Many economists anticipate the year ahead will continue to face slow growth, high inflation, high-interest rates, and a high chance of recession. Despite these concerns, some experts see underlying economic strengths that may lead to a softer landing in 2024. As we approach another year of economic uncertainty and subdued growth, many manufacturers and distributors optimize their inventories to maintain control over operating costs.

This article examines inventory management challenges, emphasizing agile operations to reduce dependence on expensive stockpiling practices. However, for many, inventory optimization comes with a significant cost, even with these additional measures. As a result, alternative financing is emerging as a timely solution to help streamline supply chain efficiencies and minimize warehousing expenses.

Continue reading to learn how to optimize inventory management through alternative financing.

Prepare for another year of uncertainty

The most optimistic forecasts for 2024 are based on real disposable household income, which has grown at a 4% pace in 2023 and is anticipated to weaken to 3% in 2024. If this prediction holds true, some analysts foresee little change in consumer spending. However, Jack Kleinhenz, Chief Economist for the National Retail Federation (NRF), reports, “There are ongoing economic challenges and questions, and the pace of consumer spending growth is becoming incrementally slower.” While his message may seem cautionary, Kleinhenz also leaves room for optimism, “While its rhythm, tone, and pattern have slowed, it (the economy) has not stalled, and recently revised data shows underlying strength that seems to be rolling forward.”

Kleinhenz’s remarks underscore what we all know – no one can predict what next year will bring. This highlights the importance of preparing for another year of uncertainty for consumer goods companies.

The challenge of demand forecasting

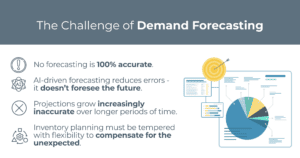

Inventory decisions rely heavily on demand forecasts, yet accurately predicting fluctuating consumer demand remains challenging even with advanced AI-driven software. Rapidly changing external factors such as economic conditions, market dynamics, competitor strategies, and consumer behavior can profoundly influence demand, leading to costly miscalculations in demand forecasting. This challenge is especially true during the economic uncertainty that current markets are experiencing.

Two well-known corporations fell victim to this scenario last year. Walmart disclosed an excess in inventory of $1.5 billion due to miscalculations in demand forecasting. Although notable, this amount was overshadowed by Nike’s announcement of a substantial $9.7 billion worth of excess goods stored in warehouses.

As the nation’s stockpile of inventory remains high, the costs and risks associated with warehousing are on the rise. To mitigate these liabilities, companies need the ability to respond quickly to unexpected changes in inventory demand without increasing their reliance on stockpiling. For this reason, operational agility must be maximized to allow for unforeseen turns in supply chain and inventory management.

Developing operational agility

The best approach to prevent under or overstocking inventory often involves aligning supply plans with integrated data-driven forecasts from sales and operation perspectives. Inventory optimization can be enhanced through various methods, including the following techniques:

- The reorder point method

- EOQ model

- MRP

- JIT inventory management

- Kanban system

- ABC analysis

- Multi-echelon inventory optimization

However, as market conditions continue to defy expectations, planning must be tempered with flexibility to compensate for the unexpected.

To maintain a continuous balance between supply and demand for cost control, maximizing operational agility by keeping inventory levels at or just above current demand is essential. To facilitate this, ensure accurate lead times, closely monitor performance metrics, and synchronize ordering frequency with seasonal fluctuations, forecast updates, and marketing promotions. Achieving this level of agility requires a responsive supply chain capable of quickly reacting to changing circumstances.

Forward-thinking companies are broadening their supply chain capabilities by fostering real-time collaboration with partners and establishing comprehensive system visibility to improve cooperation throughout the supply chain network. Diversify your network of suppliers and logistic providers to minimize service dependence, control costs more effectively, and streamline response times. Most importantly, establish a flexible financial structure that lets your company pay network partners quickly for products and services. This practice assists in building trust and loyalty in partnerships and prompts priority attention when fast response times for supplies and logistic services are required.

By leveraging network partnerships, businesses can refine their inventory levels, reducing overall costs of inventory stockpiling, improving lead times to meet customer demand, and enhancing profitability.

How to establish a flexible financial structure

A flexible financial structure is essential for consumer goods companies aiming to optimize inventory management. Typically, financial flexibility involves accessing diverse financial resources, such as cash reserves, liquid assets, credit facilities, and alternative funding options. However, in today’s low-growth economy, many companies struggle to maintain accessible cash reserves and liquid assets. To complicate matters, conventional lenders have tightened the lending market, making it more difficult for companies to secure loans. This situation leaves alternative funding options as the optimal resource to help build a more flexible financial structure.

Alternative lenders employ a distinct approach to credit qualification compared to traditional lenders. Rather than solely relying on a company’s credit score and financial statements, they evaluate the value of the business’s assets that can be utilized as collateral. This approach enables companies with unencumbered assets to secure credit, even if their business performance is subpar or their credit scores are less than ideal. Businesses with regular accounts receivable from creditworthy customers, inventory, machinery, or equipment can qualify for various financing options to increase access to business credit.

The two most frequently used alternative financing options to fund inventory optimization are:

Invoice factoring: This funding option swiftly generates positive cash flow by selling a company’s receivable invoices to an alternative lender at a discount in return for immediate cash.

Asset-based lending (ABL): ABL provides a business line of credit secured by a company’s tangible assets, including invoice receivables, equipment, machinery, and inventory. The credit amount is directly tied to the assessed value of the pledged assets, enabling businesses to access loans without depending heavily on their credit score.

These alternative financing options provide businesses the necessary capital to help establish a flexible financial structure. With easy access to working capital, consumer goods companies can support the timely payment of account payables to network partners and invest in supply chain efficiencies to optimize inventory management.

Key Takeaways

- Expectations for next year’s economy are unclear. Amid this uncertainty, manufacturers and distributors focus on optimizing inventory management to achieve cost-efficiency.

- Accurately predicting fluctuating consumer demand remains challenging even with advanced AI-driven software. Companies need the ability to respond quickly to unexpected changes in inventory demand without heavy reliance on costly stockpiling.

- Operational agility must be maximized to allow for unexpected turns in supply chain and inventory management.

- By leveraging network partnerships, businesses can better fine-tune their inventory levels to reduce costs, improve lead times, and enhance profitability.

- Establishing a flexible financial structure allows companies to pay network partners quickly for products and services. This practice assists in establishing trust and loyalty in partnerships and helps to prompt priority attention when fast response times for supplies and logistic services are required.

- Establishing a flexible financial structure is essential to support inventory management optimization.

Conclusion

Inventory optimization results in identifying the ideal inventory levels to reduce expenses, meet customer demand, and enhance business profitability. This process requires striking a balance between the expenses of maintaining inventory and the lost revenue incurred from stock-outs and missed sales opportunities due to insufficient stock.

As 2024 approaches, consumer goods companies need to be prepared for another year of uncertainty by reducing their stockpile of inventory while improving response times to customer demand. To achieve this objective, companies must maximize operational agility to maintain inventory levels at or just above current demand. Establishing a flexible financial structure capable of making timely invoice payments to network partners and investing in supply chain efficiencies is essential to support inventory management optimization.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.