The Asset-Based Lending Boom: Why Are Businesses Turning To ABL?

Content

Rising costs and increasing credit restrictions mean many small businesses are strategizing new ways to speed up cash flow. In this environment, asset-based lending is booming.

A new survey published by the Secured Finance Network (SFNet) in April reveals ABL) is steadily cementing its spot as a top choice for companies seeking fast, flexible funding.

Here’s how the asset-based lending industry is growing and why more and more businesses are seeking this from alternative finance companies.

How has the industry grown?

For banks, ABL commitments (total committed credit lines) were up 2.4% in the fourth quarter of 2022 compared to the previous year.

Non-bank lenders saw total commitments rise by 6% in the last quarter of the 2022 financial year. Compared to the same quarter in 2021, total commitments for non-banks rose by 10.4%.

“Recent growth in ABL can be attributed to a return to normalcy following the supply chain disruption, government assistance programs and general upheaval experienced during the pandemic,” said James Poston, CSO of eCapital. “As inventory and sales increase, businesses are in a position to unlock more working capital.”

Why are businesses turning to ABL now?

The rise in ABL coincides with a shaky U.S. economy said SFNet CEO Richard D. Gumbrecht in an April press release.

“As the U.S. economy remains under stress, the asset-based lending industry is primed to meet new demand,” said Gumbrecht. “Commitments have increased, and portfolio performance remains solid. Should we see a recession, the ABL industry stands ready to provide vital working capital.”

Industry experts like Poston say businesses are turning to alternative finance companies due to tightened credit at traditional lenders. For instance, small business loan approval percentages at big banks fell from 14.2% in February 2023 to 13.8% in March; the lowest approval rate for big banks since July 2021.

“As the traditional credit box continues to shrink, I’m seeing more business leaders seeking flexible and creative lending solutions from specialty finance companies like eCapital,” said Poston. “We can provide working capital financing quickly, with fewer restrictions and terms that match the needs of the business.”

What’s the future of ABL finance?

The SFNet report predicts ABL finance will remain a strong option for businesses whether conditions worsen or improve.

“A strong labor market and low energy prices could continue to propel the economy, or persistent inflation, weak real income growth, and sectoral slowdowns could prompt a recession,” stated the report. “For now, a period of relatively weak growth is the best bet, but asset-based lending, as an ‘all-weather’ industry, is well-positioned to meet new demand in any scenario.”

As ABL becomes an increasingly popular solution for businesses seeking financial stability and predictable cash flow, top alternative lenders are investing in cutting-edge technologies to serve clients more efficiently and accurately.

Poston said, “Technology continues to evolve the ABL industry, empowering SMBs with more tools and resources to effectively manage their finances. With the recent developments in singular platforms, payment automation and artificial intelligence, innovative fintech companies like eCapital are leading the way when it comes to the future of asset-based lending.”

Asset-based lending benefits

Have funds when you need it

With asset-based lending, you are borrowing in the form of a revolving credit line—which is ideal because you can use those funds whenever you need money. This helps accelerate your cash flow cycle and creates flexible working capital to fund your company and keep it thriving.

Adaptable to your business plans

Asset-based loans can be customized to meet your business needs. Reputable asset-based lenders will provide lending options that can be scaled alongside your business’ growth.

Flexible to your needs

Asset-based lending delivers funding quickly with less restrictive covenants. Since your assets are your collateral, there is maximum liquidity and fewer rules. As your assets grow, your line grows. This flexible solution bridges your business’s buy-and-sell to accelerate your sales cycle.

Conclusion

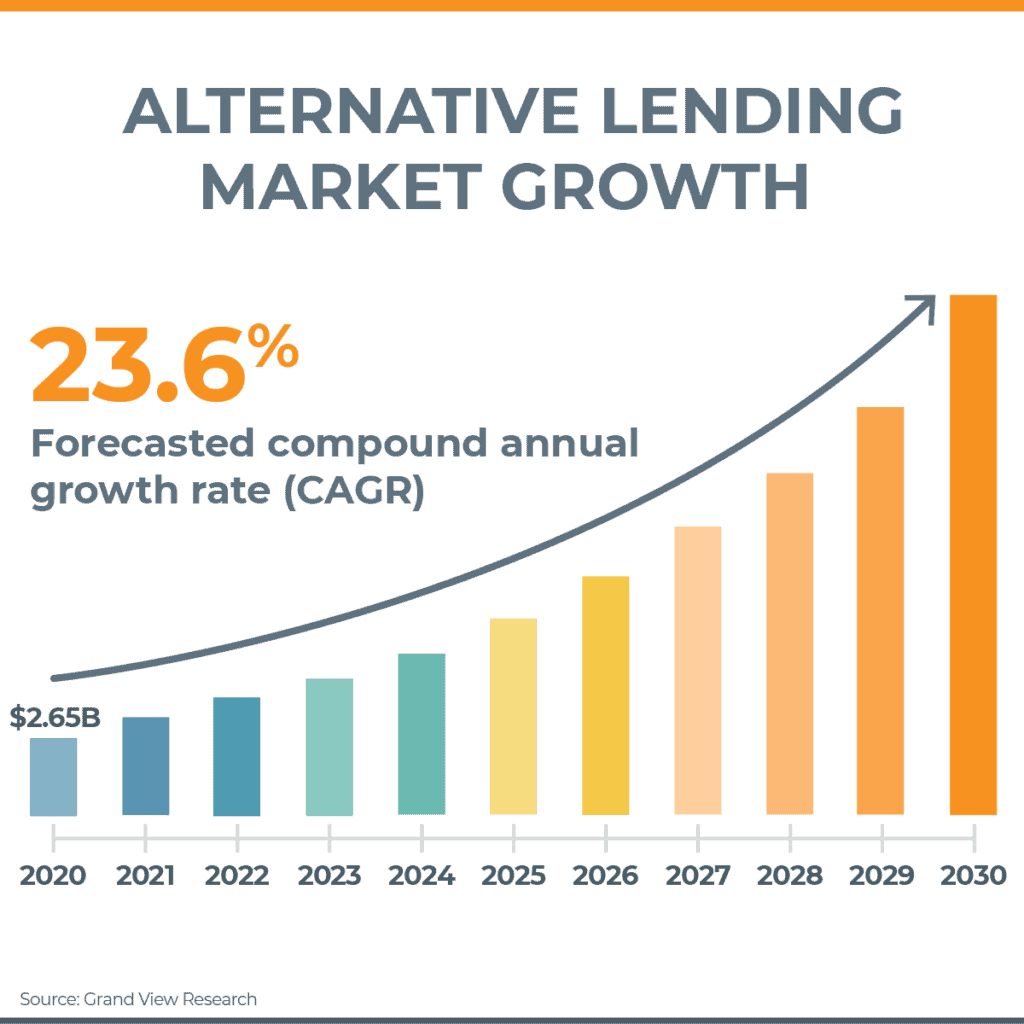

The global economic outlook is murky at best. As many traditional lenders’ risk tolerance declines, alternative finance companies are filling the credit gap. In this environment, asset-based lending is well-positioned to be a top choice for businesses seeking fast flexible funding throughout 2023 and beyond.

eCapital’s team of industry experts works to thoroughly understand your business before recommending tailored business financing solutions to meet your capital requirements. Whether a rapid asset-based line of credit or a strategic long-term financing plan, our skilled, dedicated, and friendly team structures specialized alternative funding as unique and distinct as your business.

For more information about how our experienced team supports businesses’ capital requirements through all stages of development, visit eCapital.com

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.