The Power of IP Financing: Turning Your Intellectual Assets into Funding

Content

- What Is IP Financing?

- Key Features of IP Financing:

- How Does IP Financing Work?

- Types of IP Eligible for Financing

- Who Can Benefit from IP Financing?

- Benefits of IP Financing

- Challenges of IP Financing

- Industries That Leverage IP Financing

- Real-World Example: IP Financing in Action

- How to Use IP Financing Strategically

- Tips for Choosing an IP Financing Provider

- Conclusion

- Key takeaways

In today’s innovation-driven economy, intellectual property (IP) is a critical asset for many businesses. IP holds significant value, from patents and trademarks to copyrights and trade secrets, but its potential often goes untapped. IP financing provides a way for businesses to monetize their intellectual property, turning these intangible assets into tangible funding for growth, operations, or investment.

This blog explores IP financing, how it works, its benefits, and why it’s becoming an essential tool for businesses leveraging intellectual assets.

What Is IP Financing?

IP financing involves using intellectual property as collateral to secure loans or as a basis for other financing structures. This innovative approach allows businesses to unlock the financial potential of their IP, providing access to capital while retaining ownership and control of their assets.

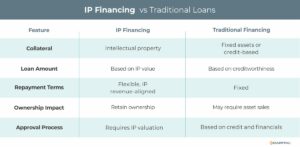

Key Features of IP Financing:

- Collateral-Based: Uses patents, trademarks, copyrights, or trade secrets as security.

- Flexible Use: Funds can be used for R&D, operational expenses, debt refinancing, or growth initiatives.

- Valuation-Driven: The loan amount depends on the assessed value of the intellectual property.

How Does IP Financing Work?

- IP Valuation: A professional appraises the intellectual property to determine its market value, income potential, and legal standing.

- Loan Application: The business applies for financing, presenting the IP as collateral and detailing the intended use of funds.

- Approval Process: Lenders evaluate the IP’s value, enforceability, and commercial potential before approving the loan.

- Disbursement: Once approved, funds are disbursed for the agreed-upon purpose.

- Repayment: The borrower repays the loan according to the terms, ensuring they retain ownership of the IP.

Types of IP Eligible for Financing

- Patents

- Innovations and inventions with commercial applications.

- Trademarks

- Brand names, logos, or slogans with market recognition.

- Copyrights

- Creative works like software, literature, music, or art.

- Trade Secrets

- Proprietary processes, formulas, or knowledge.

- Licensing Agreements

- Revenue-generating agreements tied to IP usage.

Who Can Benefit from IP Financing?

IP financing is ideal for:

- Startups and Tech Companies: Monetize patents or software to fund R&D and operations.

- Pharmaceutical and Biotech Firms: Leverage valuable patents for drug development or trials.

- Media and Entertainment Businesses: Use copyrights to secure funding for creative projects.

- Established Enterprises: Optimize balance sheets by unlocking the value of underutilized IP.

Benefits of IP Financing

- Access to Capital

- Provides funding without selling equity or assets, preserving ownership and operational control.

- Monetizes Intangible Assets

- Transforms non-cash assets into liquid capital, improving financial flexibility.

- Supports Innovation

- Enables businesses to reinvest in R&D, expand operations, or scale production.

- Tailored Financing Solutions

- Offers flexible terms aligned with the business’s financial needs and IP revenue streams.

- Retains Ownership

- Unlike outright IP sales, financing allows businesses to maintain ownership of their intellectual property.

- Strengthens Market Position

- Leveraging IP assets demonstrates strategic use of resources, enhancing credibility with investors and stakeholders.

Challenges of IP Financing

- Complex Valuation

- Accurately assessing the value of IP can be time-consuming and subjective.

- Lender Expertise

- Not all lenders are familiar with IP as collateral, limiting options for financing.

- Legal Risks

- IP must be enforceable and free of disputes to qualify as collateral.

- Higher Interest Rates

- Loans backed by intangible assets may carry higher rates due to perceived risk.

- Potential Loss of IP

- Defaulting on the loan could result in the loss of intellectual property rights.

Industries That Leverage IP Financing

- Technology

- Monetize software, patents, or algorithms to fund product development.

- Pharmaceuticals

- Use drug patents to secure capital for clinical trials or production.

- Entertainment

- Finance films, music, or digital content using copyrights.

- Consumer Goods

- Leverage trademarks or trade secrets for expansion or marketing campaigns.

- E-Commerce

- Utilize proprietary platforms or algorithms to secure funding.

Real-World Example: IP Financing in Action

Scenario: A biotech company holds patents for a groundbreaking medical device but needs $5 million to complete clinical trials and bring the product to market.

Solution: The company secures IP financing using its patents as collateral. A professional valuation estimates the patent’s worth at $15 million, enabling the company to borrow $5 million at favorable terms.

Outcome: With the funds, the company successfully completes clinical trials, launches the product, and generates revenue to repay the loan while retaining full ownership of its patents.

How to Use IP Financing Strategically

- Conduct Thorough Valuation

- Work with experts to ensure your IP is accurately appraised and legally sound.

- Align Financing with Goals

- Use the funds for initiatives that maximize ROI, such as R&D, marketing, or scaling operations.

- Choose the Right Lender

- Partner with lenders experienced in IP financing to ensure favorable terms and smooth processes.

- Monitor IP Performance

- Track revenue streams or market impact to ensure the IP continues to generate value.

- Diversify Funding Sources

- Use IP financing as part of a broader financial strategy to balance risk and opportunity.

Tips for Choosing an IP Financing Provider

- Experience with IP

- Select lenders familiar with intellectual property as collateral. Look for leading specialty lenders offering transparent terms and competitive interest rates. Visit their company websites and read customer reviews to evaluate satisfaction and reliability.

- Transparent Terms

- Ensure fees, interest rates, and repayment conditions are clear.

- Industry Knowledge

- Look for providers with expertise in your industry’s IP landscape.

- Valuation Support

- Choose providers offering robust appraisal services to streamline the process.

Conclusion

IP financing is a powerful tool for businesses seeking to capitalize on their intangible assets while preserving operational control and ownership. By leveraging patents, trademarks, copyrights, or trade secrets, businesses can secure funding to fuel innovation, scale operations, and drive long-term growth.

If your business holds valuable intellectual property and needs access to capital, IP financing could be the ideal solution. Partner with experienced lenders, conduct thorough valuations, and strategically use your IP to unlock new opportunities and achieve your financial goals.

Contact us to explore the many business financing solutions available to ensure reliable cash flow and easy access to working capital.

Key takeaways

- IP holds significant value from patents and trademarks to copyrights and trade secrets, but its potential often goes untapped.

- IP financing is a powerful tool for businesses seeking to capitalize on their intangible assets while preserving operational control and ownership.

- Using intellectual property as collateral to secure loans or as a basis for other financing structures enables businesses access to capital while retaining ownership and control of their IP assets.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.