. Discover what credit utilization means, why it’s critical for your business, and how to best manage credit. In addition, learn a different approach to business financing that is less dependent on credit strength and based more on the quality of the company’s collateral assets.

What is credit utilization?

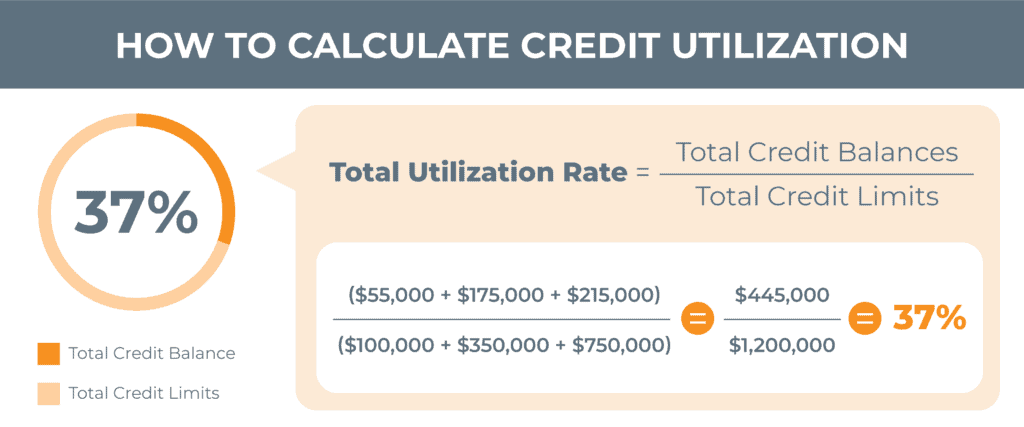

According to FICO, credit utilization is the percentage of the available credit you use compared to your total credit limit. It is calculated as a simple ratio:

Total credit used / Total credit limit = Credit utilization ratio

Let’s look at an example. If your business has used $225,000 of credit with a total credit limit of $500,000, your credit utilization will be (225,000/500,000). This gives a credit utilization ratio of 45%.

Why Is credit utilization important?

A business can only function if it has enough capital to support operations and growth initiatives. Credit is essential for a business as it can bridge gaps in cash flow, fuel growth, and help navigate challenges. However, managing credit responsibly ensures the business can comfortably pay debts.

Monitoring credit utilization regularly allows stakeholders to gauge the level of credit risk the business is exposed to. A high credit utilization indicates increased exposure to risk. A low utilization rate equals low risk, which can lead to additional loan opportunities and lower interest rates.

What is a good credit utilization score?

Generally, low is good, and high is bad. However, every business is unique, and the appropriateness of credit usage depends on factors such as financial position, growth objectives, and industry dynamics. Seeking advice from financial professionals can help businesses make informed decisions about utilizing credit effectively to support their specific goals and circumstances.

What are the risks of high credit utilization?

Excessive borrowing and reliance on credit can lead to over leveraging. This increases financial risk and makes the business vulnerable to economic downturns or unexpected events. In addition, a high utilization rate will negatively affect your business credit score, which could drive up your interest rate on future borrowing and make additional credit harder to gain.

How to best manage credit utilization?

Businesses need to approach credit responsibly to manage their debt effectively. Prudent credit management includes borrowing within the business’s means and making timely payments.

Additional good practices to improve your credit utilization ratio include the following actions:

Increase your credit limit: Ask your lender to increase your credit limit. This will affect the ratio between used and available credit to lower your utilization rate.

Pay down big debts: This may appear counterintuitive, but you should prioritize paying off your big debts, not necessarily your high-interest debts. This tactic has a greater effect in reducing your overall debt load to improve your utilization rate.

Keep old accounts open: After paying off a credit account, keep it open. Closing a credit account means removing its limit from the total pool of credit available to you and may cause your credit utilization to increase.

Transition to alternative business financing: Alternative lenders use a different model to assess creditworthiness. And as a result, they often help businesses increase their credit limit and, in turn, improve their credit utilization ratios.

How do alternative lenders help with credit utilization?

Alternative lenders offer business financing options with many advantages for companies needing of fast, flexible, and easy-to-acquire working capital and cash flow solutions. One of their key advantages lies in their ability to identify additional collateral within your organization to increase your credit limit.

Alternative lenders base credit decisions not on the credit strength of your company but on the collateral strength of your business. Companies with quality assets such as accounts receivable from creditworthy customers or equity in inventory, machinery, and equipment are well positioned to qualify for alternative funding options. And when it comes to credit utilization ratios: more available credit equals more effective credit utilization.

Common alternative financing options used to increase access to credit include the following:

In addition to increased credit, alternative lenders also provide a mainstream form of business financing that does not incur debt:

Invoice factoring indirectly improves your credit utilization ratio by increasing your access to working capital without the addition of debt.

Conclusion

Every business needs to keep a tab on its credit utilization score to ensure financial health and long-term success,

Credit utilization is an essential component of how your credit report is scored. Higher scores typically indicate higher risk to traditional lenders, while lower scores can mean additional loan opportunities and lower interest rates.

But higher scores can indicate a more significant reason for concern. Excessive borrowing can lead to increased financial risk for your business, causing it to become vulnerable to economic downturns or unexpected events. Over leveraged companies typically struggle to meet debt obligations and may face financial distress or bankruptcy.

While you can improve your credit utilization score by paying down big debts, increasing your credit limit, and keeping old accounts open, transitioning to alternative business financing options is a more flexible, fast, and tailored approach to improved credit utilization.

Seek advice from financial professionals to help make informed decisions about utilizing credit effectively to support your company’s specific goals and circumstances.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.