INVESTMENT STRATEGY

We invest more than just capital.

We invest more than just capital.

MARIUS SILVASAN – CEO OF eCAPITAL

CONTINUED GROWTH IN FINANCE

As we evaluate investment opportunities to support our corporate vision, we are focusing on 5 pillars of investment, each contributing to organizational success in unique ways. Collectively, they are supporting our overall corporate goal of leadership within the alternative lending space.

In a number of our product groups, there are opportunities in the marketplace to acquire organizations primarily to add to our existing customer base. In these cases, we will strengthen their offices and the servicing of their markets, where appropriate, by overlaying our existing internal resources; from human resources to marketing to technology.

We are continually investing in our people and infrastructure resources; strengthening our quest to become the provider of choice for organizations in need of working capital support. For example, through the application of advanced digital marketing and search engine optimization techniques, we are rapidly accelerating our access to new prospects.

We are firm believers that the ability to leverage new technologies will contribute to profitability and growth across our entire system. Whether it’s a major investment in software and hardware systems, or external technology partnerships that can improve delivery of our services to clients and enhance the customer experience overall, technology will always be a vital component of our organization.

Our leadership team focuses on a number of key areas that we believe will contribute significantly to the success of our major investment decisions:

The leadership team provides a clear vision and consistent oversight in all areas of operation.

Collaboration is key; working in silos is not conducive to our best work. The strength of our leadership team and their ability to work as a single unit are critical to our success.

While we operate across multiple sectors and expansive geography, the ability of our team to maximize synergies in all areas of operations enables us to work collectively to identify the most advantageous solutions for our clients. From there, our dedicated teams of financial experts execute their programs while embodying the core values of our organization overall.

We have created a single, powerful back-end that helps us minimize operating costs, while delivering top-tier financial solutions. As we expand and enhance our service offerings through measured acquisition, we can overlay our proven back-end model to strengthen the operations within each new organization: improving their productivity and profitability, and contribution to eCapital’s overall growth.

We are constantly building and searching for technology solutions and partners that can support further improvements in our overall operations, and our client experience. Over the past few years we have undertaken initiatives, including a partnership with Visa, to enhance the way we do business, and we see this continuing aggressively in the future.

OUR MARKET

Since the tumult of the Global Financial Crisis, one bright spot in the financial landscape has been the remarkable ascent of private asset-based finance (ABF). This surge is not just a temporary blip but signifies a profound and enduring transformation within the sector. For savvy investors looking for promising opportunities, the ABF asset class demands attention.

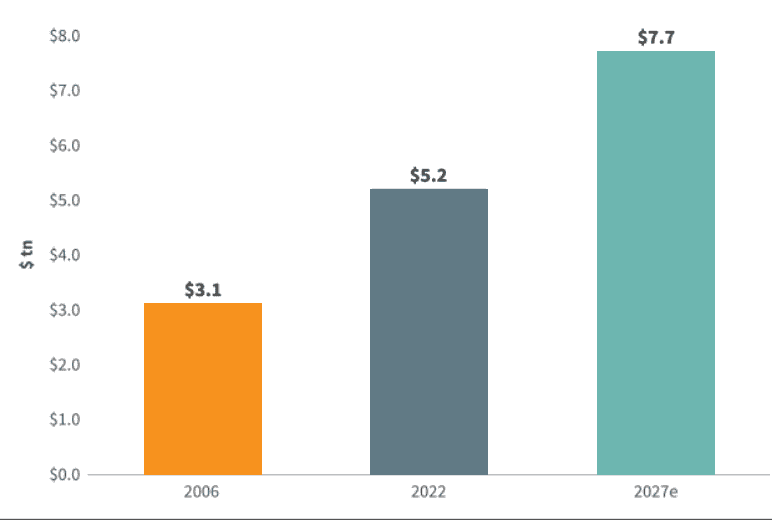

As we closed the books on 2022, the statistics were telling. The private ABF market had ballooned to 67% larger than its size back in 2006 and had grown by an impressive 15% since 2020 alone. Even more striking was its share of the overall asset-backed market, which had swelled from just over one-third in 2006 to nearly half today. Such growth trajectories are not just numbers on a page; they speak to a fundamental shift in how finance is being conducted and where future opportunities lie.

Looking ahead, the horizon is aglow with potential. Projections suggest the market could leap from $5.2 trillion to a staggering $7.7 trillion by 2027. This optimistic outlook is underpinned by several critical factors. Rising inflation, the retreat of traditional lenders in the face of climbing interest rates, and the recent shake-ups in the banking sector are all converging to heighten the appeal and necessity of private ABF.

For investors, this presents a unique window of opportunity. The burgeoning ABF sector not only offers a chance to diversify portfolios but also to tap into a market with substantial growth prospects and resilience against broader economic pressures. As traditional financing avenues grow more constrained, private asset-based finance stands out as a compelling alternative, promising both stability and significant returns.

In essence, the rise of private ABF is more than just a trend; it’s a pivotal shift towards a future where asset-based lending plays a central role in shaping financial strategies. For those looking to stay ahead of the curve, now is the time to explore the potential of ABF and consider how it might fit into your investment landscape. The journey ahead is promising, and the doors to new investment frontiers are wide open.

CONTINUED GROWTH IN ABF THROUGH 2027

IN TRILLIONS

Source: Integer Advisors forecasts and KKR research estimates as of October 31, 2022.

Clients Funded

Funded

Over

Invoices

Purchased

Industries

Served