Freight carriers and brokers are in a constant fight against time – delivering shipments safely and on schedule is only half the battle. Gaining fast, easy access to working capital to stay ahead of daily operational expenses is yet another major challenge in this constant race to beat the clock. Having the strength to deploy working equipment without financial constraint provides the flexibility to meet customer demand and capture new business opportunities as they arise. Accelerating cash flow from fast to warp speed is the next evolution in freight transportation funding.

eCapital, a leader in innovative freight factoring solutions introduces eCapital Connect, a collaboration with Visa to provide funds instantly once submitted invoices are approved. It’s the closest option to COD on the face of the planet!

A paradigm shift in how working capital is delivered

eCapital’s collaboration with Visa is a revolutionary leap forward for the trucking industry. The current industry standard for freight factoring is limited to funding clients using ACH wires, wire transfers and other legacy technologies. These methods of transfer are done electronically across a network of banks or transfer agencies and are generally reliant on East Coast banking hours which are subject to specific cutoff times for same-day processing. For active trucking companies needing reliable and round-the-clock cash flow, these limited operating hours can prove to be a hindrance. eCapital Connect provides direct connections to funds in eCapital’s proprietary Client Portal and access a line of credit to bridge any gap in day-to-day business cash flow to ensure seamless access to funds day and night. It is a paradigm shift in how working capital is delivered to trucking companies.

The benefits are boundless

Imagine the competitive advantage your trucking company will benefit from by accelerating cash flow to a new industry standard! Now imagine having a Visa card with all the features and benefits of a commercial credit card, but at no additional charge or fee. Use the card for purchases wherever Visa is accepted. The eCapital Visa platform works directly with our mobile app and client portal to provide freight factoring clients with direct control of their funds. Issue cards to employees, manage spending limits for individual cards, plus you can enable or restrict purchases on spending categories or specific merchants. The benefits are boundless:

- Rely on seamless 24/7 access to funds to execute on growth plans without funding restraints.

- React quickly and efficiently to the unexpected, such as emergency equipment repairs to minimize operational disruption.

- Retain full control of your money. Route funds instantly to your bank or distribute funds to multiple card users, such as drivers, and designate spending limits.

- Maintain full transparency with robust monitoring and reporting capabilities of all transactions.

- Go wherever the road leads knowing your financial flexibility extends to wherever Visa is accepted.

How does eCapital Connect work?

For factoring clients familiar with the easy-to-manage process of submitting invoices for funding, nothing changes – except for the speed of funding. It’s like stepping out of a go-cart and into a high-performance racing machine!

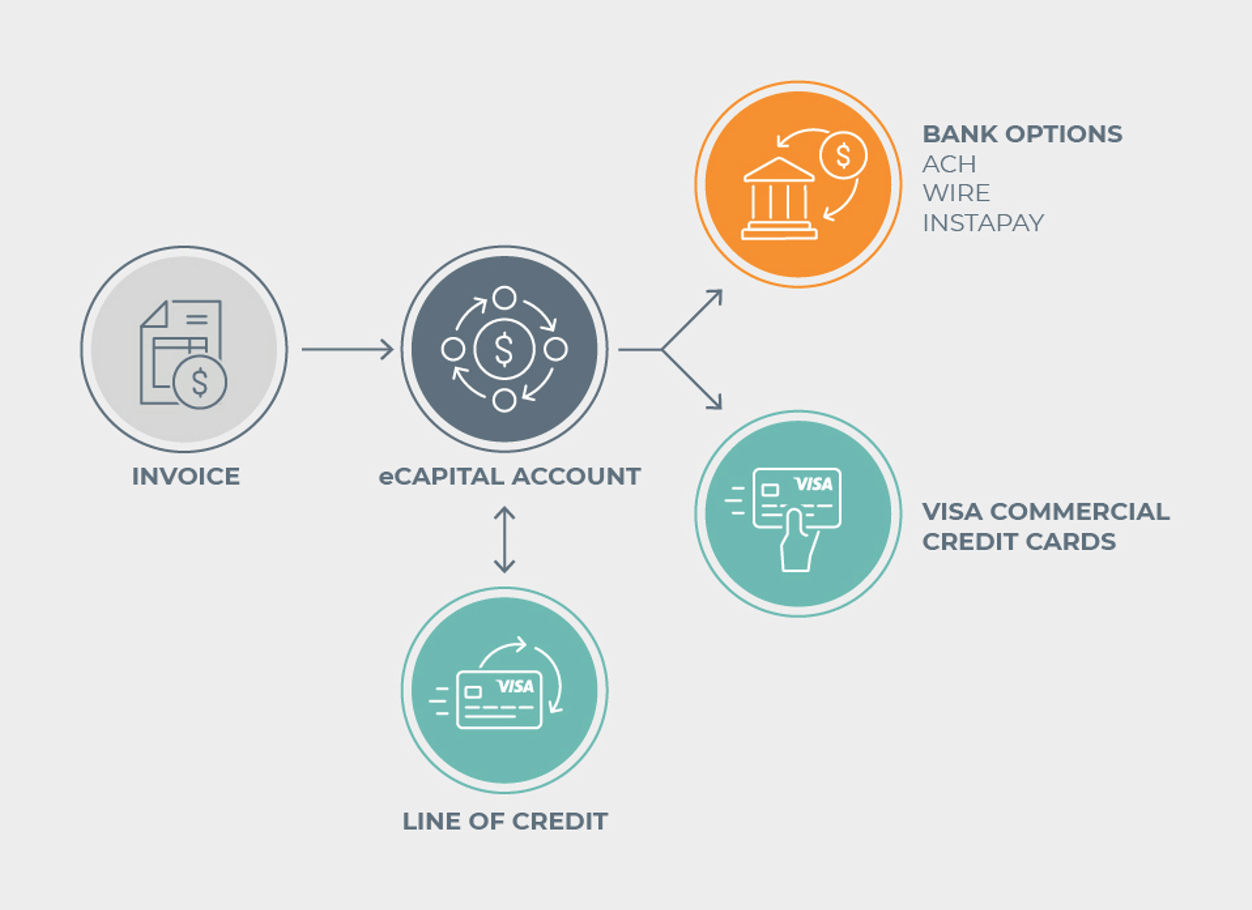

Here’s how it works:

- You submit an invoice for purchase.

- Once it’s approved, your funds and optional line of credit are available in your eCapital Account.

- Access funds on your Visa commercial credit card or transfer money to an external bank account.

Why use the eCapital Visa commercial credit card?

Freight transportation companies require a steady supply of funds to meet the financial obligations of a capital intense industry. Few trucking companies have the financial clout to self-finance operations and are therefore confined by the funding capabilities of their financial lender. Freight factoring is a specialized form of invoice factoring designed specifically for one truck companies, small and medium size fleets. It has always been the fastest and most convenient way for busy truck company owners to control their working capital needs – and now eCapital is able to deliver the funds even faster!

Speed of funding is the reason trucking companies have embraced freight factoring – uninterrupted cash flow accelerated to keep pace with your business is the reason for switching to use the eCapital Visa Commercial Credit Card.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.