The healthcare industry faces unique financial challenges, from rising operational costs to delayed insurance reimbursements. Whether it’s a hospital expanding its facilities or a private clinic investing in new equipment, healthcare financing plays a crucial role in keeping the industry functioning smoothly.

This article explores healthcare financing, how it works, and how it compares to traditional business loans. We’ll then delve into its advantages, challenges, and provide a real-world example to illustrate its impact.

What is Healthcare Financing?

Healthcare financing refers to financial solutions to help healthcare providers and businesses manage medical-related expenses. It can include funding for hospitals, clinics, and medical practices to cover operational costs, facility expansion, and equipment purchases. This flexible financing option can be tailored to align terms and repayment schedules with the needs of the business and its revenue cycles.

Key Features of Healthcare Financing:

- Flexible Use of Funds: Can be used for medical equipment, facility upgrades, staffing, or patient care.

- Short-Term and Long-Term Options: Includes business loans, medical credit lines, and insurance claim advances.

- Secured and Unsecured Options: Financing can be backed by assets (such as equipment or real estate) or offered without collateral.

How Does Healthcare Financing Work?

- A medical provider applies for financing: This could be a loan, a line of credit, or equipment financing.

- Lender evaluates creditworthiness: Approval is based on revenue, patient volume, and insurance reimbursement history.

- Funds are disbursed: The healthcare provider uses the financing for operating expenses, payroll, medical technology, or expansion.

- Repayment is made over time: Payments are structured based on revenue cycles and insurance payouts.

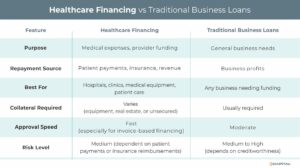

Key Differences

- Healthcare financing is tailored for medical businesses, considering revenue cycles and patient payments.

- Business loans are broader in scope, less flexible, and require strong credit and collateral.

Example of Healthcare Financing in Action

Scenario: A private healthcare clinic specializes in outpatient procedures but wants to expand into advanced imaging services by purchasing an MRI machine.

Challenge: The MRI machine costs $1.2 million, and the clinic does not have enough liquid capital to cover the full cost upfront.

Solution: The clinic secures a medical equipment loan, allowing them to:

- Spread payments over 5 years instead of paying the full cost immediately.

- Generate additional revenue from new imaging services to offset loan payments.

- Retain working capital for staffing, marketing, and operational costs.

Outcome:

- The clinic expands services, attracting new patients and increasing revenue.

- The financing provider receives monthly payments from the clinic’s profits.

- The investment pays for itself over time, helping the clinic grow without financial strain.

Benefits of Healthcare Financing

- Improves Cash Flow: Covers operating expenses and smooths revenue fluctuations due to delayed patient and insurance payments.

- Funds Growth and Expansion: Supports clinic expansions, new technology, and hiring more staff.

- Preserves Working Capital: Allows providers to invest in improvements without depleting cash reserves.

- Flexible Repayment Terms: Tailored financing options match patient payment cycles and insurance payouts.

Challenges of Healthcare Financing

- Risk of Patient Non-Payment: Providers relying on timely patient payments must maintain repayment schedules to ensure compliance with loan terms.

- Complex Insurance Reimbursements: Delays in insurance payments can impact cash flow and impede loan repayment obligations.

- Interest and Fees: Some healthcare loans may carry higher costs, especially for longer repayment terms.

How to Overcome These Challenges

- Work with Reputable Financing Providers: Choose lenders specializing in healthcare finance to get better terms.

- Implement Strong Payment Policies: Ensure patients understand their repayment obligations upfront.

- Use Insurance Claim Advances When Needed: Short-term financing can bridge the gap between treatments and reimbursements.

Who Should Consider Healthcare Financing?

- Hospitals and Clinics: Expanding facilities, upgrading technology, or managing payroll.

- Pharmacies: Managing inventory and handling reimbursement delays.

- Medical Equipment Suppliers: – Offering flexible financing to healthcare providers.

- Doctors and Dentists: Setting up private practices or purchasing medical tools.

Conclusion

Healthcare financing is an essential tool for medical providers. It helps clinics and hospitals expand services, invest in advanced medical technology, and manage operational costs.

If you’re a healthcare provider looking to scale your operations but require flexible payment options to accommodate staggered revenue streams, exploring healthcare financing solutions can help you manage costs effectively while ensuring quality medical care.

Contact us to speak with an experienced financing professional to find the best funding solution for your needs today!

Key Takeaways

- Whether it’s a hospital expanding its facilities, a private clinic investing in new equipment, or a dentist managing cash flow, the healthcare industry faces unique financial challenges.

- Healthcare financing is a set of financial solutions designed to help healthcare providers and businesses manage medical-related expenses.

- This could be a loan, a line of credit, or equipment financing.

- This flexible financing option can be tailored to align terms and repayment schedules with the needs of the business and its revenue cycles.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.