Frequently Asked Questions (FAQs) When Shopping For Non-Recourse Factoring

Content

High-interest rates and an uncertain economy are pushing more businesses into financial distress. Debt defaults by US companies continue to rise as commercial chapter 11 filings increased 40 percent YoY in April 2024. Consequently, B2B businesses must strengthen their financial structures and build resilience against bad debt.

In this environment, non-recourse factoring companies are gaining increased popularity with their enhanced business financing solution. Non-recourse factoring is an easy to manage funding solution with increased credit protection against payment defaults from the business’s customers who may face bankruptcy.

This article explores the nature of non-recourse factoring with answers to frequently asked questions. Keep reading to discover the advantages of using this easy to manage financial strategy to increase liquidity and mitigate bad debt.

Frequently Asked Questions (FAQs)

-

Why choose invoice factoring?

For many companies, the go-to solution for fast, reliable business financing is invoice factoring – the selling of invoice receivables at a discount to a factoring company in exchange for immediate payment. Businesses choose invoice factoring for a cost effective and easy to manage strategy to increase liquidity and accelerate cash flow.

-

What is non-recourse factoring?

There are two main types of invoice factoring – recourse and non-recourse. Recourse factoring is considered the standard form of factoring and is the most used as it is the lower cost of the two options. However, with this type of factoring, your company is responsible for buying back any invoices that the factoring company cannot collect payment on.

As business closures continue to rise, another form of invoice factoring is gaining popularity. Non-recourse factoring companies provide a better option for risk protection from bad debt by adding a layer of protection against non-payment due to customer bankruptcy.

In a non-recourse factoring agreement, the factoring company assumes the credit risk for the invoices it purchases. This means that if the business’s customer doesn’t pay the invoice due to bankruptcy, the responsibility for the loss falls on the non-recourse factoring company, not the business that sold the invoices. It’s an assurance that you will get paid despite your customers’ vulnerability to bankruptcy. This protection is critical to maintain financial stability in down markets and volatile industries such as freight transportation.

-

Why does non-recourse factoring cost more?

Recourse and non-recourse factoring differ significantly regarding risk. This difference is reflected by an increased fee charged by the non-recourse factoring company.

Recourse Factoring: The company selling the invoices retains the risk for any invoices not paid in full to the factoring company within the recourse period (typically 90 days). In these cases, the business is responsible for buying back unpaid invoices from the factoring company or replacing them with other invoices of equal value. If your customer goes bankrupt, you must buy back the invoice.

Non-Recourse Factoring: The factoring company assumes the risk of non-payment due to bankruptcy. If an invoice is not paid because the business’s customer is insolvent, the business is not required to repurchase or replace the invoice – the financial loss of bad debt falls on the non-recourse factoring company. Non-recourse factoring companies compensate for this additional risk by charging a slightly higher fee for their services. It is the cost of enhanced credit risk insurance.

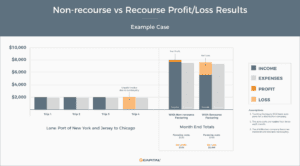

In the following example, a trucking company delivers auto parts, making four trips each month from the Port of New York and Jersey to a Chicago based distributor. Margins are razor thin – there’s little room for unexpected events. Before the month is out, the distributor claims bankruptcy leaving the trucking company stuck with an unpaid invoice. The graph below illustrates the difference in profit and loss depending on whether the company was working with a non-recourse factoring company or recourse.

-

What are the main advantages and disadvantages of these two factoring options?

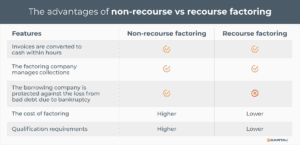

Recourse and non-recourse factoring offer the same advantages of accelerated cash flow and improved accounts receivable management. In both factoring arrangements, invoices are converted to cash within hours and the factoring company manages collections.

The disadvantages associated with both factoring arrangements are rooted in the issues of risk exposure.

Recourse Factoring may be more cost efficient, but the borrowing company remains responsible for repaying advanced funds on unpaid invoices and taking over responsibility for the bad debt. This approach requires the company to have a robust credit management system to minimize the risk of non-payment.

Conversely, the disadvantages of working with a non-recourse factoring company are higher fees and more stringent qualification requirements. To be approved for non-recourse factoring, the business’s customer base must meet higher credit ratings and have healthy credit repayment histories.

In the following example, a trucking company delivers auto parts, making four trips each month from the Port of New York and Jersey to a Chicago based distributor. Margins are razor thin – there’s little room for unexpected events. Before the month is out, the distributor claims bankruptcy leaving the trucking company stuck with an unpaid invoice. The example below illustrates the difference in profit and loss depending on whether the company was working with a non-recourse factoring company or recourse.

-

How do I get non-recourse factoring?

Obtaining non-recourse factoring involves a series of steps. Here’s how you can go about it:

Assess Your Needs: Evaluate your company’s risk associated with customer non-payment to determine whether non-recourse factoring is appropriate for your business.

Research Non-recourse Factoring Companies: Look for reputable factoring companies that specialize in your industry and offer non-recourse options. Online reviews, industry publications, and recommendations from business contacts can be good starting points. Not all non-recourse factoring companies offer the same protection, so it is important to do the research and speak to a rep when possible.

Review Qualifications: When you are reviewing the options available, find out their qualification requirements and make sure you meet their criteria for non-recourse factoring. This often includes having a certain volume of invoices and customers with good credit histories. Often a factor will cover a maximum invoice size and base your cost percentage on your history of aging accounts receivable and anticipated volume for the year.

Initial Contact and Application: Reach out to potential non-recourse factoring companies to discuss your needs and to assess how well each factor’s terms, conditions, and service features align with company’s funding requirements. Once you have selected your candidate of choice, start the application process. This usually involves filling out an application and providing necessary documentation, such as invoices, customer lists, and financial statements.

Due Diligence: The non-recourse factoring company will perform a credit check on your customers to assess their creditworthiness.

Agreement Review: If you pass the due diligence phase, you’ll receive a Factoring Agreement outlining the terms, fees, and conditions. Pay special attention to the terms that specify the conditions under which the factoring is considered non-recourse. If you would like to learn more about the terms, fees and conditions, have a look at our blog.

Sign and Initiate: Once you agree with the terms, you’ll sign the non-recourse factoring company’s contract and can start submitting invoices for factoring.

Ongoing Relationship: The best non-recourse factoring companies are national leaders, recognized for their reputation for superior customer service and reliable funding. Leaders, such as eCapital, one of the nation’s fastest growing alternative lenders specialize in flexible financing options including non-recourse invoice factoring and place high value on optimizing ongoing customer relationships. Develop and maintain ongoing relations with your account manager to streamline services and ensure reliable funding.

-

When should I get non-recourse factoring?

Opting for non-recourse factoring can be a strategic decision based on various factors like your industry, customer payment behavior, and your company’s financial stability. Here are some situations where non-recourse factoring may be beneficial for you:

High Customer Credit Risk: If you’re dealing with customers who may decline into financial instability, a non-recourse factoring company can offer you protection against non-payment due to insolvency.

Limited Cash Reserves: If your company has limited cash reserves, absorbing the cost of unpaid invoices can be a financial strain. In such cases, transferring the risk to a non-recourse factoring company may be advantageous. Non-recourse factoring helps operations to continue without having to worry about receiving payment from customers facing bankruptcy.

New or Expanding Businesses: Start-ups and businesses in expansion mode may not have the in-house capabilities to manage credit risk effectively. Non-recourse factoring companies can help serve as a buffer against bad debt.

Complex Sales Cycles: Industries with long sales cycles or complicated delivery frameworks often face payment delays. Non-recourse factoring companies can provide an added safety net to minimize risk.

Variable Customer Base: If you deal with a diverse set of customers, especially those from different countries with varying credit standards, non-recourse factoring companies can make things easier to stay on top of your receivables.

Seasonal Businesses: Companies with seasonal demand spikes may find it challenging to manage cash flow effectively throughout the year. Non-recourse factoring companies help to fill cash flow gaps and mitigate financial instability caused by unpaid invoices.

Competitive Industry: In industries where competition is fierce, offering lenient credit terms to customers may be necessary to retain business. However, this increases the risk of late or defaulted payments. Non-recourse factoring companies can help balance competitive credit terms with financial stability.

Focus on Core Activities: If you prefer to focus on your core business activities rather than on accounts receivable management and debt collection, working with non-recourse factoring companies allows you to off load these responsibilities.

Uncertain Economic Conditions: During economic downturns or periods of uncertainty, the risk of invoice defaults can increase. Non-recourse factoring companies provide a cushion against these external financial pressures.

Regulatory Changes: If you are in an industry that is subject to sudden regulatory changes that might impact your customers’ financial stability, non-recourse factoring companies can offer an additional layer of security.

Summary

Understanding the difference between recourse and non-recourse factoring is crucial for businesses considering invoice factoring as a financial strategy. Keep in mind that non-recourse factoring companies generally charge higher fees due to the added risk taken on by the factoring company. Therefore, it’s crucial to weigh the costs against the benefits to determine if this is the right option for your business.

Consult with a financial specialist, carefully research, and choose the right non-recourse factoring company to best meet your business needs. Be sure to understand the terms of the non-recourse factoring agreement before you sign. By managing the arrangement well, and maintaining a good working relationship with your lender, your business can successfully utilize non-recourse factoring to enhance cash flow while minimizing associated risks.

Key Takeaways

- Debt defaults by US companies continue to rise as commercial chapter 11 filings increased 40 percent YoY in April 2024.

- B2B businesses need to be aware of the financial health of their customers and be prepared for the possibility of payment default on invoice receivables due to bankruptcies.

- Businesses considering invoice factoring as a financial strategy need to understand the difference between recourse and non-recourse factoring.

- Non-recourse factoring companies provide bad debt protection, meaning that the responsibility for losses falls on the factor if customers don’t pay invoices due to bankruptcy.

- By managing the arrangement well, your business can successfully utilize non-recourse factoring to enhance cash flow while minimizing bad debt risks.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.