Working capital management (WCM) has re-emerged as a key priority for enterprise treasuries, driven by economic uncertainty, technological innovations, and increasing regulatory demands.

Maintaining steady cash flow is essential for effective WCM to cover daily operations, pay employees, purchase inventory, and manage unforeseen expenses. However, financial gaps can arise due to seasonal fluctuations, delayed receivables, or unexpected costs. This is where working capital loans become invaluable—a financing option designed to help businesses meet their short-term financial needs.

Working capital loans offer quick access to cash, helping companies maintain liquidity and avoid disruptions during periods of slow revenue or seasonal fluctuations. By ensuring that a business can meet its immediate financial obligations without sacrificing growth opportunities, this type of financing enables smoother operations and allows businesses to stay competitive, even in challenging economic conditions.

In this blog, we’ll explore working capital loans, how they work, their benefits, and how businesses can make the most of this financial tool.

What Is a Working Capital Loan?

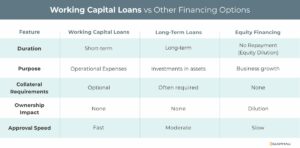

A working capital loan is a type of financing specifically designed to cover the short-term operational needs of a business. Unlike loans for long-term investments like equipment or property, this type of financing provides immediate cash to help businesses manage day-to-day expenses.

Key Features of Working Capital Loans:

- Short-Term Duration: Typically repaid within 12 months to a few years.

- Flexible Use: Funds can be used for payroll, rent, inventory, or utilities.

- Unsecured or Secured: Can be collateral-free or backed by assets like invoices or inventory.

How Does a Working Capital Loan Work?

- Application: Businesses apply for the loan, providing financial documents like income statements, balance sheets, and cash flow projections.

- Approval: Lenders evaluate the business’s financial health, creditworthiness, and repayment capacity.

- Disbursement: Once approved, the loan amount is disbursed in a lump sum or a line of credit.

- Repayment: Businesses repay the loan through fixed monthly payments or based on revenue cycles, depending on the loan terms.

Why Businesses Need Working Capital Loans

- Seasonal Revenue Fluctuations: Retailers and businesses with seasonal sales cycles often need working capital to prepare for peak seasons or manage slower months.

- Delayed Receivables: Waiting for customer payments can create cash flow gaps, which working capital loans can bridge.

- Unexpected Expenses: Equipment repairs, supply chain disruptions, or other unforeseen costs can arise, requiring immediate funding.

- Growth Opportunities: Businesses may need extra funds to capitalize on short-term opportunities like bulk inventory purchases or marketing campaigns.

Types of Working Capital Loans

- Term Loans

- A lump sum loan with a fixed repayment schedule over a set period.

- Line of Credit

- Lines of credit are flexible borrowing options that allow businesses to draw funds as needed, paying interest only on the amount used.

- Invoice Financing

- Invoice financing advances funds against outstanding invoices, providing cash while waiting for customer payments.

- Merchant Cash Advances

- Provides an upfront lump sum in exchange for a percentage of future credit card sales.

- Trade Credit

- Financing provided by suppliers, allowing businesses to delay payments for goods or services.

Benefits of Working Capital Loans

- Improved Cash Flow

- Provides liquidity to manage daily expenses and maintain smooth operations.

- Quick Access to Funds

- Many working capital loans have streamlined approval processes, enabling businesses to access funds quickly.

- No Impact on Ownership

- Unlike equity financing, working capital loans don’t require giving up ownership or control of the business.

- Flexible Usage

- Funds can be used for various operational needs, from paying suppliers to launching marketing campaigns.

- Tailored Repayment Options

- Repayment terms can be structured to align with the business’s cash flow and revenue cycles.

Challenges of Working Capital Loans

- Higher Interest Rates

- Short-term loans often come with higher interest rates compared to long-term financing.

- Credit Requirements

- Businesses with poor credit may face difficulty securing loans or may be offered less favorable terms.

- Repayment Pressure

- Regular repayment obligations can strain cash flow if not managed carefully.

- Collateral Requirements

- Some loans may require collateral, putting business assets at risk in case of default.

How to Choose the Right Working Capital Loan

- Evaluate Your Needs

- Determine the exact purpose and amount of funding required to avoid overborrowing.

- Compare Lenders

- Research banks, online lenders, and alternative financiers to find the best terms and interest rates. Look for reputable lenders offering transparent terms and competitive interest rates. Visit their company websites and read customer reviews to evaluate satisfaction and reliability.

- Understand Terms

- Carefully review loan terms, including interest rates, repayment schedules, and fees.

- Assess Cash Flow

- Ensure your business can comfortably meet repayment obligations without jeopardizing operations.

- Seek Expert Advice

- Consult with financial advisors or accountants to ensure the loan aligns with your overall financial strategy.

Real-World Example: Working Capital Loan in Action

Scenario: A manufacturer producing consumer electronics experiences high sales as the holiday season approaches but struggles with cash flow in the leading months due to upfront operational costs.

Solution: The business secures a $500,000 working capital loan to cover operational costs, such as inventory, additional payroll burdens, and equipment maintenance. The loan is repaid within six months after the holiday demand surge generates sufficient revenue.

Outcome: The manufacturer successfully meets demand, boosting revenue and profitability without experiencing cash flow disruptions.

Conclusion

Working capital loans are a lifeline for businesses seeking to manage short-term financial challenges or capitalize on growth opportunities. With quick access to funds, flexible usage, and tailored repayment options, these loans empower businesses to maintain operations and seize opportunities without compromising their financial health.

Before applying for a working capital loan, carefully evaluate your needs, understand the terms, and choose a lender that aligns with your goals. With the right approach, a working capital loan can be a powerful tool to fuel your business’s success.

Contact us to explore the many business financing solutions available to ensure reliable cash flow and easy access to working capital.

Key Takeaways

- Cash flow gaps can arise due to seasonal fluctuations, delayed receivables, or unexpected costs, creating short-term liquidity shortages.

- Working capital loans offer quick access to cash, helping companies maintain liquidity and avoid disruptions during periods of slow revenue or seasonal fluctuations.

- This type of financing provides a lifeline for businesses seeking to manage short-term financial challenges or capitalize on growth opportunities. With quick access to funds, flexible usage, and tailored repayment options, these loans empower businesses to maintain operations and seize opportunities without compromising their financial health.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.