Payroll Funding: Ensuring Smooth Operations for Your Workforce

Content

- What Is Payroll Funding?

- Key Features of Payroll Funding:

- How Does Payroll Funding Work?

- Who Needs Payroll Funding?

- Benefits of Payroll Funding

- Challenges of Payroll Funding

- Industries That Benefit from Payroll Funding

- How to Use Payroll Funding Strategically

- Real-World Example: Payroll Funding in Action

- Tips for Choosing a Payroll Funding Provider

- Conclusion

- Key Takeaways

For businesses of all sizes, maintaining timely and accurate payroll is essential for employee satisfaction, compliance, and operational stability. However, managing payroll can become a challenge when cash flow is tight due to delayed receivables, seasonal fluctuations, or unexpected expenses. This is where payroll funding steps in, offering a reliable solution to bridge cash flow gaps and ensure your workforce gets paid on time.

This blog explores payroll funding, how it works, its benefits, and how businesses can use it to maintain operations and foster employee trust.

What Is Payroll Funding?

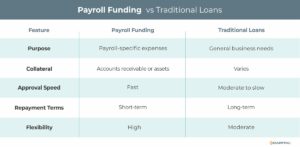

Payroll funding, also known as payroll financing, is a short-term cash flow solution designed to help businesses cover payroll expenses. By leveraging assets like accounts receivable, businesses can secure the funds needed to pay employees on time, even when cash flow is constrained.

Key Features of Payroll Funding:

- Cash Flow Bridge: Provides immediate funds to meet payroll obligations.

- Short-Term Solution: Focused on covering short-term needs during financial gaps.

- Asset-Based: Often tied to receivables or other business assets as collateral.

How Does Payroll Funding Work?

- Application: Businesses apply for this type of funding by providing financial details, including accounts receivable or other collateral.

- Approval: Lenders evaluate the business’s financial health and receivables to determine funding eligibility.

- Funding: Approved funds are disbursed quickly, often within days, to cover payroll obligations.

- Repayment: Businesses repay the funding as receivables are collected or according to agreed terms.

Who Needs Payroll Funding?

Payroll funding is particularly beneficial for:

- Small and Medium-Sized Enterprises (SMEs): Facing cash flow challenges or delayed payments from clients.

- Seasonal Businesses: Managing payroll during off-peak times with reduced revenue.

- Staffing Agencies: With high payroll demands but delayed client payments.

- Growing Businesses: Scaling rapidly and requiring additional cash flow to meet expanding payroll needs.

Benefits of Payroll Funding

- Ensures Timely Payroll

- Prevents payroll delays, maintaining employee satisfaction and trust.

- Improves Cash Flow

- Frees up cash for other operational expenses by covering payroll gaps.

- Flexible Financing

- Scales with your payroll needs, allowing businesses to borrow only what they require.

- Quick Access to Funds

- Fast approval and disbursement ensure businesses can address urgent payroll needs.

- No Equity Dilution

- Unlike equity financing, this type of funding does not require giving up ownership in the business.

- Supports Growth

- Enables businesses to hire more staff or expand operations without cash flow concerns.

Challenges of Payroll Funding

- Interest and Fees

- Costs can add up, especially for businesses with long-term reliance on payroll funding.

- Credit Requirements

- Some lenders require a good credit score or strong receivables to approve funding.

- Dependency Risks

- Over-reliance on this type of funding can indicate underlying cash flow issues that need to be addressed.

- Collateral Requirements

- Asset-based funding requires businesses to pledge receivables or other assets as collateral.

Industries That Benefit from Payroll Funding

- Staffing Agencies

- Manage high payroll demands while waiting for client payments.

- Retail and E-Commerce

- Cover payroll during slower seasons or invest in seasonal hiring.

- Construction and Contracting

- Ensure timely payroll for on-site workers while managing project-based receivables.

- Healthcare

- Maintain payroll for medical staff while awaiting insurance reimbursements.

- Hospitality and Event Planning

- Bridge cash flow gaps during off-peak periods or between large events.

How to Use Payroll Funding Strategically

- Plan for Seasonal Needs

- Anticipate payroll and the funding required during periods of low cash flow.

- Align Repayment with Receivables

- Use receivables-based financing to ensure repayments align with incoming cash.

- Avoid Over-Reliance

- Use this type of funding as a short-term solution while addressing long-term cash flow issues.

- Maintain Accurate Records

- Keep detailed accounts receivable records to streamline the application process.

- Choose the Right Lender

- Work with reputable lenders offering transparent terms and competitive rates.

Real-World Example: Payroll Funding in Action

Scenario: A staffing agency has a payroll obligation of $200,000 but is waiting for $250,000 in client payments due in 45 days.

Solution: The agency secures payroll funding using its accounts receivable as collateral. The funds are disbursed within two days, enabling the agency to pay employees on time.

Outcome: Once the client payments are received, the agency repays the funding and avoids payroll disruptions, maintaining trust with employees and clients.

Tips for Choosing a Payroll Funding Provider

- Evaluate Costs

- Understand the interest rates, fees, and repayment terms to assess the total cost of funding.

- Check for Flexibility

- Ensure the lender offers solutions that align with your specific payroll needs.

- Review Reputation

- Work with a provider known for reliable service and quick fund disbursement.

- Understand Collateral Requirements

- Confirm the type and value of assets required to secure funding.

- Assess Customer Support

- Choose a lender that provides responsive and transparent communication. Check the lender’s website for service capabilities and examine client reviews to assess customer satisfaction.

Conclusion

Payroll funding is a vital financial tool for businesses facing temporary cash flow challenges or growing payroll obligations. By ensuring timely employee payments, this financing option not only maintains workforce morale but also supports operational stability and growth.

If your business needs a short-term cash flow boost to cover payroll, consider payroll funding as a flexible and effective solution. Evaluate your financial needs, choose a trusted provider, and take the steps necessary to keep your workforce paid and your business thriving.

Contact us to learn about our extensive array of flexible business financing options and consult our experienced financial experts to maximize potential returns with tailored cash flow solutions.

Key Takeaways

- Managing payroll can become a challenge when cash flow is tight due to delayed receivables, seasonal fluctuations, or unexpected expenses.

- Payroll funding leverages assets like accounts receivable, enabling businesses to secure the funds needed to pay employees on time, even when cash flow is constrained.

- Evaluate your financial needs, choose a trusted provider, and take the steps necessary to keep your workforce paid and your business thriving.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.