Understanding Factoring Rates, Fees, and the Total Cost of a Factoring Agreement

Content

Since the great recession of 2008, alternative financing has gained wide acceptance and invoice factoring has become a mainstream cash flow solution across North America. The popularity in factoring invoices has been growing due to the simple yet effective way it unlocks the cash already sitting in your accounts receivables. However, while the concept of invoice factoring is very straightforward, the process of determining the final cost of your own factoring agreement may include a few twists and turns that you need to be aware of before signing on the dotted line. Having a solid knowledge of rates and additional factoring fees will help you navigate through much of this uncertainty. Understanding the total cost of invoice factoring (sometimes referred to as accounts receivable financing) will assist you in finding the right provider and negotiating the best deal to meet your unique needs.

So, let’s start by digging into the rate and additional factoring fees that make up the total cost of a factoring agreement.

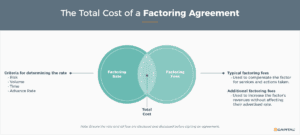

The total cost of a factoring agreement

The total cost of a factoring agreement is a combination of a factoring rate and additional factoring fees. To understand factoring agreements, you need to first understand the various ways that rates and fees can be calculated.

Factoring rate

The factoring rate is the percentage used to calculate the cost a factoring company charges your business for financing your invoices. This rate is usually calculated on the gross value of an invoice over a specified period of time (the recourse period). All factoring companies charge a factoring rate for their services and use the same criteria to determine the rate:

- Risk

- Volume

- Time

- Advance Rate

How do risk and volume affect your rate?

The two most important criteria used to determine the rate are the risks associated with buying your invoices and the volume of invoices to be factored.

At this stage, the factoring company will consider:

- Your company’s industry and type of business: Some industries and businesses by their nature tend to be more or less risky than others.

- The creditworthiness of your customer base: The more creditworthy your customers, the lower the risk of not getting paid.

- The volume and value of invoices to be factored: the more invoices you factor, the more likely the factor may be to provide you with a preferential rate to maintain your business based on economies of scale.

How does Time affect your rate?

How long a factoring company needs to finance your accounts receivables is the next consideration to be calculated. There are four basic types of factoring rates, all of which are structured on time frames. The best type of rate for your company will depend on the number of days it takes for your customers to typically make payment.

The four types of factoring rates

- Flat fee factoring rate: This fee is a one-time cost for the entire recourse period, usually 60 or 90 days. Whenever your customer pays their invoice within the recourse period, the fee will be the same. Due to its simplicity, this is the easiest fee to calculate and manage.

- Split fee factoring rate: Sometimes referred to as a tiered rate. This fee is typically accrued in blocks of 10 or 15 days, although it may be calculated on a monthly, weekly, or daily schedule. An example of a standard split factoring fee arrangement might look like this:

- 5% for the initial 15 days

- An additional 1.0% for each additional 15 days until payment. This fee is best suited for companies with customers that usually pay their invoices quickly.

- Daily fee factoring rate: This fee is calculated every day the invoice is outstanding. For companies with consistent quick-paying customers, this may be the easiest low-cost pricing model to manage. However, as each day the invoice remains unpaid, the cost of factoring rises.

- Prime plus factoring rate: A Prime plus factoring fee is calculated each day an invoice is outstanding. The rate is the current prime lending rate plus a per annum rate calculated daily based on the amount of cash advanced to you by the factoring company. A standard rate that could be offered is “prime + 3.5%.” For this example, let’s use 3% as the current prime rate. In this case, the factoring rate would be 6.5% per year. Typically, these types of facilities also include a small one time admin fee charged against the value of your invoices. This fee is potentially the most cost-effective for companies with large volumes of receivables and those looking to have better control over the dollar costs of their lending. These facilities act more like a traditional bank line of credit.

How does the size of your advance affect your rate?

The final criteria to be considered is how much of the invoice you are asking the factoring company to advance upfront. Typical advance rates range from 75% to 100% of the invoice face value. The more cash you need upfront, the greater the premium you may end up paying.

What is the best approach to rates?

It depends on your situation. Here are four summary points to consider regarding your best approach to negotiating the right rate.

- Risk: Anything that you can do to reduce the risk associated with your customers’ ability to pay and pay quickly can positively impact your rate.

- Volume: The higher the combined dollar volume of the invoices you factor, the more willing your provider may be to improve your rate.

- Time: This one depends on your priorities. If you prefer simplicity and your customers are all over the map with their payment schedules, flat fee may be your best approach. On the other hand, if you have mostly blue-chip clients who pay reasonably quickly, split fee factoring may prove to be a better deal overall.

- Advance rate: Generally, the larger the advance, the more it’s going to cost. But if you need to maximize your real-time cash flow, it may be worth it to pay a slight premium to receive this benefit.

When negotiating a factoring agreement, it’s important to focus on aiming for the lowest possible rate with the longest possible recourse period and the highest possible advance. Equally important is assuring you will receive a high degree of customer service to ensure you are consistently provided cash flow you can count on.

Factoring fees

The factoring rate gives you clarity on the ongoing percentage you will be charged to factor invoices. However, it is essential to understand that several other typical and additional factoring fees may be added to your bills. The good news is that any reputable factoring company will explain and discuss these factoring fees upfront during negotiations. Non-the-less, it is important that you always read the fine print to ensure you have clarity before you sign. So keep reading to understand better the range of factoring fees that may be applied and the impacts that they may have on your overall costs.

Factoring fees are vehicles used to compensate the factoring company for services and actions taken as per the terms of the agreement. Unfortunately, there is no consistent model to refer to as “the right way”. It really depends on the individual factors’ approach to their business. For example, some factoring companies may separate and list their factoring fees to maintain transparency and accountability. In contrast, others may offer contracts with no additional factoring fees but end up raising their factoring rate to make up the difference.

In the end, all factoring fees should be transparent, reasonable, and justifiable. Too many factoring fees can drain your profits, while too few fees may indicate hidden costs. To better recognize a well-balanced factoring agreement with rates and fees, let’s start by looking at an example. The following are eCapital’s typical factoring fees for a freight transportation factoring agreement.

- Documentation fee – Factoring companies usually charge this one-time factoring fee at the beginning of a factoring agreement to conduct due diligence and process legal documents. This fee is standard in the industry but may be referred to as the Due Diligence Fee or Setup Fee.

- As utilized fees – This group of factoring fees is used to cover the costs incurred by the factoring company to run credit checks, verification of invoices, and the disbursement of advances and reserves for each invoice processed throughout the factoring contract.

Following are the factoring fees within this group:- Invoice Processing Fees

- Transfer Fees: Wire, ACH, Money Code, Check by Mail, InstaPay

- Non-recourse credit guarantee fee – Your factoring agreement will either be recourse or non-recourse. In a recourse factoring agreement, your business is responsible for any unpaid balances on an invoice. By utilizing non-recourse factoring, your business will not be liable for outstanding invoices due to a debtor company becoming insolvent. If the invoice is unpaid for any other reason, your company remains liable and must repay the balance owing. Credit Protection is an extension of non-recourse factoring, providing your company with full liability coverage throughout the factoring contract against unpaid invoices for any reason.

- Carrier payments – This factoring fee is charged on payments made to a third-party operator acting in service of the factoring customer.

- Buyout fee – When transferring an existing factoring account to a different factoring company, the new factor may charge a buyout fee for moving the invoices over from the old factor. Typically, it’s a percentage of the total buyout cost.

- Early termination fee – Typically, invoice factoring companies that offer the best rates and service generally require a signed factoring contract ranging from 1 to 3 years. Having a defined commitment period allows the factor to provide the lowest cost for their services. If for any reason, the client wants to cancel the factoring agreement, a reputable factoring company will allow it and charge an early termination fee to compensate for the loss of projected revenues. The absence of an early termination fee in a factoring contract is a red flag to be questioned. Before signing any factoring agreement, ensure you understand the costs to exit the funding relationship; otherwise, your company will be obligated to live out the factoring contract to its expiry date.

Additional factoring fees index

The above examples from the eCapital business model represents a typical range of factoring fees that could be included in a freight transportation factoring agreement. These fees, if included, would be clearly stated in the contract. However, depending on the factor you choose, they are not the only factoring fees that may surface in your factoring agreement. To help you understand what other factoring fees to look for within your contract, the following is an index of additional factoring fees that may be encountered when dealing with an invoice factoring company. Learning about these factoring fees will help you assess and identify a good factoring contract when you see it.

- Servicing fees – Servicing fees are used to cover the costs of keeping an account current, providing reports, etc. This factoring fee is sometimes called an Administration or Maintenance Fee and is normally charged on a monthly basis. A Lockbox fee may be included or charged separately.

- Credit check fees – The factoring company is likely to perform credit checks on your customer base at the start of the factoring contract. Your factor may pass on the cost for performing this due diligence as an additional factoring fee.

- Credit management (service) fee – Throughout the factoring contract, the factor will monitor and verify the creditworthiness of your new and existing customers. If a customer has a history of late or missed payments, or if the average time to pay increases, this customer’s invoices may not be approved for financing. Some factoring companies charge an additional factoring fee for this effort.

- Same-day funding fee – Invoices paid within 24 hours is a standard feature provided by most reputable factoring companies. Some factors charge an additional factoring fee to deliver same day funding.

- Monthly minimum fees – Some factoring companies require that a client factors a minimum amount of invoices per month throughout the duration of the factoring contract. Should the client not meet this requirement, they will be charged a monthly minimum factoring fee to make up for the difference. If you’re not comfortable about your small business meeting these requirements each month, you should renegotiate the existing factoring agreement or consult another factor.

- Misdirected payment fees and missing notation fees – Any payments incorrectly made to your business from invoices sold to the factor must be redirected to the factoring company. If your company cashes a misdirected payment, the funds must be returned, and an additional factoring fee will be charged.

- Renewal fee – If you have an existing factoring contract, the factor may charge you an additional factoring fee to renew your account each year.

- Termination notice period – Some factors automatically renew an existing factoring contract unless written notice is provided within a specified Termination notice period. Although it is not a factoring fee, this contract term will govern the duration of the factoring contract and all associated rates and fees.

Know your rates and fees

Before signing any factoring agreement, be knowledgeable of the options you have available in negotiating your factoring rate. Then, ask for clarity on the additional factoring fees that will be charged. A factoring agreement can be lengthy, but it doesn’t have to be complicated. Before committing to a contract, be sure to identify and understand all rates and factoring fees that make up the total cost of a factoring agreement.

With a clearer understanding of rates and factoring fees, you will be much better prepared to sign a contract that provides you with the best overall value based on your unique circumstances.

Conclusion

Invoice factoring has become widely used and continues to grow in popularity. This growing trend results from a financial gap caused by banks continuing to restrict credit to small and mid-size businesses (SMBs). Invoice factoring is closing this gap with benefits that outweigh the cost of factoring. These benefits improve working capital management for SMBs throughout their business life cycle and promote increased profitability. Be sure to understand the rates and all the factoring fees before signing an agreement.

Key Takeaways

- The rate and additional factoring fees make up the total cost of a factoring agreement.

- Understanding the total cost of invoice factoring will assist you in finding the right provider and negotiating the best deal to meet your unique needs.

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.