Rising inflation, interest rate hikes, and lower consumer spending are challenging businesses of all types throughout the U.S economy. Declining financial performance levels and a contracting credit market are forcing business owners to expand their search for efficiencies, working capital, and inspiration to navigate these tough times.

Dealing with diminishing profits, financial instability, or insolvency can seem overwhelming – that’s why finding reputable sources of business advice to learn from and to help guide strategic decisions can be a lifeline.

Luckily there are hundreds of books you can turn to for sound guidance in times of financial crisis. Business owners equipped with respected financial advice and management guidance will be best positioned to lead their organization through financial hardship and back to stability through improved financial performance.

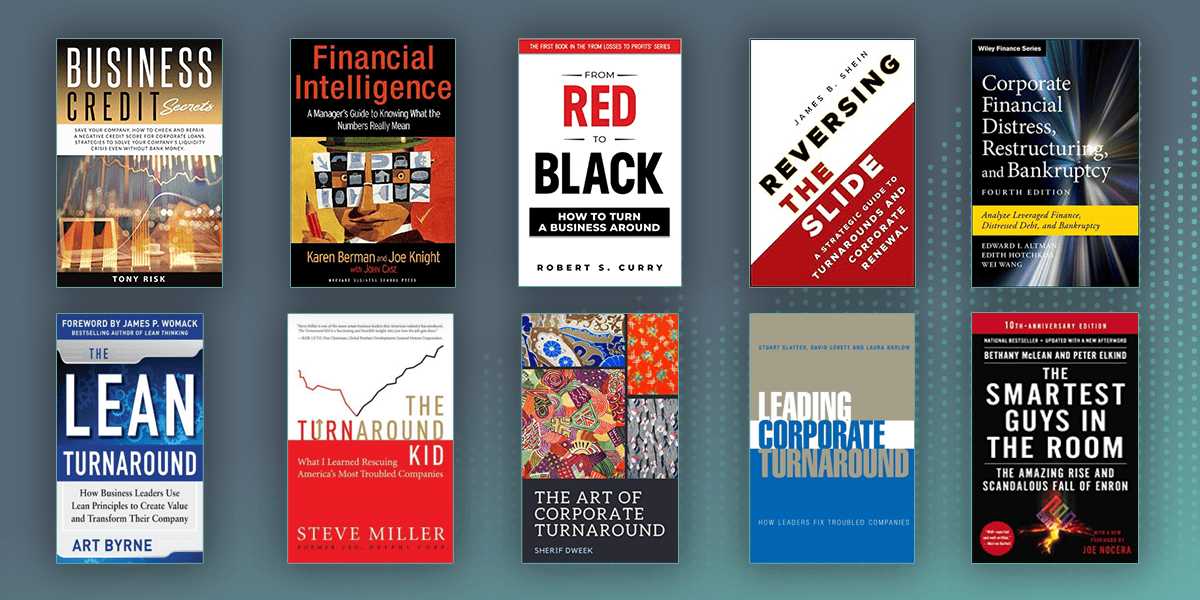

This handpicked collection of 10 books, written by business leaders across various industries, reveals proven strategies and tactics to revitalize a business in financial distress. Discover tips, learn rules, and follow guidance on managing critical matters such as poor financial performance, maxed-out credit, special loans, forbearance, insolvency, and bankruptcy.

Learning from the experience of industry leaders who have “been there, done that” can be the best investment you can make for your struggling company.

1 Financial Intelligence: A Manager’s Guide to Knowing What the Numbers Really Mean

by Karen Berman, Joe Knight, and John Case

Often, business owners might be intimidated by the complexity of accounting practices. This book outlines finance basics – what the numbers mean and why they matter.

Inc Magazine calls it one of “the best, clearest guides to the numbers on the market,” With 93% of over 2000 ratings hitting four or five stars, this book is clearly helping business leaders manage their businesses more effectively. Find it here.

2 Business Credit Secrets: Save Your Company

by Tony Risk

Companies in financial distress may struggle to access credit as their financial ratios decline. This publication includes practical tips to address your business’s finances and restore its access to credit. The book details the various types of financing available for businesses and the factors that influence business credit and how you can improve them. Find it here.

3 From Red to Black

by Robert S. Curry

Personal anecdotes from successful business community members can help business leaders push through adversity. Robert Curry shares his true story of how he turned a Florida-based company, which was on the brink of bankruptcy, into a profitable venture. The book covers his thought processes and action steps, with profit improvement recommendations, showing how he rolled up his sleeves, motivated his team, and turned his business around. Find it here.

4 Reversing the Slide

by James B Shein

Business owners entering a period of financial insecurity might be unfamiliar with the typical stages of an in-distress journey. This book explores how a struggling company can navigate the various stages of financial distress. Shein explores the common pitfalls that can lead to failure and gives advice on how to avoid them. It also provides step-by-step instructions on how to bounce back to profitability. Find it here.

5 Corporate Financial Distress, Restructuring, and Bankruptcy

by Edward I. Altman, Edith Hotchkiss, Wei Wang

Since the first edition of this book, published in 1983, it has been described as the most authoritative book on financial distress and bankruptcy. It further delves into related topics dealing with leveraged finance, high-yield, and distressed debt markets. The authors have continued to expand the guide, now in its 4th edition, explaining the U.S. Chapter 11 process and examining out-of-court restructurings. Find it here.

6 The Lean Turnaround

by Art Byrne

When a business is facing financial threats, leaning on the advice of experts is likely the smartest move. Author Art Byrne has over 30 years of experience in turning failing businesses around, most famously, the wire management company Wiremold. In this guide, he shares everything he has learned over the last three decades to develop the Lean strategies that have successfully saved businesses. Discover simple yet effective turnaround tactics as he explores how to create further efficiencies that elevate your business’s profits. His methods and recommendations apply to businesses in any industry. Find it here.

7 The Turnaround Kid

by Steve Miller

Another expert in the field of corporate restructuring is Steve Miller, or as the Wall Street Journal calls him, the “U.S. Industry’s Mr. Fix It.” He has built an international reputation while spending a career resurrecting failing businesses in such varied industries as steel, construction, and health care. Miller shares the inside story of the business turnarounds he’s led, outlines the lessons he’s learned, and discusses what it takes to identify the issues impeding a business’s success and how to fix them. Find it here.

8 The Art of Corporate Turnaround

by Sherif Dweek

Since business conditions change regularly, leaders must have a current understanding of how to manage difficult financial affairs in light of current economic conditions. This book covers the rules business leaders need to know to navigate the complexities of modern business. The chapters cover topics, including cost-cutting, disruptions, key performance indicators, and how to rebuild teams. With over 200 tips to turn around and save failing businesses, this book should be on every business leader’s shelf. Find it here.

9 Leading Corporate Turnaround

by Stuart Slatter

Leading a corporate turnaround requires a high level of interpersonal and financial skill as well as the buy-in and trust of all stakeholders. Slatter wrote this book to help business leaders understand that the answers to a distressed company’s problems lie almost always within the firm itself – the secret is cooperation. Learn the top leadership and management skills required for a successful turnaround. Slatter uses case studies to demonstrate the drivers of turnaround as well as the alternatives. Find it here.

10 The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron

by Bethany McClean and Peter Elkind

Knowing what not to do in extreme financial difficulties can be just as valuable as absorbing expert advice on next steps. The Smartest Guys in the Room doesn’t advise how to turn around a failing business. However, it gives a detailed account of how not to grow and run a business. Enron was one of the most spectacular business failures in history, demonstrating how greed and poor accounting can lead to business failure and, at a large enough scale, trigger an economic crash. Find it here.

An extra pick

Want to read these books but don’t have time? Here’s a bonus recommendation. HBR’s 10 Must Reads On Managing in a Downturn by Chris Zook, James Allen, Ronald Heifetz, Marty Linsky, published by the Harvard Business Review. The book is a collection of the publisher’s most important articles to help your company persevere through economic challenges and continue to grow even as your competitors stumble.

Conclusion

Navigating financial distress as a business leader can be an overwhelming and daunting task. However, with the right knowledge and guidance, it is possible to overcome these challenges and emerge stronger than ever. These 10 books offer valuable insights, strategies, and practical advice from experts who have weathered similar storms.

These books provide a comprehensive toolkit for understanding the intricacies of financial distress and offer actionable steps to take control of the situation. Taking their advice to heart – and putting it into practice – can be a valuable step on the road to recovery.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.