Rising Costs Challenge Small Business Cash Flow: 2023 Spring Report [Updated for 2025]

Companies remain less likely than in pre-pandemic years to forecast revenue growth.

A new study reveals that revenue stagnation, rising costs and worker shortages remain barriers to growth for thousands of small and medium-sized businesses this spring.

Among nearly 8,000 businesses polled in the Federal Reserve Bank’s 2022 Small Business Credit Survey (SBCS), 94% faced financial challenges in the 12 months prior. The share of firms forecasting revenue growth for 2023 fell from 42% to 35%.

“Financially, around four in five firms cited challenges related to rising costs, and close to half of firms reported difficulties paying operating expenses or navigating uneven cash flows,” states an SBCS press release.

Aimed at providing a year-over-year picture of small business conditions, the survey highlights lingering staffing shortages that threaten profitability across dozens of industries. 40% of respondents found it “very difficult” to hire new staff in the previous 12-month period. This compares to only 27% of companies that reported the same level of difficulty pre-pandemic.

81% said rising costs of goods, services, and wages posed financial challenges, and 54% said uneven cash flow and paying operating expenses also shrunk revenue expectations.

“Business leaders are struggling to keep up with ballooning operational costs, which are putting a strain on working capital,” said Kyle Wilson, senior vice president, director of business development at eCapital.

“The best advice I can give is, don’t sit back and wait for things to improve,” he said. “Reach out to a finance company to know your options before your business faces a cash flow crisis.”

Trends in business financing

While 25% of small businesses applied for loans, lines of credit or cash advances in the 2021 survey, 40% did so in 2022.

The most common reasons for doing so? Meeting operating expenses or expanding the business.

However, less than half of those applications were fully approved.

Wilson said this trend has led to the growing popularity of alternative finance companies who can accelerate access to working capital even as traditional lenders restrict credit.

“Alternative finance companies like eCapital qualify businesses for funding quickly, using a different set of qualification criteria than a traditional lender,” he said. “The alternative finance market has boomed as more and more small and medium-sized businesses seek more flexible funding options.”

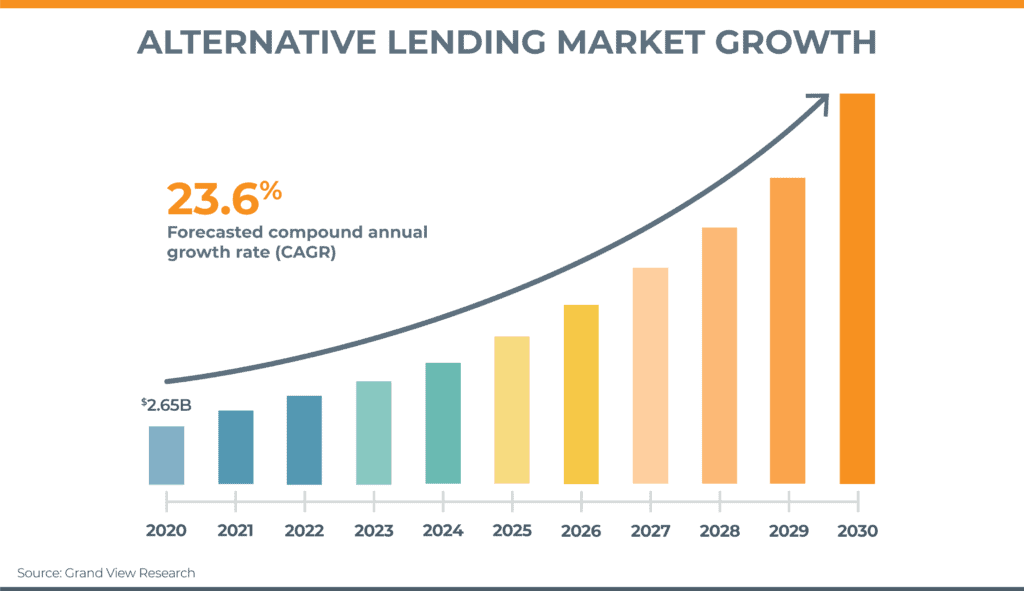

According to a Grand View Research Report, the alternative lending market was worth more than USD 2.24 billion in 2021, and is poised to boom over the next decade at a compound annual growth rate (CAGR) of 23.6% from 2022 to 2030.

Alternative finance companies offer a suite of services to accelerate cash flow and provide easy access to working capital. These services include the following:

- Invoice factoring: This longstanding form of financing has been revived, modernized, and popularized to become a mainstream form of business financing. It is the selling of invoice receivables at a discount in exchange for immediate payment. Today, alternative finance companies leverage advanced technology to transfer funds within minutes to hours of verifying invoices against purchase orders and confirming delivery receipts. This enhanced speed of funding thereby creates instant positive cash flow, and fast access to working capital.

- Asset-based lending: Asset-based lending (ABL) is a form of debt financing. It allows you to secure a loan based on the value of your business assets, such as inventory, machine and equipment, real estate, accounts receivable, and even intellectual property. This differs from traditional bank ABL funding as it is far more flexible with fewer covenants attached and can be paired with other lending facilities. In short, by choosing an ABL solution through an alternative lender, your company has more creativity in managing debt to ensure you keep pace with growth.

- Lines of Credit: An alternative lender can provide a line of credit, like what a bank provides, but with two significant differences. First, an alternative lender’s line of credit allows you to spend on credit as needed up to a limit, but with minimal lender oversight. This means the facility is easier and less time-consuming to manage. Secondly, the facility has no restrictive covenants that prevent the borrower from pursuing additional forms of credit. The borrower retains the ability to take on additional business financing if needed.

- Equipment refinancing: This specialized form of asset-based lending converts the equity tied up in working equipment into a significant injection of capital. By leveraging the value in long-term assets to provide cash in hand, companies can improve operations, take on new contracts, fund an acquisition, support a turnaround strategy, or consolidate debt.

- Visa commercial cards: One of the latest financing additions that eCapital, a leading alternative finance company, offers is the Visa Commercial card program. With this card, businesses can now create and control a true expense management system. The card provides the cash you need when you need it to cover costs and the control you need to regulate expenses. Business owners can issue cards to their employees with spending limits and categories for where the cards can be used. The Visa Commercial card program provides a powerful tool to customers who would not usually have access to this card program.

Conclusion

Stagnate revenue growth generally translates to increasing cash flow challenges because of lower sales and profits. As rising costs of goods, services, and wages heighten financial barriers to cash-strapped businesses, SMBs need to secure flexible financing options to overcome instability. Alternative finance companies provide flexible funding solutions with easy qualification requirements that allow companies to navigate the challenges of adverse economic conditions.

To remain stable, in good standing with creditors, and able to capitalize on growth opportunities, SMBs need dependable cash flow and easy access to working capital. Look for a leading alternative finance company with a suite of financing options and experience in your industry to provide the flexibility needed to survive and prosper in difficult conditions.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.